- United States

- /

- Communications

- /

- OTCPK:WSTL

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the Federal Reserve's meeting on interest rates takes center stage, the U.S. markets are experiencing a mix of anticipation and caution, with indices like the Dow Jones facing consecutive declines while others hit record highs. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.42 | $2.03B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.874625 | $6.32M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.87 | $89.78M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.23 | $8.25M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.50 | $48.84M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.875 | $13.39M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8366 | $75.59M | ★★★★★☆ |

Click here to see the full list of 716 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cocrystal Pharma (NasdaqCM:COCP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cocrystal Pharma, Inc. is a biotechnology company dedicated to discovering and developing antiviral therapeutic treatments for serious and chronic viral diseases, with a market cap of $19.41 million.

Operations: Cocrystal Pharma, Inc. currently does not report any revenue segments.

Market Cap: $19.41M

Cocrystal Pharma, Inc., with a market cap of US$19.41 million, is a pre-revenue biotechnology company focused on antiviral treatments. Despite its unprofitability and declining earnings forecast of 15.1% annually over the next three years, it has reduced losses by 18.2% per year over the past five years. The company benefits from an experienced management team and board, with average tenures of 16.9 and 5.2 years respectively, but faces challenges such as high volatility and less than one year of cash runway based on current free cash flow trends. Recent earnings reports show increasing net losses compared to last year.

- Unlock comprehensive insights into our analysis of Cocrystal Pharma stock in this financial health report.

- Gain insights into Cocrystal Pharma's future direction by reviewing our growth report.

Moving iMage Technologies (NYSEAM:MITQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Moving iMage Technologies, Inc. is involved in designing, manufacturing, integrating, installing, and distributing both proprietary and custom cinema equipment as well as off-the-shelf products for cinema needs globally, with a market cap of $7.29 million.

Operations: The company's revenue is primarily generated from its Audio/Video Products segment, amounting to $18.76 million.

Market Cap: $7.29M

Moving iMage Technologies, Inc., with a market cap of US$7.29 million, designs and distributes cinema equipment globally. Despite being debt-free and having sufficient cash runway for over three years, the company remains unprofitable with declining earnings over the past five years at a very large rate annually. Recent financial results show sales of US$5.25 million for Q1 2025, down from US$6.64 million the previous year, alongside a net loss of US$0.025 million compared to last year's net income of US$0.439 million. The management team is experienced but faces challenges in reversing profit declines amidst stable weekly volatility.

- Click to explore a detailed breakdown of our findings in Moving iMage Technologies' financial health report.

- Explore historical data to track Moving iMage Technologies' performance over time in our past results report.

Westell Technologies (OTCPK:WSTL)

Simply Wall St Financial Health Rating: ★★★★★★

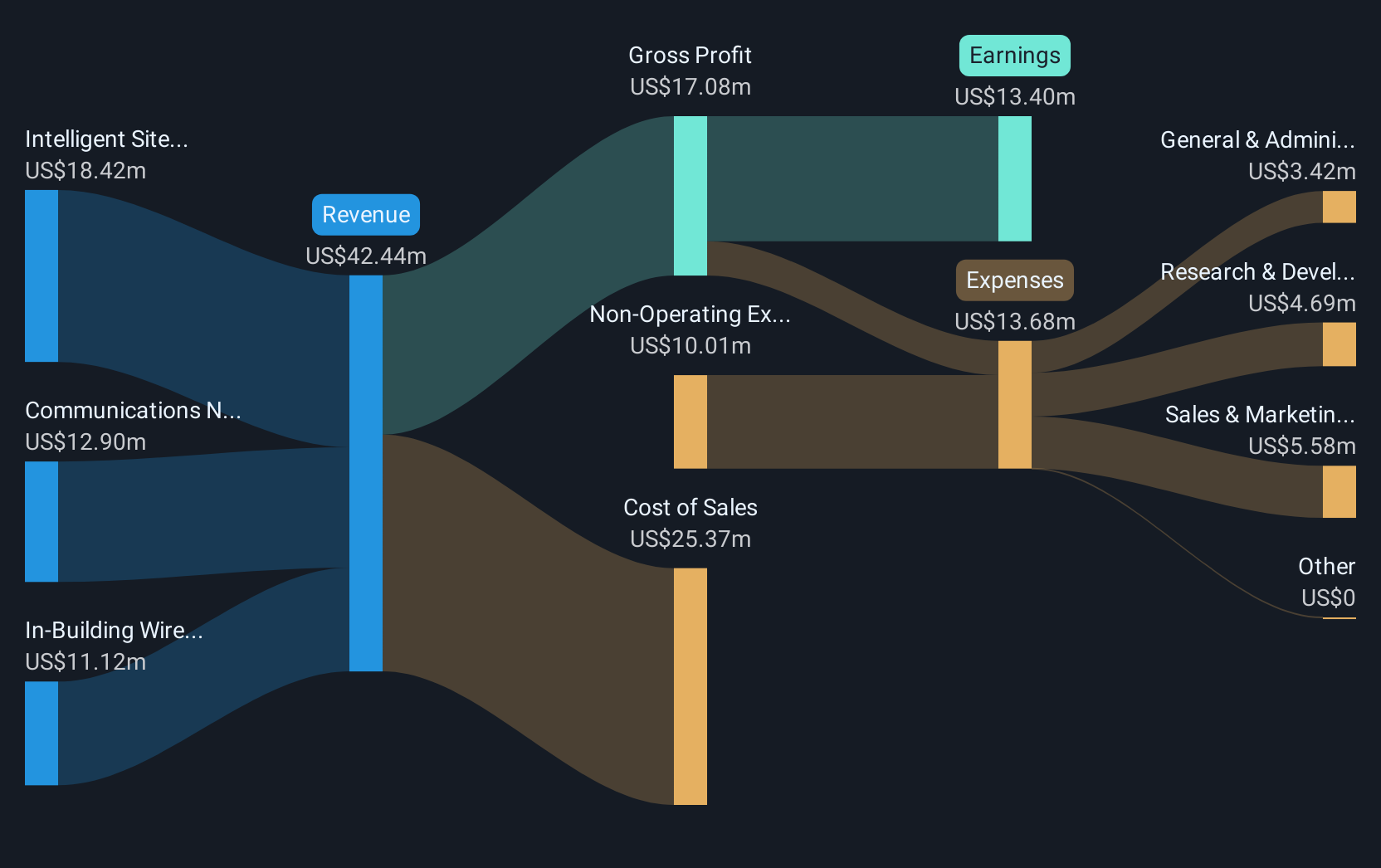

Overview: Westell Technologies, Inc., through its subsidiary, designs, manufactures, and distributes telecommunications solutions to telephone companies in the United States with a market cap of $17.24 million.

Operations: The company's revenue is derived from three segments: In-Building Wireless (IBW) at $10.46 million, Intelligent Site Management (ISM) at $11.37 million, and Communications Network Solutions (CNS) at $10.50 million.

Market Cap: $17.24M

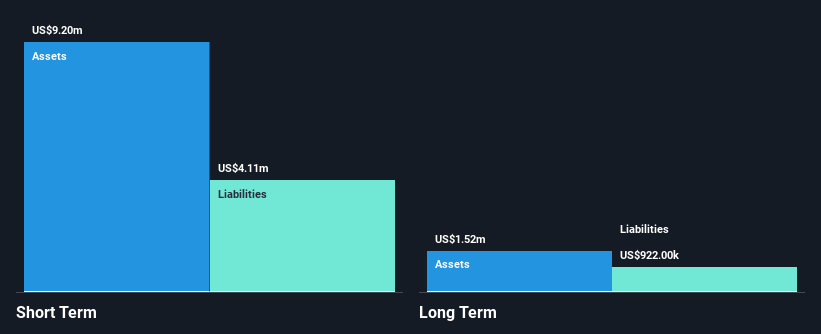

Westell Technologies, Inc., with a market cap of US$17.24 million, operates without debt and maintains stable weekly volatility at 5%. The company's net profit margins have decreased to 3.3% from 6.8% last year, while earnings growth has been negative at -66.3%. Despite this decline, Westell's short-term assets of US$36.8 million comfortably cover both its short-term and long-term liabilities. Recent earnings reports indicate a drop in sales to US$9.67 million for the second quarter compared to US$10.55 million a year ago, with net income also falling from US$0.796 million to US$0.403 million year-over-year.

- Get an in-depth perspective on Westell Technologies' performance by reading our balance sheet health report here.

- Examine Westell Technologies' past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Embark on your investment journey to our 716 US Penny Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westell Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:WSTL

Westell Technologies

Through its subsidiary, designs, manufactures, and distributes telecommunications solutions to telephone companies in the United States.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives