- United States

- /

- Software

- /

- OTCPK:PAYD

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the U.S. markets navigate a period of uncertainty with the Dow Jones Industrial Average experiencing its longest slump since 1978, investors are keenly watching for the Federal Reserve's upcoming interest rate decision. Amidst this backdrop, penny stocks—often representing smaller or newer companies—continue to capture attention due to their potential for growth at lower price points. While the term "penny stocks" may seem outdated, these investments can still offer unique opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.39 | $1.94B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $120.12M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.9075 | $6.35M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.88 | $87.05M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2392 | $8.46M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.9971 | $15.52M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.859 | $75.24M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.57 | $387.6M | ★★★★☆☆ |

Click here to see the full list of 720 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Lantronix (NasdaqCM:LTRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lantronix, Inc. develops, markets, and sells industrial and enterprise IoT products and services across various global regions with a market cap of $130.82 million.

Operations: Lantronix generates revenue of $161.72 million from its Computer Networks segment.

Market Cap: $130.82M

Lantronix, Inc., with a market cap of US$130.82 million, is navigating the penny stock landscape by focusing on industrial and enterprise IoT innovation. Despite being unprofitable, the company has reduced its losses over the past five years and maintains a strong cash position exceeding its total debt. Recent product announcements highlight advancements in AI-driven applications, potentially bolstering future revenue streams. However, volatility remains high and shareholder dilution occurred last year with shares outstanding increasing by 3.2%. The management team is relatively new with an average tenure of 0.8 years, indicating ongoing leadership transitions.

- Navigate through the intricacies of Lantronix with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Lantronix's future.

Vanda Pharmaceuticals (NasdaqGM:VNDA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vanda Pharmaceuticals Inc. is a biopharmaceutical company that develops and commercializes therapies for high unmet medical needs globally, with a market cap of approximately $270 million.

Operations: The company's revenue is primarily generated from its Biotechnology (Startups) segment, amounting to $190.86 million.

Market Cap: $269.97M

Vanda Pharmaceuticals, with a market cap of US$270 million, operates in the biopharmaceutical sector and is currently unprofitable. Despite this, it has no debt and strong short-term assets of US$432.4 million exceeding its liabilities. The company recently raised its 2024 revenue guidance to between US$190 and US$210 million after reporting third-quarter revenue growth to US$47.65 million from the previous year. However, it faced setbacks with the FDA's rejection of its tradipitant application for gastroparesis treatment, impacting potential future revenues despite ongoing efforts to secure approval.

- Take a closer look at Vanda Pharmaceuticals' potential here in our financial health report.

- Assess Vanda Pharmaceuticals' future earnings estimates with our detailed growth reports.

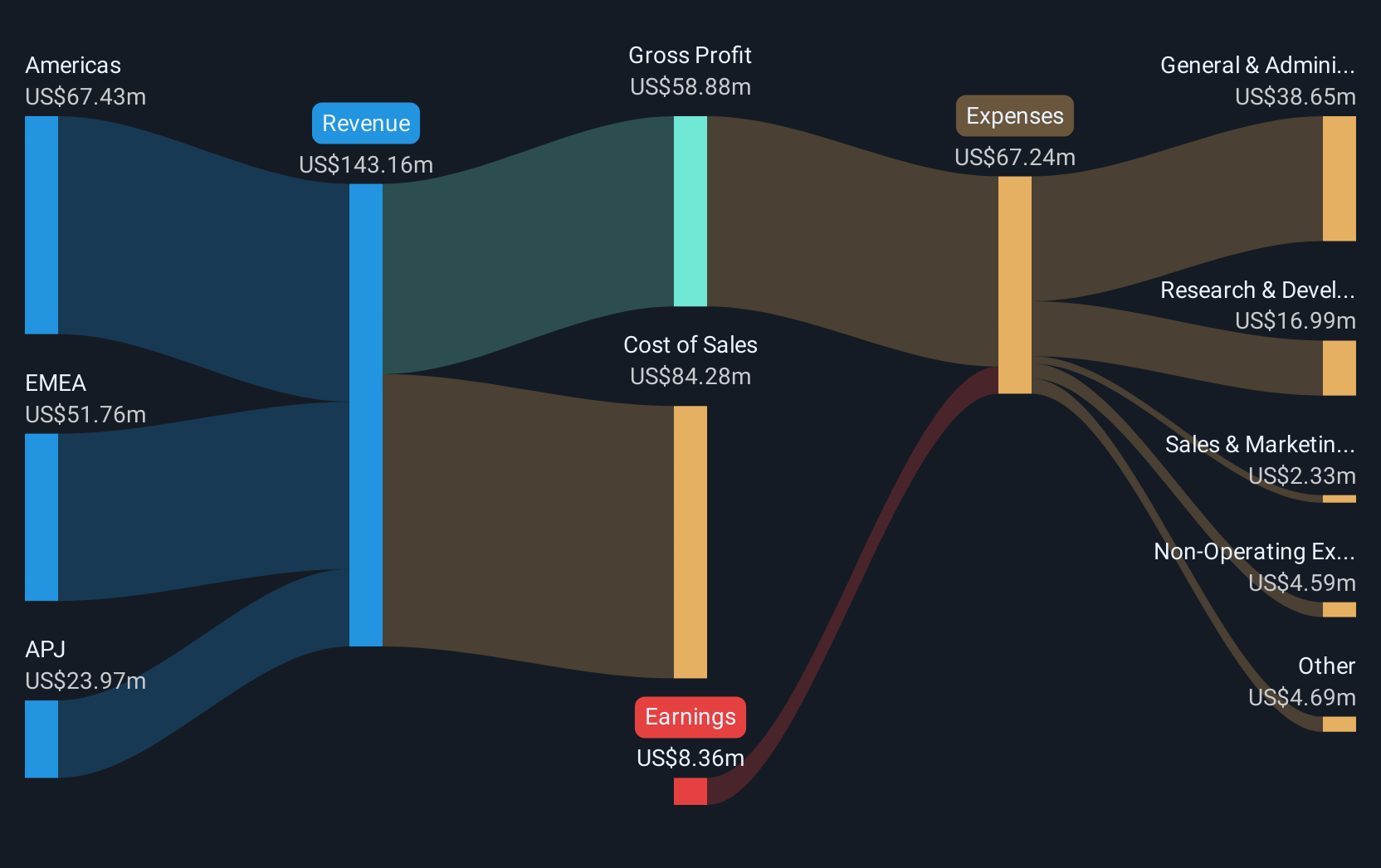

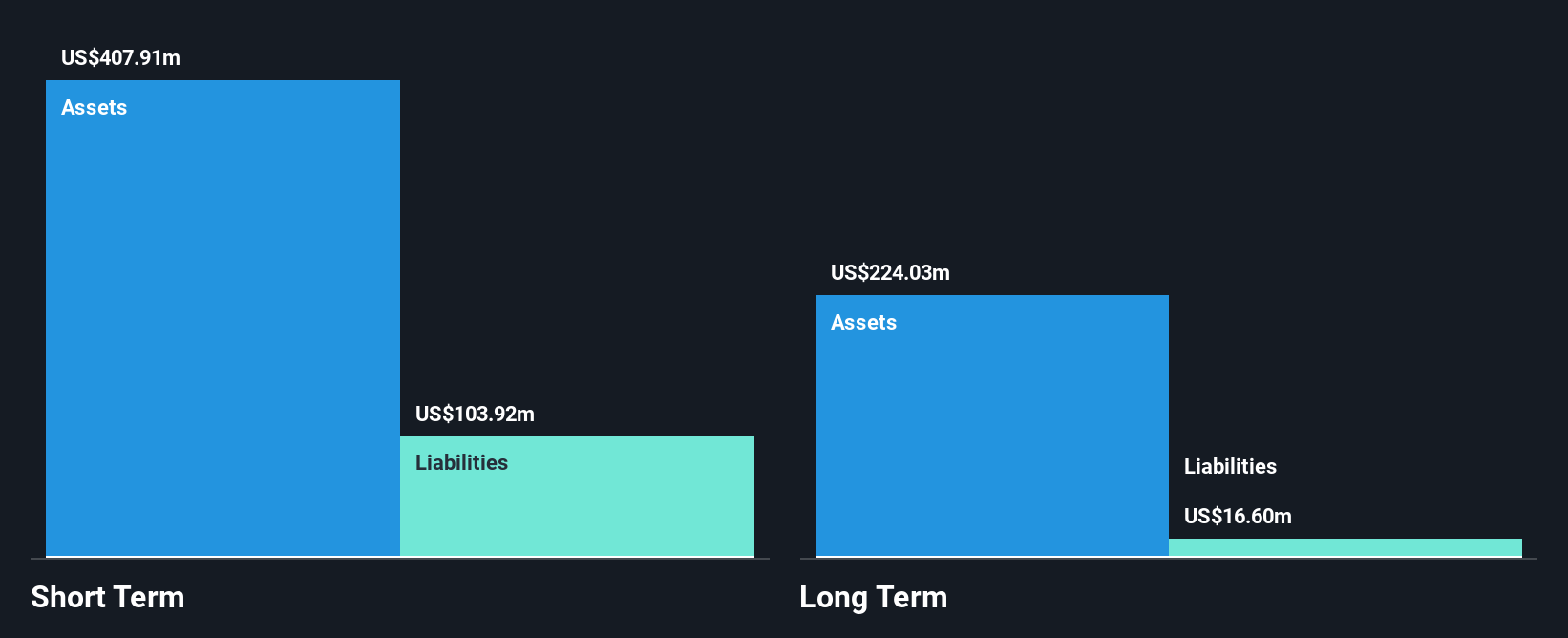

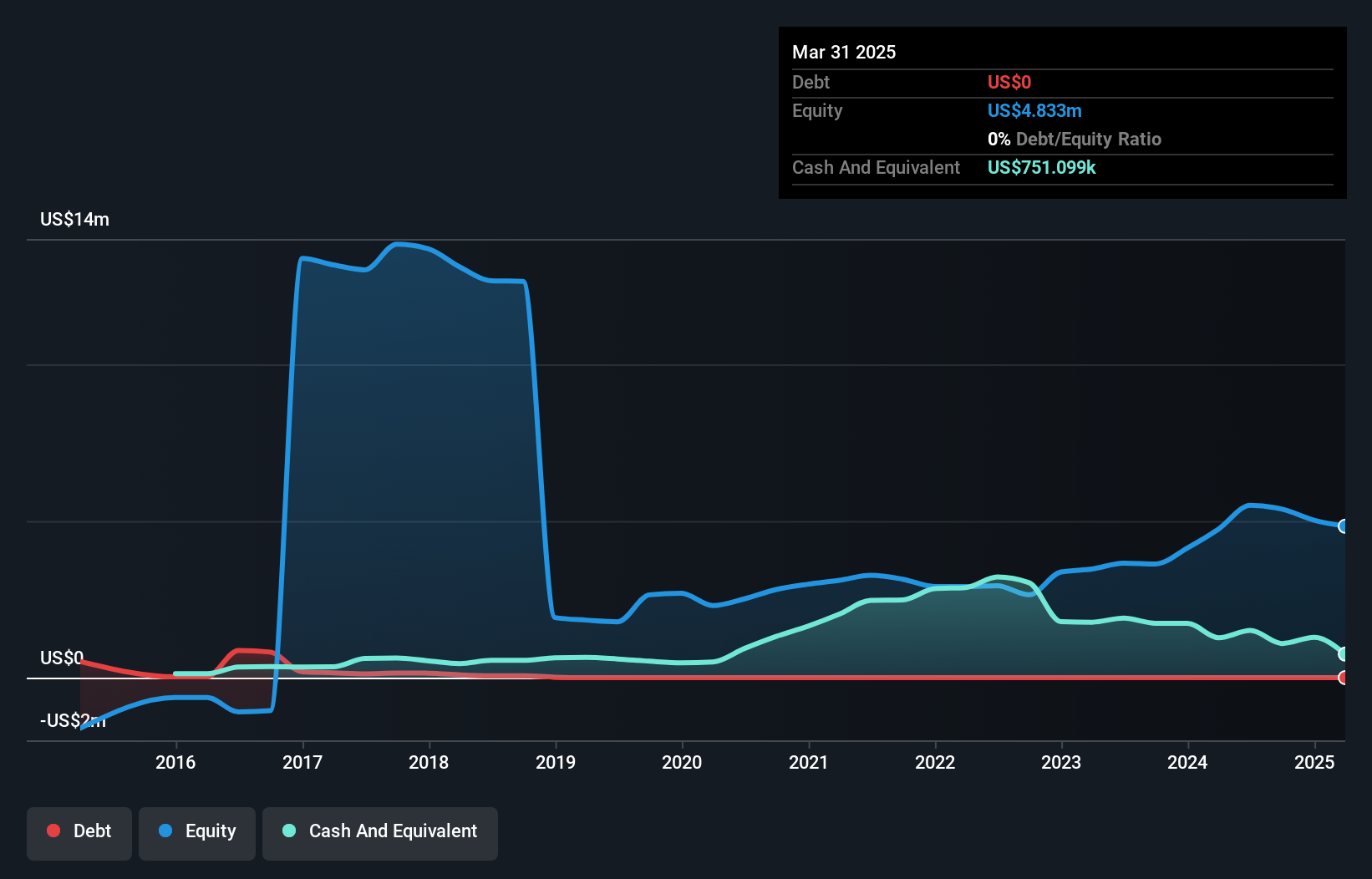

PAID (OTCPK:PAYD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PAID, Inc. offers a SaaS-based platform for businesses in the United States and Canada, facilitating website creation, online sales, payment collection, and shipping services with a market cap of $20.23 million.

Operations: The company generates revenue primarily from Shipping Coordination and Label Generation Services, amounting to $17.64 million, and Merchant Processing Services, contributing $0.06 million.

Market Cap: $20.23M

PAID, Inc. has demonstrated strong financial management with no debt and short-term assets of US$5.8 million covering both its short-term and long-term liabilities. The company reported third-quarter sales growth to US$4.45 million, contributing to a nine-month revenue of US$13.21 million, up from the previous year. Despite a net loss in the recent quarter, PAID achieved profitability over the past five years with significant earnings growth of 244.7% last year, outpacing industry averages and reflecting improved profit margins now at 8.9%. Its experienced board and management team further support its operational stability.

- Unlock comprehensive insights into our analysis of PAID stock in this financial health report.

- Learn about PAID's historical performance here.

Taking Advantage

- Click here to access our complete index of 720 US Penny Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:PAYD

PAID

Develops a line of software as a service (SaaS) based business services to provide businesses with a streamlined experience for website creation, online sales, payment collection, and shipping all in one platform in the United States and Canada.

Excellent balance sheet low.

Market Insights

Community Narratives