- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:OB

3 Promising US Penny Stocks With At Least $100M Market Cap

Reviewed by Simply Wall St

As U.S. stock markets reach record highs following the recent presidential election, investors are keenly exploring diverse opportunities across various sectors. Penny stocks, though often overlooked, represent a niche where smaller or newer companies can offer significant growth potential at lower price points. While the term may seem outdated, these stocks can still be compelling investments when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.80735 | $5.81M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $173.78M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.59 | $588.6M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.60 | $2.05B | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.50 | $129.74M | ★★★★★☆ |

| Flexible Solutions International (NYSEAM:FSI) | $3.9606 | $50.3M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $2.24 | $3.83M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.26 | $9.77M | ★★★★★★ |

| So-Young International (NasdaqGM:SY) | $1.25 | $91.21M | ★★★★☆☆ |

Click here to see the full list of 751 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Harvard Bioscience (NasdaqGM:HBIO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Harvard Bioscience, Inc. develops, manufactures, and sells technologies, products, and services for life science applications globally with a market cap of approximately $104.23 million.

Operations: The company generates revenue from its Medical Products segment, which amounted to $101.13 million.

Market Cap: $104.23M

Harvard Bioscience, Inc. presents a mixed picture for investors interested in penny stocks. The company is currently unprofitable, with increasing losses over the past five years, but it maintains a positive free cash flow and has a substantial cash runway exceeding three years. Its short-term assets surpass both its short- and long-term liabilities, suggesting financial stability despite its high net debt to equity ratio of 47%. Recent product innovations like the Mesh MEA™ platform show promise in life sciences applications, potentially enhancing future revenue streams. However, shareholder dilution remains a concern as shares outstanding increased by 2.2% last year.

- Take a closer look at Harvard Bioscience's potential here in our financial health report.

- Explore Harvard Bioscience's analyst forecasts in our growth report.

Outbrain (NasdaqGS:OB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Outbrain Inc. operates a technology platform that links media owners and advertisers with engaged audiences globally, with a market cap of approximately $215.55 million.

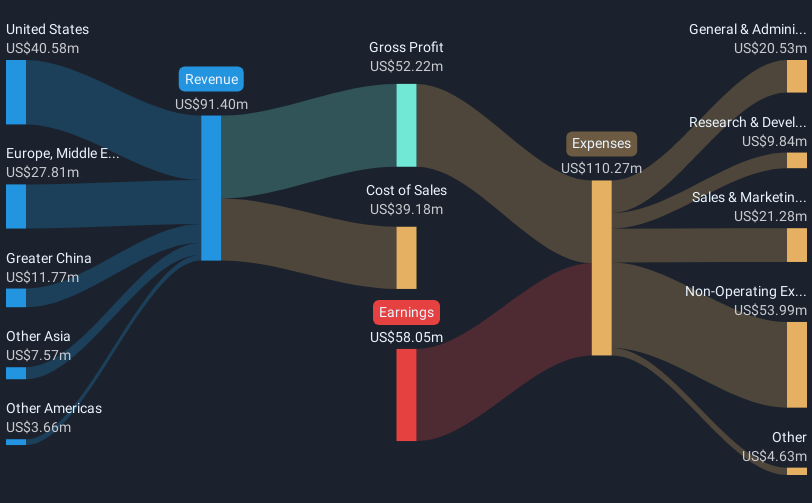

Operations: The company's revenue segment is derived entirely from its Internet Information Providers business, generating $909.36 million.

Market Cap: $215.55M

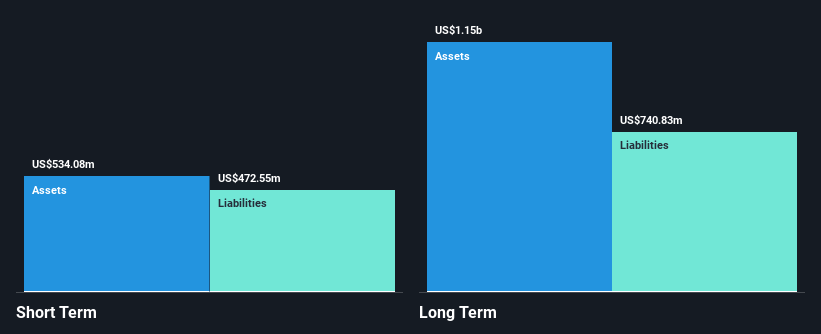

Outbrain Inc. offers a compelling case for penny stock investors with its strategic collaborations and innovative products, despite being unprofitable. The company recently expanded its partnership with Microsoft Azure to enhance its advertising solutions using generative AI, potentially increasing advertiser engagement and return on ad spend. Its new product, Moments by Outbrain, introduces vertical video browsing to the open internet, promising improved user engagement and brand recall for advertisers. Financially, Outbrain has a solid cash runway exceeding three years and more cash than total debt, ensuring stability while it navigates profitability challenges.

- Navigate through the intricacies of Outbrain with our comprehensive balance sheet health report here.

- Learn about Outbrain's future growth trajectory here.

2seventy bio (NasdaqGS:TSVT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 2seventy bio, Inc. is a cell and gene therapy company dedicated to researching, developing, and commercializing cancer treatments in the United States with a market cap of $242.04 million.

Operations: The company generates revenue from its biotechnology segment, totaling $44.12 million.

Market Cap: $242.04M

2seventy bio, Inc. stands out in the penny stock arena with its focus on cell and gene therapy for cancer treatments. Despite being unprofitable, the company has made strides by reducing losses at a rate of 8.9% per year over the past five years. It reported second-quarter revenue of US$8.97 million, a significant drop from US$36.05 million a year ago, yet achieved net income of US$24.88 million compared to a previous loss. With no debt and short-term assets covering liabilities, 2seventy bio maintains financial stability while navigating industry challenges with an inexperienced management team and board.

- Click here to discover the nuances of 2seventy bio with our detailed analytical financial health report.

- Gain insights into 2seventy bio's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Click this link to deep-dive into the 751 companies within our US Penny Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OB

Outbrain

Operates a technology platform that connects media owners and advertisers with engaged audiences to drive business outcomes in the United States, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives