- United States

- /

- Healthcare Services

- /

- OTCPK:MEHC.Q

US Penny Stocks: 3 Picks With Market Caps Under $200M

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite reach record highs, driven by a surge in technology stocks, investors are increasingly exploring diverse opportunities across the market spectrum. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.81715 | $5.81M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.56 | $2.03B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $136.98M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2421 | $8.86M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.58 | $52.47M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9597 | $84.8M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.76 | $413.23M | ★★★★☆☆ |

| Information Services Group (NasdaqGM:III) | $3.11 | $181.08M | ★★★★☆☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

23andMe Holding (NasdaqCM:ME)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: 23andMe Holding Co. is a consumer genetics testing company operating in the United States, the United Kingdom, Canada, and internationally, with a market cap of $91.72 million.

Operations: The company generates revenue primarily from its Consumer & Research Services segment, amounting to $193.26 million.

Market Cap: $91.72M

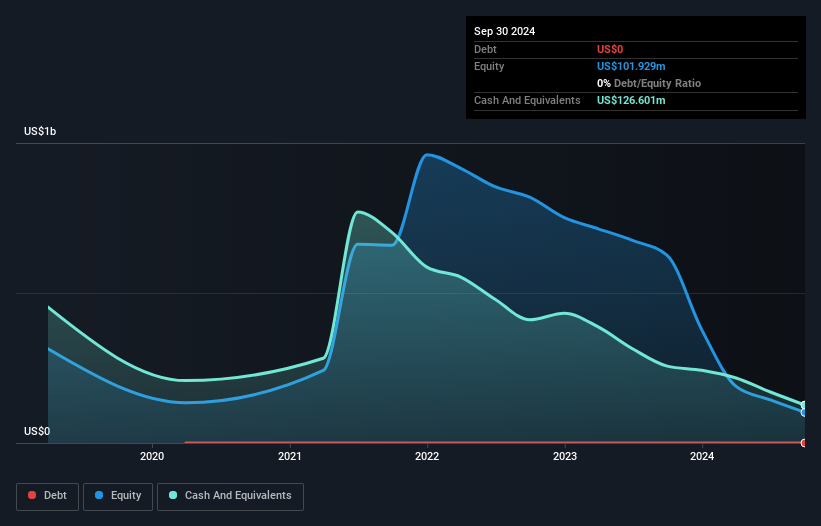

23andMe Holding Co. faces challenges typical of penny stocks, including high volatility and a history of unprofitability with growing losses. Recent strategic shifts include discontinuing its therapeutics programs and exploring alternatives for these assets, aiming to streamline operations and cut costs by over US$35 million annually. Despite these hurdles, the company remains debt-free and has secured compliance with Nasdaq listing requirements after a reverse stock split. Additionally, it continues to leverage its extensive genetic database in collaborations like the recent one with Mirador Therapeutics, highlighting potential in precision medicine despite financial difficulties.

- Click to explore a detailed breakdown of our findings in 23andMe Holding's financial health report.

- Learn about 23andMe Holding's historical performance here.

Gossamer Bio (NasdaqGS:GOSS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gossamer Bio, Inc. is a clinical-stage biopharmaceutical company focused on developing and commercializing seralutinib for the treatment of pulmonary arterial hypertension in the United States, with a market cap of $158.19 million.

Operations: Gossamer Bio, Inc. currently does not report any revenue segments as it is focused on the clinical development of seralutinib for pulmonary arterial hypertension in the United States.

Market Cap: $158.19M

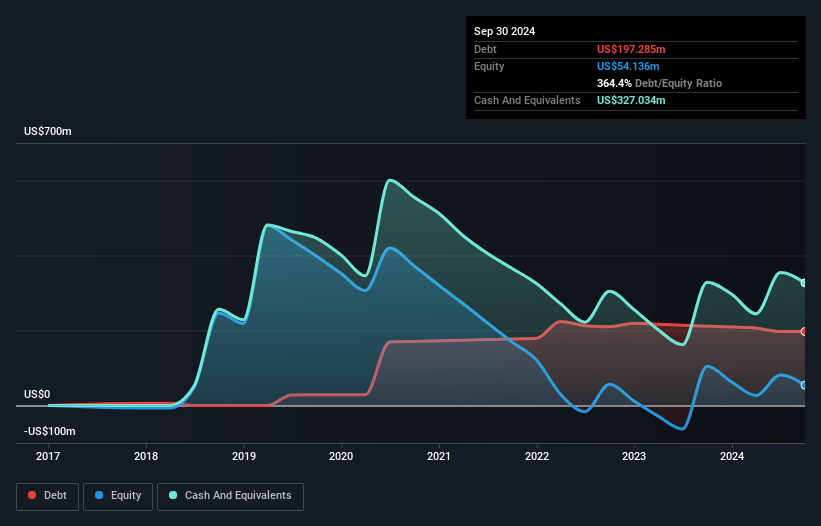

Gossamer Bio, Inc. is navigating the challenges associated with penny stocks, including a recent Nasdaq delisting notice due to its stock price falling below US$1.00 per share. The company has until March 2025 to regain compliance or risk further actions such as a reverse stock split. Despite being unprofitable, Gossamer reported third-quarter revenue of US$9.48 million and reduced net losses compared to the previous year. It maintains a robust cash position with short-term assets of US$344.3 million exceeding both short- and long-term liabilities, providing some financial stability amidst ongoing clinical developments for seralutinib.

- Navigate through the intricacies of Gossamer Bio with our comprehensive balance sheet health report here.

- Gain insights into Gossamer Bio's future direction by reviewing our growth report.

Grove Collaborative Holdings (NYSE:GROV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Grove Collaborative Holdings, Inc. is a plastic neutral consumer products retailer in the United States with a market cap of $60.99 million.

Operations: The company's revenue segment includes $213.78 million from online retailers.

Market Cap: $61M

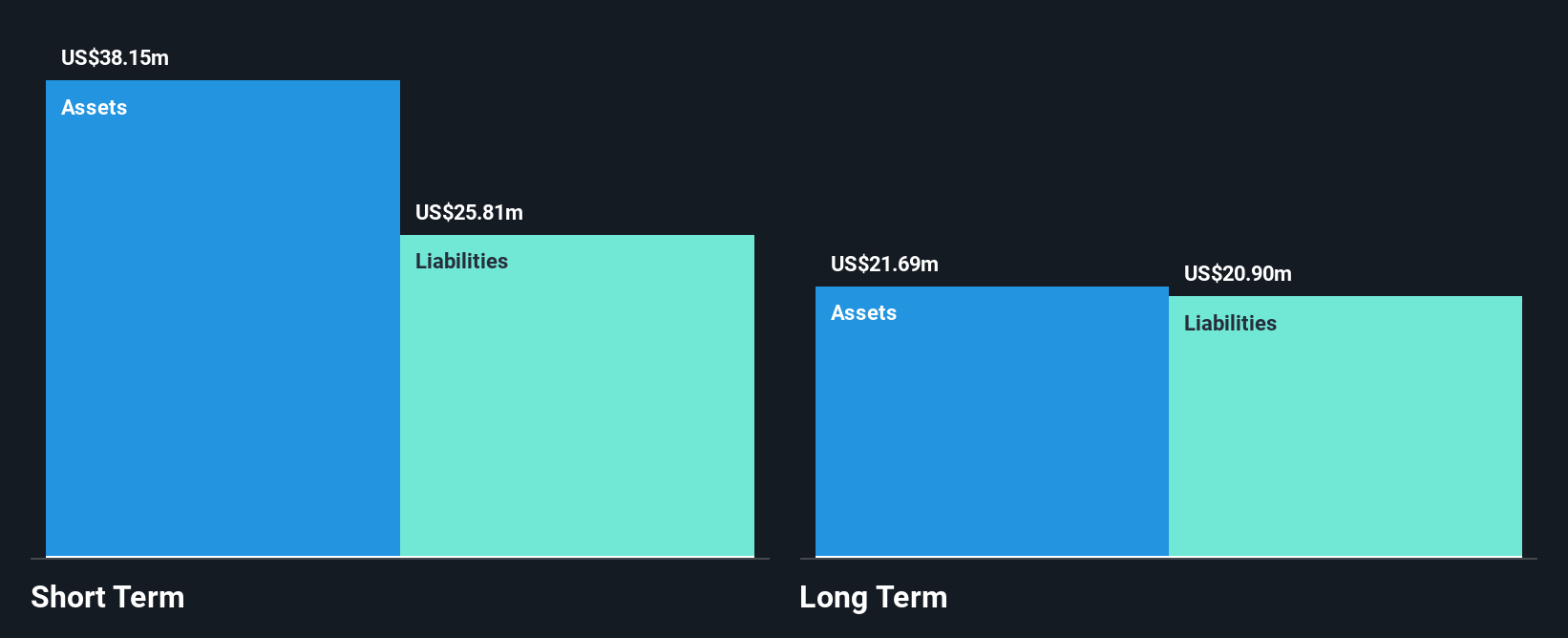

Grove Collaborative Holdings, Inc. faces typical challenges of penny stocks, including recent revenue declines and ongoing unprofitability. The company reported third-quarter sales of US$48.28 million, down from US$61.75 million a year ago, while net losses decreased significantly to US$1.34 million from US$9.81 million in the previous year. Despite this, Grove has sufficient cash runway for over three years based on current free cash flow and maintains more cash than its total debt, suggesting financial resilience amid volatility concerns and shareholder dilution over the past year with shares outstanding increasing by 5.1%.

- Click here and access our complete financial health analysis report to understand the dynamics of Grove Collaborative Holdings.

- Learn about Grove Collaborative Holdings' future growth trajectory here.

Make It Happen

- Click through to start exploring the rest of the 706 US Penny Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:MEHC.Q

23andMe Holding

Operates as a consumer genetics testing company in the United States, the United Kingdom, Canada, and internationally.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives