- United States

- /

- Biotech

- /

- NasdaqGS:GERN

Those who invested in Geron (NASDAQ:GERN) three years ago are up 188%

Some Geron Corporation (NASDAQ:GERN) shareholders are probably rather concerned to see the share price fall 32% over the last three months. But in three years the returns have been great. Indeed, the share price is up a very strong 188% in that time. After a run like that some may not be surprised to see prices moderate. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Geron

Geron isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 3 years Geron saw its revenue grow at 119% per year. That's much better than most loss-making companies. Along the way, the share price gained 42% per year, a solid pop by our standards. This suggests the market has recognized the progress the business has made, at least to a significant degree. Nonetheless, we'd say Geron is still worth investigating - successful businesses can often keep growing for long periods.

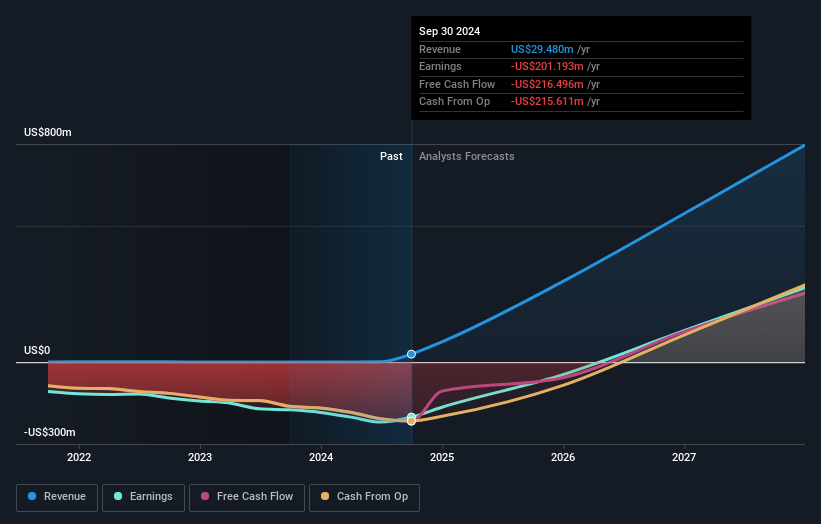

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Geron has rewarded shareholders with a total shareholder return of 54% in the last twelve months. That gain is better than the annual TSR over five years, which is 18%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. You could get a better understanding of Geron's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GERN

Geron

A late-stage clinical biopharmaceutical company, focuses on the development and commercialization of therapeutics for myeloid hematologic malignancies.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives