- United States

- /

- Communications

- /

- NYSE:CALX

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The United States stock market has recently experienced a surge, with major indices like the Dow Jones and Nasdaq Composite showing significant gains amid optimism over reduced China tariffs and easing concerns about Federal Reserve independence. In this environment of heightened risk appetite and tech sector rallies, identifying high-growth tech stocks involves looking for companies that not only show strong innovation potential but also demonstrate resilience in navigating trade tensions and economic uncertainties.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.29% | 29.79% | ★★★★★★ |

| TG Therapeutics | 26.03% | 37.60% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| Arcutis Biotherapeutics | 25.76% | 58.17% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.96% | 58.81% | ★★★★★★ |

| TKO Group Holdings | 22.92% | 25.17% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.84% | 59.74% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Travere Therapeutics (NasdaqGM:TVTX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Travere Therapeutics, Inc. is a biopharmaceutical company focused on identifying, developing, and delivering therapies for rare kidney and metabolic diseases in the United States, with a market cap of approximately $1.34 billion.

Operations: The company generates revenue primarily through the development and commercialization of innovative therapies, amounting to $233.18 million.

Travere Therapeutics, showcasing robust potential in the biotech sector, recently highlighted its progress with FILSPARI® at multiple medical conferences. Notably, at the National Kidney Foundation meetings, FILSPARI demonstrated significant efficacy in proteinuria reduction compared to irbesartan. Despite challenges like hepatotoxicity risks and stringent REMS requirements, Travere's strategic presentations and recent FDA submissions for broader approvals reflect a proactive approach to overcoming regulatory hurdles. With revenue surging by 28.6% annually and projected earnings growth of 66.06%, Travere is navigating its path towards profitability amidst a competitive landscape marked by intensive research and development efforts.

- Unlock comprehensive insights into our analysis of Travere Therapeutics stock in this health report.

Gain insights into Travere Therapeutics' past trends and performance with our Past report.

Geron (NasdaqGS:GERN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Geron Corporation is a commercial-stage biopharmaceutical company dedicated to developing therapeutic products for oncology, with a market cap of $859.82 million.

Operations: Geron focuses on developing oncology therapeutics, generating $76.99 million in revenue from this segment.

Amidst significant legal challenges and leadership transitions, Geron Corporation has shown resilience with a notable revenue jump from $0.237 million to $76.99 million year-over-year, marking an impressive growth trajectory in the biotech sector. Despite recent setbacks including a sharp 32% stock price drop following underwhelming Q4 performance due to competitive pressures and operational hurdles with Rytelo, the company's aggressive expansion efforts are evident. With annual earnings projected to surge by 63.84%, Geron is strategically positioning itself for profitability within three years, underscoring its potential amidst tumultuous times.

- Dive into the specifics of Geron here with our thorough health report.

Explore historical data to track Geron's performance over time in our Past section.

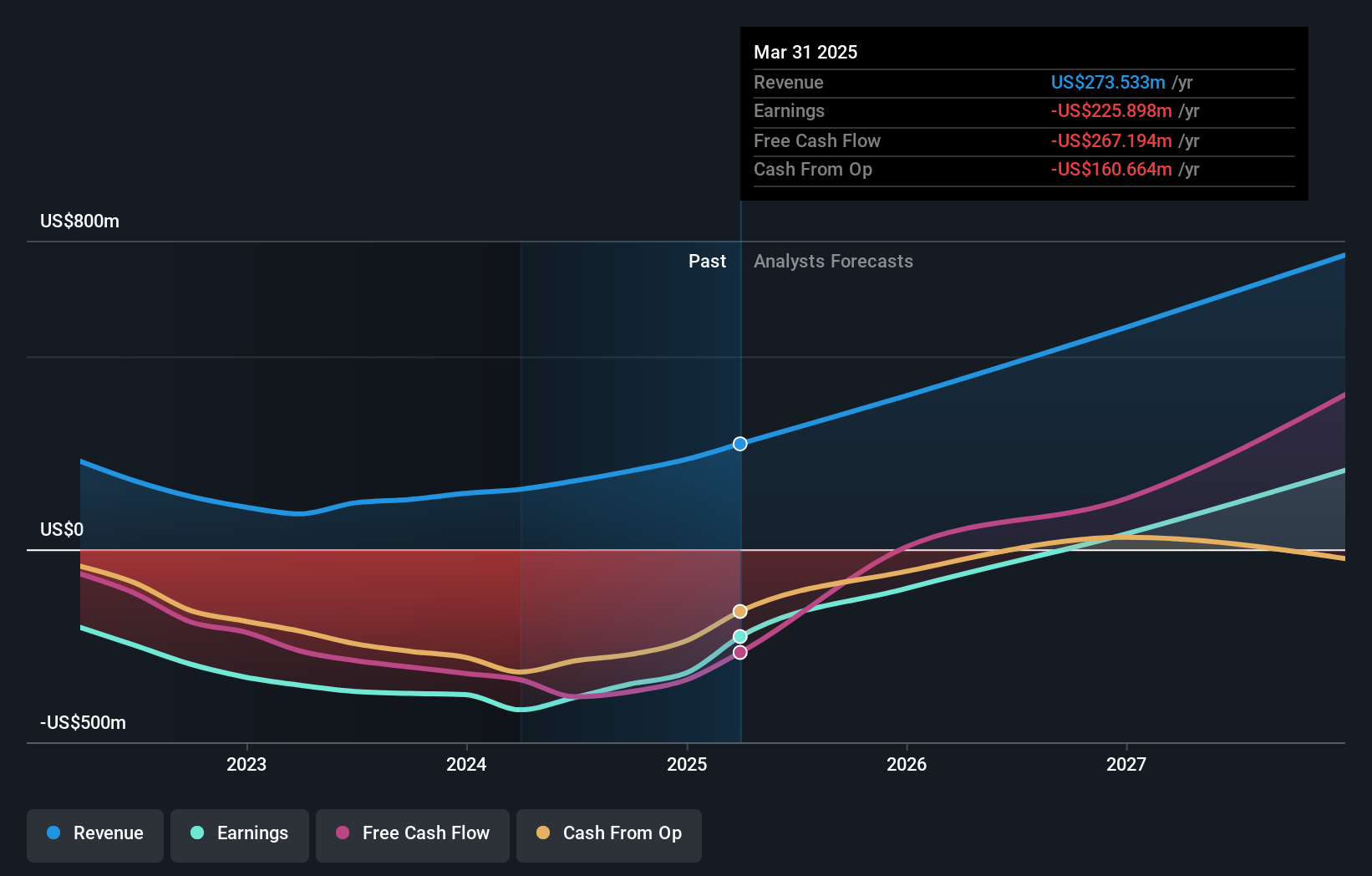

Calix (NYSE:CALX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Calix, Inc. offers cloud and software platforms, systems, and services across various regions globally with a market cap of $2.22 billion.

Operations: Calix, Inc. generates revenue through its cloud and software platforms, systems, and services offered across multiple regions including the United States, Europe, the Middle East, Africa, and Asia Pacific. The company focuses on providing technological solutions to enhance network capabilities for its clients worldwide.

Calix's recent financial performance reflects a challenging quarter with sales dropping to $220.24 million from $226.31 million year-over-year and shifting from a net income of $0.103 million to a net loss of $4.79 million. Despite these hurdles, the company remains proactive in shareholder value enhancement, evidenced by an aggressive buyback strategy that saw 1,157,000 shares repurchased for $39.99 million in the first quarter alone, completing a significant portion of its ongoing buyback plan totaling $137.12 million for 3,710,000 shares since July 2022. This strategic move underscores Calix's commitment to navigating through market fluctuations while fostering robust growth avenues like its partnership with Texas-based YK Communications through Calix University—aimed at transforming broadband service frameworks and enhancing workforce capabilities in response to industry demands for more skilled professionals amidst anticipated retirements over the next decade.

- Take a closer look at Calix's potential here in our health report.

Assess Calix's past performance with our detailed historical performance reports.

Next Steps

- Take a closer look at our US High Growth Tech and AI Stocks list of 233 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CALX

Calix

Provides cloud and software platforms, and systems and services in the United States, rest of Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives