- United States

- /

- Biotech

- /

- NasdaqGM:FHTX

More Unpleasant Surprises Could Be In Store For Foghorn Therapeutics Inc.'s (NASDAQ:FHTX) Shares After Tumbling 41%

Foghorn Therapeutics Inc. (NASDAQ:FHTX) shareholders that were waiting for something to happen have been dealt a blow with a 41% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 27% share price drop.

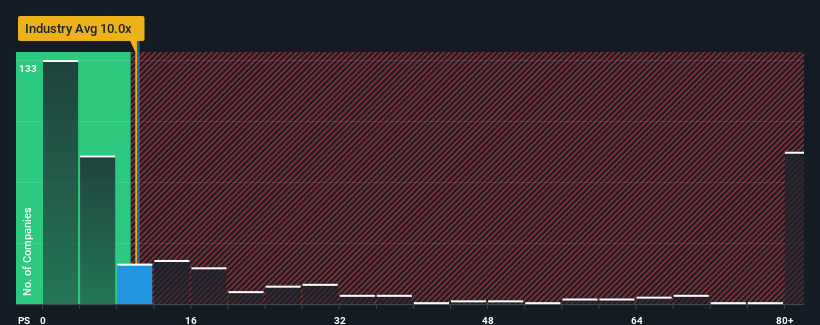

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Foghorn Therapeutics' P/S ratio of 10.3x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in the United States is also close to 10x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Foghorn Therapeutics

How Foghorn Therapeutics Has Been Performing

Foghorn Therapeutics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Foghorn Therapeutics.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Foghorn Therapeutics' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Looking ahead now, revenue is anticipated to climb by 17% per annum during the coming three years according to the eight analysts following the company. With the industry predicted to deliver 114% growth per annum, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Foghorn Therapeutics is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Foghorn Therapeutics' P/S?

With its share price dropping off a cliff, the P/S for Foghorn Therapeutics looks to be in line with the rest of the Biotechs industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Foghorn Therapeutics' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Foghorn Therapeutics (of which 2 are significant!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FHTX

Foghorn Therapeutics

A clinical-stage biopharmaceutical company, engages in the discovery and development of medicines targeting genetically determined dependencies within the chromatin regulatory system in the United States.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives