- United States

- /

- Biotech

- /

- NasdaqGM:FHTX

Foghorn Therapeutics Inc.'s (NASDAQ:FHTX) 28% Share Price Plunge Could Signal Some Risk

The Foghorn Therapeutics Inc. (NASDAQ:FHTX) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 134% in the last twelve months.

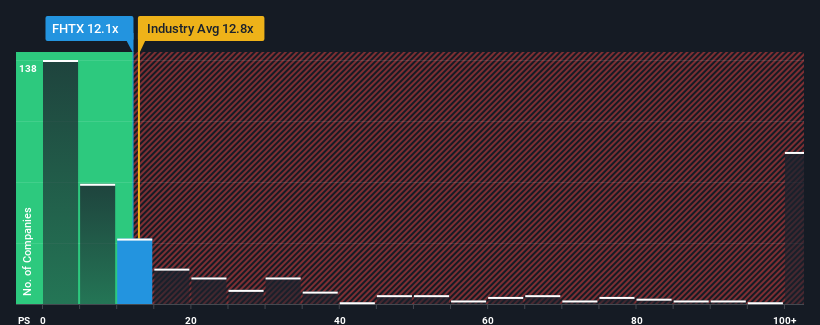

In spite of the heavy fall in price, it's still not a stretch to say that Foghorn Therapeutics' price-to-sales (or "P/S") ratio of 11.4x right now seems quite "middle-of-the-road" compared to the Biotechs industry in the United States, where the median P/S ratio is around 12.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Foghorn Therapeutics

What Does Foghorn Therapeutics' Recent Performance Look Like?

Recent times haven't been great for Foghorn Therapeutics as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Foghorn Therapeutics will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Foghorn Therapeutics' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 62% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 16% per year during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 148% per year, which is noticeably more attractive.

In light of this, it's curious that Foghorn Therapeutics' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

With its share price dropping off a cliff, the P/S for Foghorn Therapeutics looks to be in line with the rest of the Biotechs industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Foghorn Therapeutics' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 4 warning signs for Foghorn Therapeutics you should be aware of, and 1 of them is potentially serious.

If these risks are making you reconsider your opinion on Foghorn Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Foghorn Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FHTX

Foghorn Therapeutics

A clinical-stage biopharmaceutical company, engages in the discovery and development of medicines targeting genetically determined dependencies within the chromatin regulatory system in the United States.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives