- United States

- /

- Biotech

- /

- NasdaqCM:EXAS

Did Upbeat Analyst Revisions and Strong Medicare Coverage Just Shift Exact Sciences' (EXAS) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent weeks, Exact Sciences Corporation has seen multiple upward analyst earnings estimate revisions and a new Zacks Rank #1 (Strong Buy) designation, reflecting growing optimism ahead of the company’s upcoming third-quarter 2025 financial results announcement and investor webcast scheduled for early November.

- This wave of positive analyst sentiment comes as Exact Sciences continues to expand access to key cancer screening products like Cologuard Plus and Oncodetect, both receiving Medicare coverage, signaling broader patient reach in the evolving diagnostics landscape.

- We'll examine how strongly improved analyst earnings outlooks and estimate revisions are shaping Exact Sciences' broader investment narrative going forward.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Exact Sciences Investment Narrative Recap

Belief in Exact Sciences as an investment centers on the company’s ability to grow its cancer diagnostics platform through expanded reimbursement and adoption, especially with flagship products like Cologuard Plus and Oncodetect. While the stream of recent analyst upgrades and earnings estimate increases is encouraging, this news has little direct effect on the company’s near-term vulnerability to reimbursement changes, competitive threats in colorectal cancer screening, or continued margin pressure from R&D spending.

The recent Medicare coverage win for Oncodetect stands out, expanding access for a larger patient population and potentially adding to revenue momentum. This move aligns closely with current analyst interest and adds short-term clarity around the company’s path to broader adoption, though the broader risks to Exact’s long-term growth from advances in competitive technologies and payer policy remain.

But investors should also be aware that despite gains in coverage and sentiment, control over long-term market share could shift quickly if...

Read the full narrative on Exact Sciences (it's free!)

Exact Sciences' outlook anticipates $4.1 billion in revenue and $277.2 million in earnings by 2028. This is based on analysts forecasting 11.6% annual revenue growth and a $1.28 billion increase in earnings from the current -$1.0 billion.

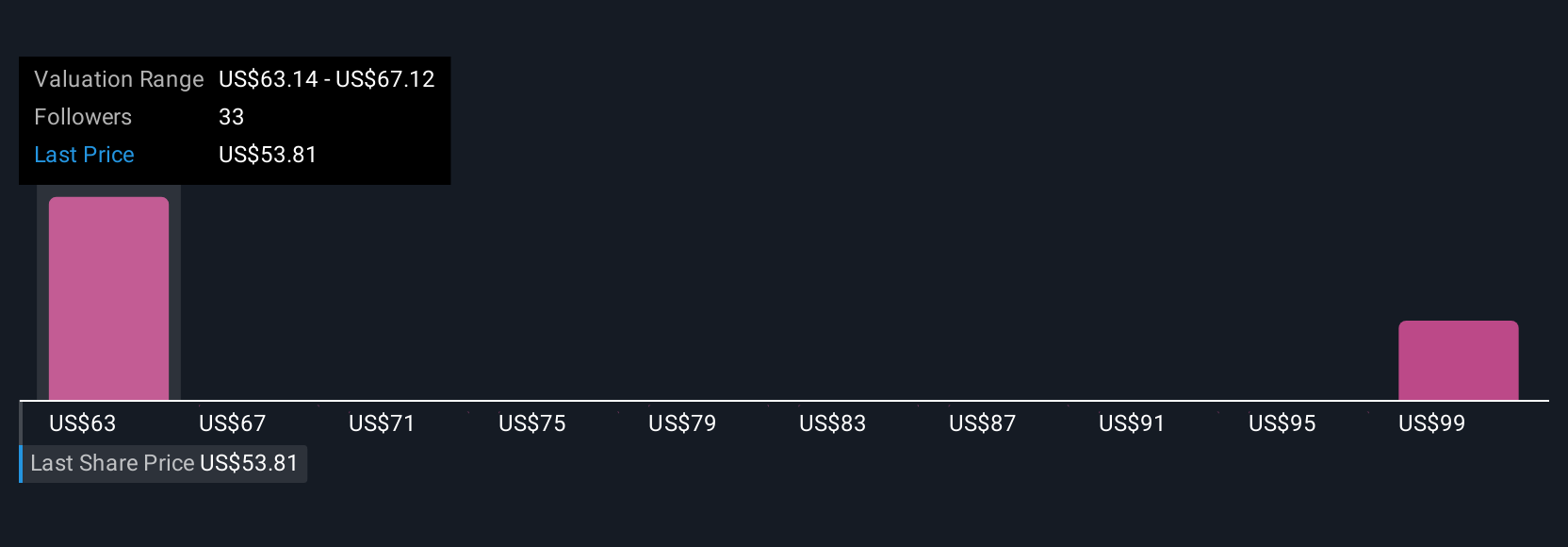

Uncover how Exact Sciences' forecasts yield a $65.38 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Seven private investors in the Simply Wall St Community estimate Exact Sciences’ fair value between US$65 and US$155 per share. While most see room for upside, increased competition and evolving payer guidelines are top of mind for those watching future revenue growth and pricing power.

Explore 7 other fair value estimates on Exact Sciences - why the stock might be worth just $65.38!

Build Your Own Exact Sciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exact Sciences research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Exact Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exact Sciences' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exact Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EXAS

Exact Sciences

Provides cancer screening and diagnostic test products in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives