- United States

- /

- Biotech

- /

- NasdaqGS:DNLI

Exploring Denali Therapeutics (DNLI) Valuation After Recent 24% Share Price Rally

Reviewed by Kshitija Bhandaru

See our latest analysis for Denali Therapeutics.

Denali Therapeutics’ sharp 24% rally this month stands out after a challenging stretch, with its 1-day and 7-day share price returns both in firmly positive territory. Although momentum is building lately, its total shareholder return over the past year tells a different story at minus 41%, signaling ongoing volatility and the potential for sentiment shifts ahead.

If biotech’s recent volatility has you looking for fresh ideas, consider this the perfect chance to check out See the full list for free.

With Denali’s recent surge and a price still well below analysts’ targets, is the market underrating its long-term prospects, or are investors already factoring in any potential turnaround, leaving little room for upside?

Price-to-Book of 2.3x: Is it justified?

Denali Therapeutics is trading with a price-to-book ratio of 2.3x, which positions it as attractively valued relative to similar biotech firms in the US market and among its peers. At last close, shares stood at $16.31, reflecting a multiple noticeably below the peer average of 4.6x and the broader industry average of 2.5x.

The price-to-book ratio compares a company's market value to its book value, offering a lens through which investors assess whether a stock is valued above or below its actual net assets. This metric is especially relevant for biotech firms, where tangible assets can be a core marker of financial grounding amid ongoing R&D expenses and uncertain timelines to profitability.

The comparably low 2.3x ratio suggests that the market may be underpricing Denali’s capacity to generate future value relative to peer companies. Both the peer group and industry trade at considerably higher multiples, highlighting a valuation gap that may have room to close if sentiment improves.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 2.3x (UNDERVALUED)

However, investors should note that Denali’s lack of consistent profitability and ongoing negative net income remain key risks that could limit share price upside.

Find out about the key risks to this Denali Therapeutics narrative.

Another View: DCF Model Paints a Contrasting Picture

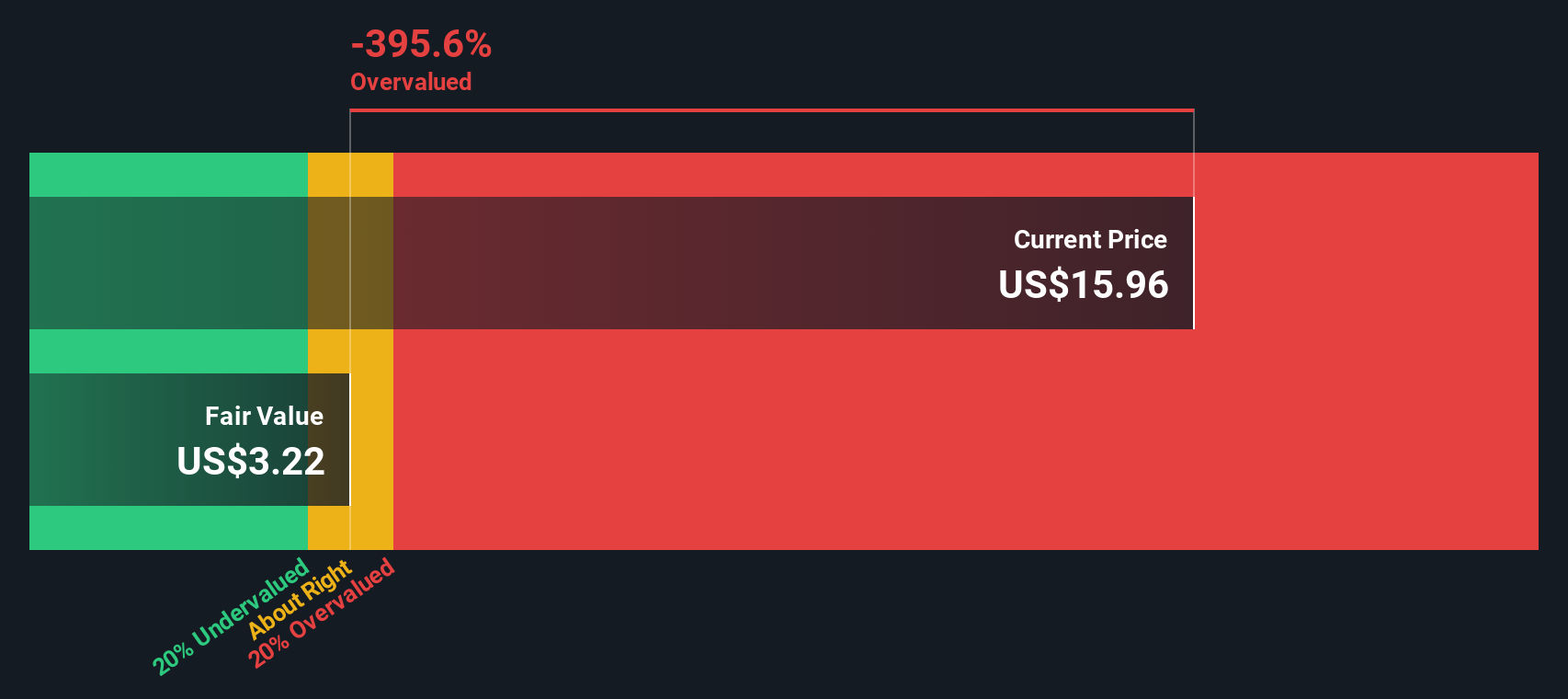

While Denali Therapeutics appears undervalued using the price-to-book ratio, our DCF model offers a different perspective. The SWS DCF model estimates Denali's fair value at $3.31, substantially below its current trading price, indicating the stock could be overvalued when viewed through this lens. Such a stark contrast raises questions about which metric truly captures Denali's outlook. Are the company's future cash flows being overestimated, or is the market underestimating its turnaround?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Denali Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Denali Therapeutics Narrative

If you have a different perspective or want a closer look at the underlying numbers, you can easily craft your own analysis in just a few minutes. Do it your way

A great starting point for your Denali Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great opportunities are everywhere, but only if you know where to look. Give your portfolio an edge by investigating these unique avenues before others beat you to it:

- Uncover stocks offering potential comeback potential, supported by strong cash flow fundamentals, when you start with these 874 undervalued stocks based on cash flows today.

- Maximize yield in your holdings by evaluating companies on these 18 dividend stocks with yields > 3% that deliver solid returns above 3%.

- Ride innovation’s next wave as you dig into the breakthroughs from these 26 quantum computing stocks and spot businesses shaping tomorrow’s tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DNLI

Denali Therapeutics

A biopharmaceutical company, discovers and develops therapeutics to treat neurodegenerative and lysosomal storage diseases.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives