- United States

- /

- Biotech

- /

- OTCPK:DMTK.Q

Analyst Forecasts Just Became More Bearish On DermTech, Inc. (NASDAQ:DMTK)

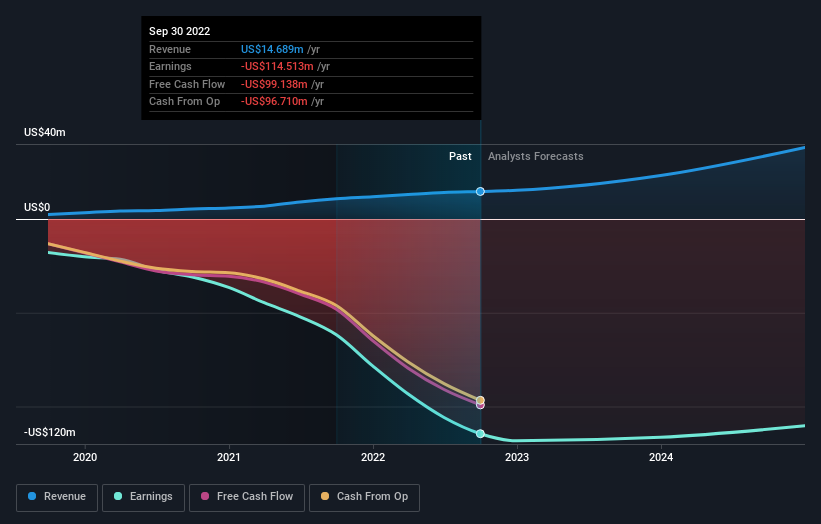

The latest analyst coverage could presage a bad day for DermTech, Inc. (NASDAQ:DMTK), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue estimates were cut sharply as analysts signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well.

After the downgrade, the six analysts covering DermTech are now predicting revenues of US$23m in 2023. If met, this would reflect a substantial 60% improvement in sales compared to the last 12 months. Losses are forecast to narrow 2.6% to US$3.69 per share. Yet before this consensus update, the analysts had been forecasting revenues of US$32m and losses of US$3.70 per share in 2023. So there's definitely been a change in sentiment in this update, with the analysts administering a substantial haircut to next year's revenue estimates, while at the same time holding losses per share steady.

View our latest analysis for DermTech

The consensus price target fell 28% to US$12.67, with the analysts clearly concerned about the weaker revenue outlook and expectation of ongoing losses. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic DermTech analyst has a price target of US$20.00 per share, while the most pessimistic values it at US$6.00. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how think this business will perform. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The period to the end of 2023 brings more of the same, according to the analysts, with revenue forecast to display 45% growth on an annualised basis. That is in line with its 47% annual growth over the past five years. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 14% annually. So it's pretty clear that DermTech is forecast to grow substantially faster than its industry.

The Bottom Line

While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Overall, given the drastic downgrade to next year's forecasts, we'd be feeling a little more wary of DermTech going forwards.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with DermTech's financials, such as dilutive stock issuance over the past year. For more information, you can click here to discover this and the 3 other warning signs we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:DMTK.Q

DermTech

A molecular diagnostic company, engages in the development and marketing of novel non-invasive genomics tests to aid in the diagnosis and management of melanoma in the United States.

Mediocre balance sheet low.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026