- United States

- /

- Biotech

- /

- NasdaqGS:CYTK

Cytokinetics Insiders Sold US$4.7m Of Shares Suggesting Hesitancy

In the last year, many Cytokinetics, Incorporated (NASDAQ:CYTK) insiders sold a substantial stake in the company which may have sparked shareholders' attention. Knowing whether insiders are buying is usually more helpful when evaluating insider transactions, as insider selling can have various explanations. However, when multiple insiders sell stock over a specific duration, shareholders should take notice as that could possibly be a red flag.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

See our latest analysis for Cytokinetics

Cytokinetics Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the CEO, President & Director, Robert Blum, for US$1.2m worth of shares, at about US$52.60 per share. So what is clear is that an insider saw fit to sell at around the current price of US$49.20. We generally don't like to see insider selling, but the lower the sale price, the more it concerns us. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

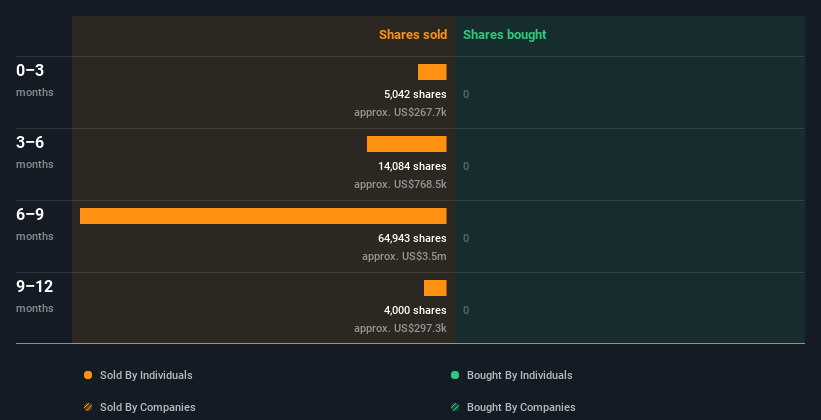

Cytokinetics insiders didn't buy any shares over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

Insiders At Cytokinetics Have Sold Stock Recently

The last three months saw significant insider selling at Cytokinetics. Specifically, Executive Vice President of Research & Development Fady Malik ditched US$263k worth of shares in that time, and we didn't record any purchases whatsoever. Overall this makes us a bit cautious, but it's not the be all and end all.

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. It appears that Cytokinetics insiders own 0.5% of the company, worth about US$28m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At Cytokinetics Tell Us?

An insider sold Cytokinetics shares recently, but they didn't buy any. And there weren't any purchases to give us comfort, over the last year. Insiders own shares, but we're still pretty cautious, given the history of sales. We're in no rush to buy! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Cytokinetics. Every company has risks, and we've spotted 4 warning signs for Cytokinetics (of which 1 is a bit concerning!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

If you're looking to trade Cytokinetics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CYTK

Cytokinetics

A late-stage biopharmaceutical company, focuses on discovering, developing, and commercializing muscle activators and inhibitors as potential treatments for debilitating diseases in the United States.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives