- United States

- /

- Biotech

- /

- NasdaqGM:CVAC

Optimistic Investors Push CureVac N.V. (NASDAQ:CVAC) Shares Up 47% But Growth Is Lacking

CureVac N.V. (NASDAQ:CVAC) shareholders would be excited to see that the share price has had a great month, posting a 47% gain and recovering from prior weakness. But the last month did very little to improve the 58% share price decline over the last year.

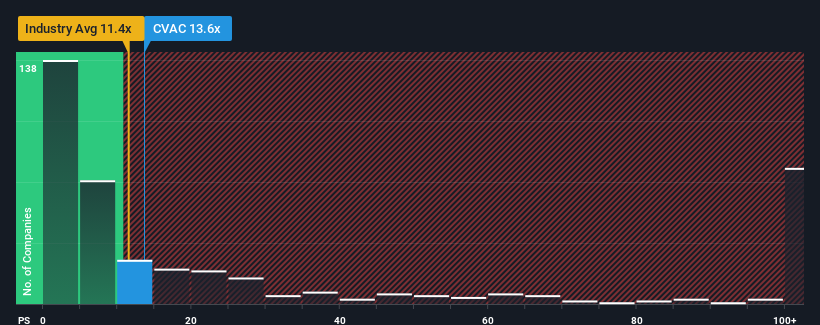

Although its price has surged higher, there still wouldn't be many who think CureVac's price-to-sales (or "P/S") ratio of 13.6x is worth a mention when the median P/S in the United States' Biotechs industry is similar at about 11.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for CureVac

How Has CureVac Performed Recently?

Recent times haven't been great for CureVac as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think CureVac's future stacks up against the industry? In that case, our free report is a great place to start.How Is CureVac's Revenue Growth Trending?

In order to justify its P/S ratio, CureVac would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. The latest three year period has also seen a 5.8% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 37% per year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 210% per annum, which is noticeably more attractive.

In light of this, it's curious that CureVac's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On CureVac's P/S

CureVac's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that CureVac's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for CureVac (of which 1 is a bit unpleasant!) you should know about.

If these risks are making you reconsider your opinion on CureVac, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CVAC

CureVac

A biopharmaceutical company, focuses on developing various transformative medicines based on messenger ribonucleic acid (mRNA).

Adequate balance sheet with moderate growth potential.