- United States

- /

- Biotech

- /

- NasdaqGS:CTMX

Revenues Working Against CytomX Therapeutics, Inc.'s (NASDAQ:CTMX) Share Price Following 26% Dive

Unfortunately for some shareholders, the CytomX Therapeutics, Inc. (NASDAQ:CTMX) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 78% loss during that time.

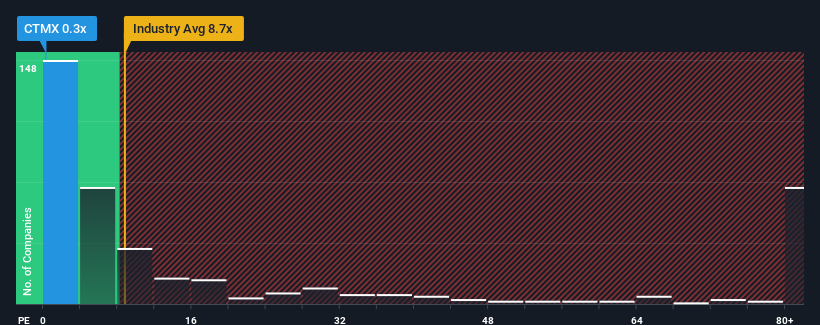

Following the heavy fall in price, CytomX Therapeutics may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 8.5x and even P/S higher than 47x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for CytomX Therapeutics

What Does CytomX Therapeutics' Recent Performance Look Like?

Recent times haven't been great for CytomX Therapeutics as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think CytomX Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start .Is There Any Revenue Growth Forecasted For CytomX Therapeutics?

The only time you'd be truly comfortable seeing a P/S as depressed as CytomX Therapeutics' is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 36%. The latest three year period has also seen an excellent 270% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 32% each year as estimated by the five analysts watching the company. That's not great when the rest of the industry is expected to grow by 170% each year.

With this in consideration, we find it intriguing that CytomX Therapeutics' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does CytomX Therapeutics' P/S Mean For Investors?

Having almost fallen off a cliff, CytomX Therapeutics' share price has pulled its P/S way down as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of CytomX Therapeutics' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, CytomX Therapeutics' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 5 warning signs for CytomX Therapeutics you should be aware of, and 2 of them can't be ignored.

If you're unsure about the strength of CytomX Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CTMX

CytomX Therapeutics

Operates as an oncology-focused biopharmaceutical company that focuses on developing novel conditionally activated biologics localized to the tumor microenvironment.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives