- United States

- /

- Biotech

- /

- NasdaqGM:CRVS

We're Not Worried About Corvus Pharmaceuticals' (NASDAQ:CRVS) Cash Burn

There's no doubt that money can be made by owning shares of unprofitable businesses. By way of example, Corvus Pharmaceuticals (NASDAQ:CRVS) has seen its share price rise 128% over the last year, delighting many shareholders. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

In light of its strong share price run, we think now is a good time to investigate how risky Corvus Pharmaceuticals' cash burn is. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Corvus Pharmaceuticals

When Might Corvus Pharmaceuticals Run Out Of Money?

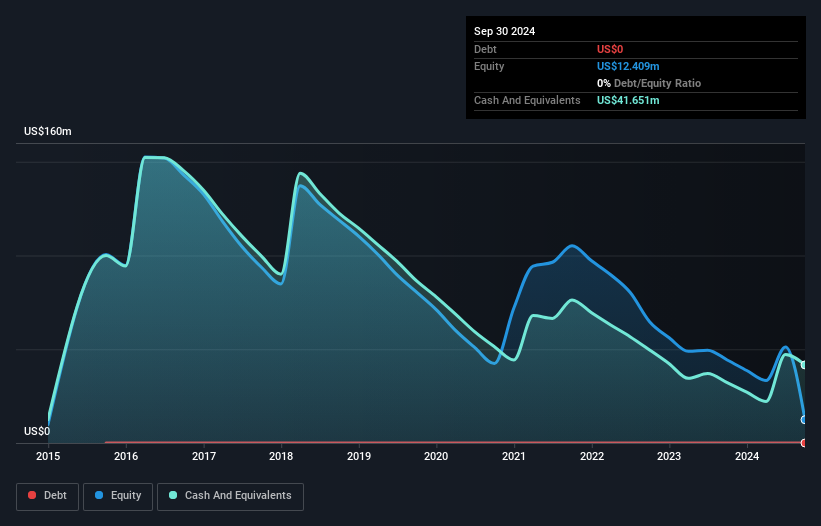

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. When Corvus Pharmaceuticals last reported its September 2024 balance sheet in November 2024, it had zero debt and cash worth US$42m. Importantly, its cash burn was US$22m over the trailing twelve months. That means it had a cash runway of around 23 months as of September 2024. Notably, however, analysts think that Corvus Pharmaceuticals will break even (at a free cash flow level) before then. If that happens, then the length of its cash runway, today, would become a moot point. You can see how its cash balance has changed over time in the image below.

How Is Corvus Pharmaceuticals' Cash Burn Changing Over Time?

Because Corvus Pharmaceuticals isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. With cash burn dropping by 16% it seems management feel the company is spending enough to advance its business plans at an appropriate pace. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Corvus Pharmaceuticals To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Corvus Pharmaceuticals to raise more cash in the future. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Corvus Pharmaceuticals' cash burn of US$22m is about 6.5% of its US$342m market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is Corvus Pharmaceuticals' Cash Burn Situation?

As you can probably tell by now, we're not too worried about Corvus Pharmaceuticals' cash burn. In particular, we think its cash burn relative to its market cap stands out as evidence that the company is well on top of its spending. On this analysis its cash burn reduction was its weakest feature, but we are not concerned about it. There's no doubt that shareholders can take a lot of heart from the fact that analysts are forecasting it will reach breakeven before too long. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. Taking a deeper dive, we've spotted 4 warning signs for Corvus Pharmaceuticals you should be aware of, and 1 of them is a bit concerning.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CRVS

Corvus Pharmaceuticals

A clinical stage biopharmaceutical company, focuses on the development and commercialization of immune modulator product candidates to treat solid cancers, T cell lymphomas, autoimmune, allergic, and infectious diseases.

Adequate balance sheet slight.

Market Insights

Community Narratives