- United States

- /

- Biotech

- /

- NasdaqCM:CPRX

Assessing Catalyst Pharmaceuticals’ Value After Recent Positive FDA Ruling in 2025

Reviewed by Bailey Pemberton

If you have Catalyst Pharmaceuticals stock on your watchlist or in your portfolio, you might be asking yourself: is it time to make a move? Recent price swings have kept investors guessing. The stock closed at $20.36, only slightly down over the past week by 2.3%, but still up 2.0% in the last month. Year-to-date, it is down 5.4%, but when you zoom out, here is where things get interesting. Catalyst has delivered an impressive 62.2% return over three years and a striking 522.6% over the last five years. Clearly, this is a company that has been rewarded for growth and resilience over the long term.

Market watchers have recently noted shifts in sentiment, as positive developments in Catalyst’s pipeline and a more favorable outlook in the pharmaceutical sector have helped renew optimism. The market appears to be recalibrating how it values the company, balancing recent volatility with the high long-term growth numbers.

What really stands out is that, by our numbers, Catalyst earns a valuation score of 6 out of 6. That means on every one of the six key valuation checks, the company looks undervalued right now. It is the kind of all-around result that makes investors take notice and wonder if the market is overlooking something important.

But what exactly do these valuation checks look at, and how much weight should you give each one? In the next section, we will walk through the key valuation approaches and then share a method that could give you an even clearer perspective on what Catalyst is really worth.

Approach 1: Catalyst Pharmaceuticals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) valuation estimates the true worth of a business by projecting its future cash flows and discounting them back to today's value. This method is a widely relied upon approach for assessing whether a stock is under- or overvalued, especially for companies with clear paths to future profitability.

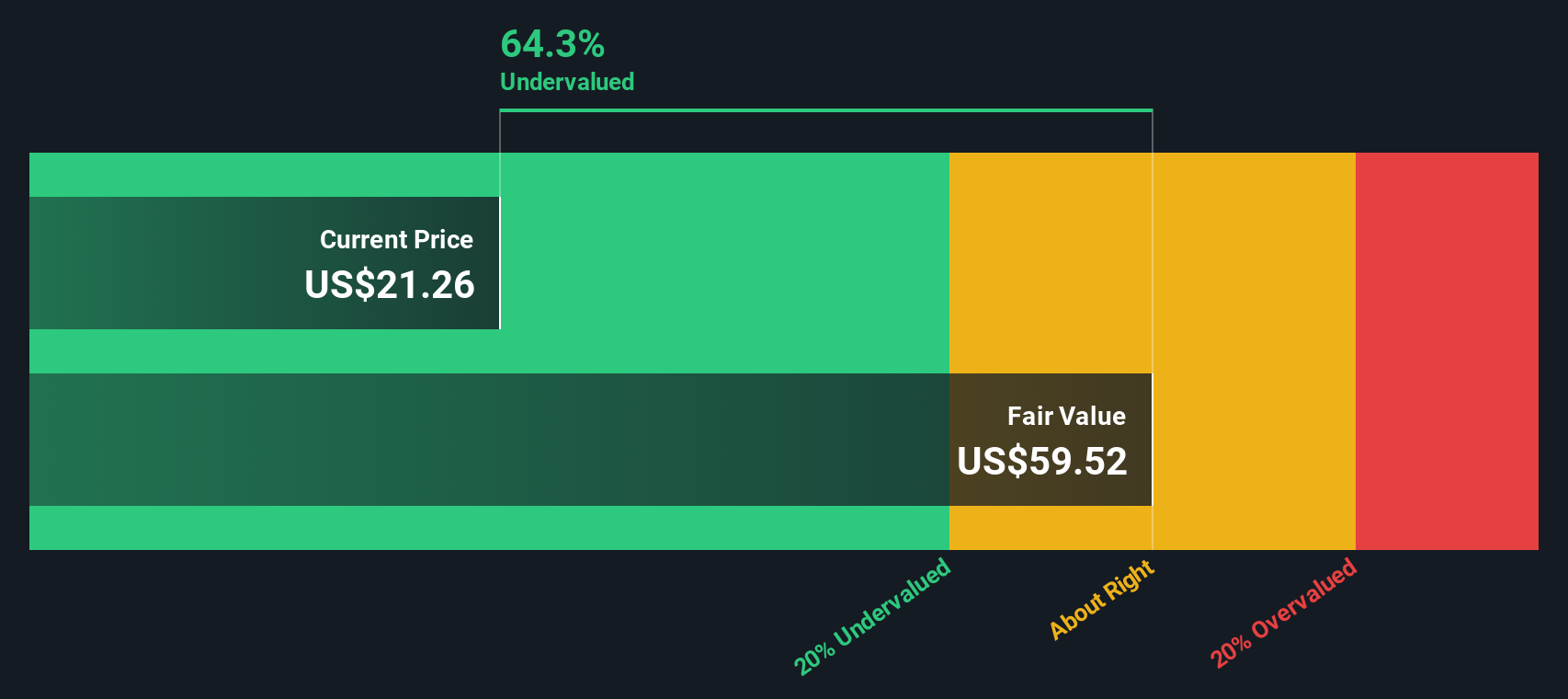

For Catalyst Pharmaceuticals, the current Free Cash Flow stands at $185 million. Analysts have forecasted that annual free cash flows will continue to climb, with projections reaching $292 million by 2029. It is important to note that while analyst estimates provide FCF data for roughly five years, projections beyond this period are extrapolated based on recent trends and margin assumptions. These longer-term projections help fill in the outlook up to ten years into the future.

Applying the DCF model using these projections, the estimated intrinsic value for Catalyst Pharmaceuticals comes out to $59.57 per share in USD. With the recent closing share price at $20.36, this suggests the stock is trading at a 65.8% discount to its intrinsic value. According to this analysis, Catalyst Pharmaceuticals appears to be significantly undervalued by the market at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Catalyst Pharmaceuticals is undervalued by 65.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Catalyst Pharmaceuticals Price vs Earnings (PE)

The price-to-earnings (PE) ratio is widely regarded as the go-to valuation metric for established, profitable companies like Catalyst Pharmaceuticals. It provides a clear measure of how much investors are willing to pay for each dollar of earnings, making it useful for benchmarking against both peers and broader industry trends.

It is important to remember that what constitutes a "normal" or "fair" PE ratio depends on a company's future earnings growth prospects and the risks associated with its business. Higher expected growth and lower risk typically justify a higher PE ratio, while greater risk or slower growth might warrant a lower one.

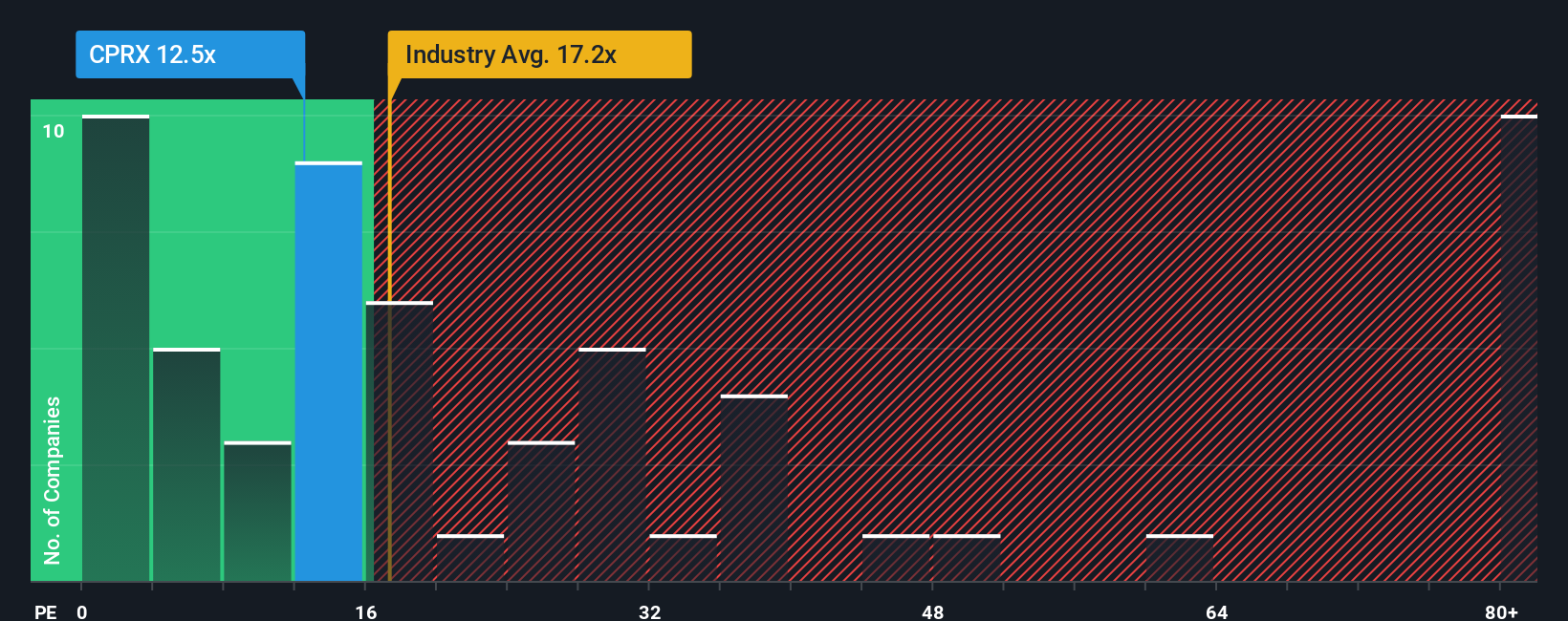

Catalyst trades at a PE of 11.94x. For context, the average PE across the Biotechs industry stands at 16.61x, and the average among similar peers is even higher at 42.46x. By comparison, Catalyst appears quite conservatively valued on this metric.

However, simply comparing to peers and the industry can be misleading, as every company has a unique combination of growth, profitability, market cap, and risk. This is where Simply Wall St’s proprietary "Fair Ratio" comes in. The Fair Ratio, calculated for Catalyst at 16.09x, reflects a more nuanced view. It considers the company’s actual earnings outlook, risks, and other fundamentals rather than relying solely on broad averages.

When we compare Catalyst’s current PE of 11.94x to its Fair Ratio of 16.09x, the difference is significant enough to suggest the stock is undervalued based on these underlying fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Catalyst Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is more than just a number; it is your opportunity to build a story about a company based on your perspective around what drives its future, blending your assumptions about revenue growth, earnings, and margins into an outlook that links the company's story directly to a financial forecast and fair value.

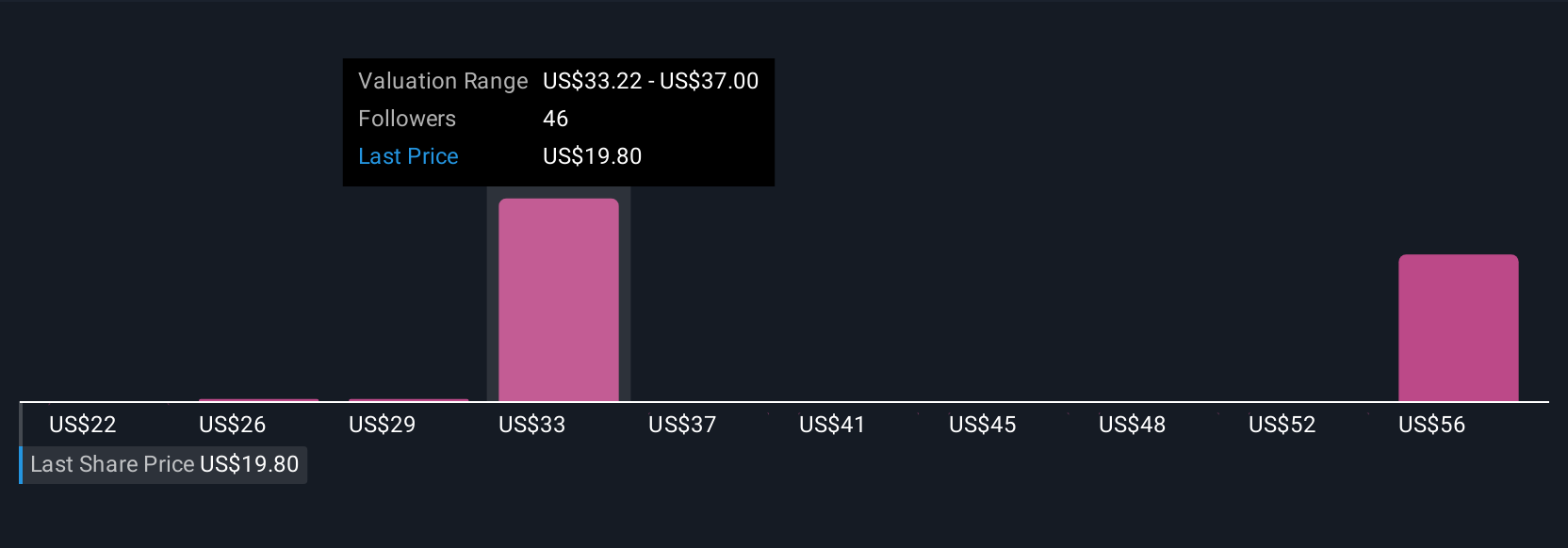

Narratives are an accessible, hands-on toolkit available to all investors right within the Simply Wall St Community page. They are designed to make sophisticated investing easy and interactive. By creating or exploring different Narratives, you can compare your calculated Fair Value with Catalyst's current share price, helping you decide when it might be time to buy, sell, or hold based on scenarios you believe in.

Unlike static forecasts, Narratives are dynamic and will update automatically as new information comes in, such as fresh earnings results or industry news. Your perspective therefore remains relevant and informed. For example, some investors believe Catalyst Pharmaceuticals could reach as high as $40.00 per share based on aggressive revenue growth and success with new drug launches, while others see a more cautious outlook around $31.00 if risks materialize and the product pipeline does not deliver as hoped.

Do you think there's more to the story for Catalyst Pharmaceuticals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CPRX

Catalyst Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on developing and commercializing medicines for patients living with rare diseases in the United States.

Very undervalued with outstanding track record.

Market Insights

Community Narratives