- United States

- /

- Pharma

- /

- NasdaqGS:COLL

It Looks Like Shareholders Would Probably Approve Collegium Pharmaceutical, Inc.'s (NASDAQ:COLL) CEO Compensation Package

Key Insights

- Collegium Pharmaceutical to hold its Annual General Meeting on 16th of May

- Salary of US$817.0k is part of CEO Joe Ciaffoni's total remuneration

- The overall pay is comparable to the industry average

- Collegium Pharmaceutical's total shareholder return over the past three years was 74% while its EPS grew by 24% over the past three years

We have been pretty impressed with the performance at Collegium Pharmaceutical, Inc. (NASDAQ:COLL) recently and CEO Joe Ciaffoni deserves a mention for their role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 16th of May. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

View our latest analysis for Collegium Pharmaceutical

How Does Total Compensation For Joe Ciaffoni Compare With Other Companies In The Industry?

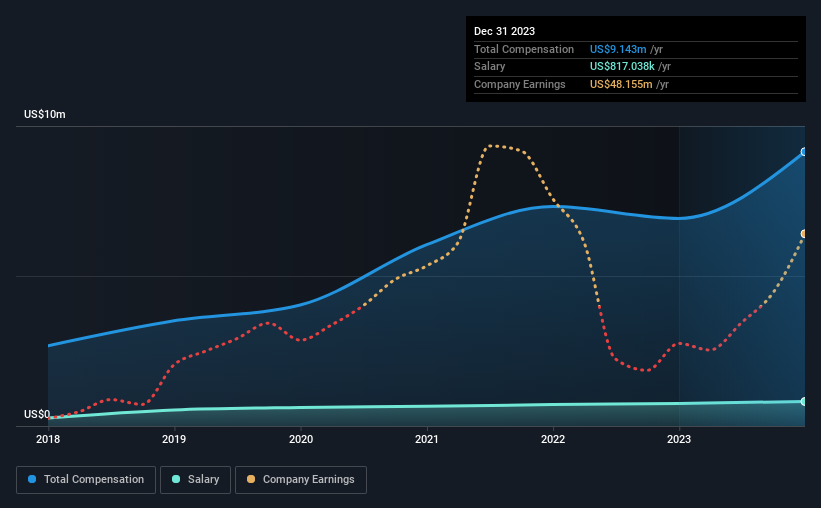

Our data indicates that Collegium Pharmaceutical, Inc. has a market capitalization of US$1.2b, and total annual CEO compensation was reported as US$9.1m for the year to December 2023. We note that's an increase of 32% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$817k.

On examining similar-sized companies in the American Pharmaceuticals industry with market capitalizations between US$1.0b and US$3.2b, we discovered that the median CEO total compensation of that group was US$7.7m. So it looks like Collegium Pharmaceutical compensates Joe Ciaffoni in line with the median for the industry. Furthermore, Joe Ciaffoni directly owns US$5.6m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$817k | US$752k | 9% |

| Other | US$8.3m | US$6.2m | 91% |

| Total Compensation | US$9.1m | US$6.9m | 100% |

Speaking on an industry level, nearly 28% of total compensation represents salary, while the remainder of 72% is other remuneration. Collegium Pharmaceutical pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Collegium Pharmaceutical, Inc.'s Growth

Over the past three years, Collegium Pharmaceutical, Inc. has seen its earnings per share (EPS) grow by 24% per year. It achieved revenue growth of 22% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Collegium Pharmaceutical, Inc. Been A Good Investment?

We think that the total shareholder return of 74%, over three years, would leave most Collegium Pharmaceutical, Inc. shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Some shareholders will probably be more lenient on CEO compensation in the upcoming AGM given the pleasing performance of the company recently. However, despite the strong growth in earnings and share price growth, the focus for shareholders would be how the company plans to steer the company towards sustainable profitability in the near future.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which makes us a bit uncomfortable) in Collegium Pharmaceutical we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:COLL

Collegium Pharmaceutical

A specialty pharmaceutical company, engages in the development and commercialization of medicines for pain management.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026