- United States

- /

- Biotech

- /

- NasdaqGM:CLGN

CollPlant Biotechnologies (NASDAQ:CLGN) adds US$7.9m to market cap in the past 7 days, though investors from three years ago are still down 60%

This week we saw the CollPlant Biotechnologies Ltd. (NASDAQ:CLGN) share price climb by 13%. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 60% in that period. So it's good to see it climbing back up. After all, could be that the fall was overdone.

While the stock has risen 13% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for CollPlant Biotechnologies

CollPlant Biotechnologies wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, CollPlant Biotechnologies' revenue dropped 33% per year. That means its revenue trend is very weak compared to other loss making companies. Arguably, the market has responded appropriately to this business performance by sending the share price down 17% (annualized) in the same time period. When revenue is dropping, and losses are still costing, and the share price sinking fast, it's fair to ask if something is remiss. After losing money on a declining business with falling stock price, we always consider whether eager bagholders are still offering us a reasonable exit price.

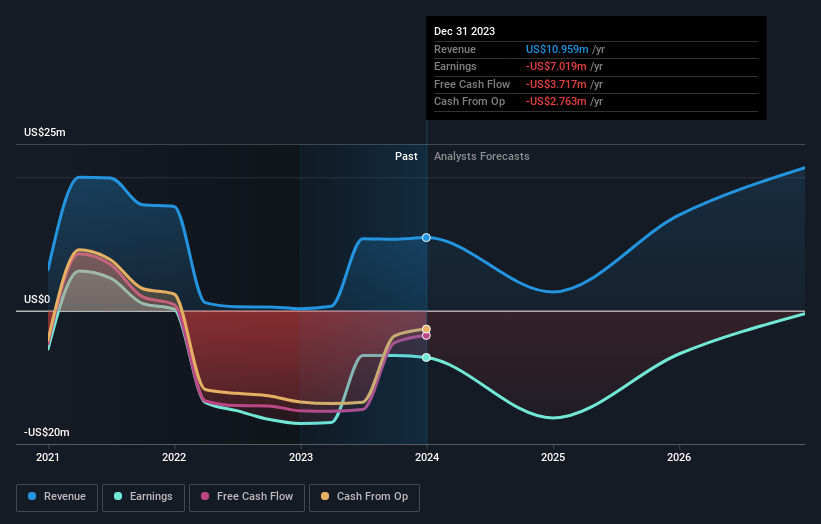

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at CollPlant Biotechnologies' financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 24% in the last year, CollPlant Biotechnologies shareholders lost 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for CollPlant Biotechnologies you should be aware of.

Of course CollPlant Biotechnologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CLGN

CollPlant Biotechnologies

A regenerative and aesthetic medicine company, focuses on three-dimensional (3D) bioprinting of tissues and organs, and medical aesthetics in the United States, Canada, Israel, Europe, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives