- United States

- /

- Biotech

- /

- NasdaqCM:CKPT

The Checkpoint Therapeutics (NASDAQ:CKPT) Share Price Is Up 141% And Shareholders Are Boasting About It

It might be of some concern to shareholders to see the Checkpoint Therapeutics, Inc. (NASDAQ:CKPT) share price down 14% in the last month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. We're very pleased to report the share price shot up 141% in that time. So it is important to view the recent reduction in price through that lense. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

See our latest analysis for Checkpoint Therapeutics

We don't think Checkpoint Therapeutics' revenue of US$1,069,000 is enough to establish significant demand. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that Checkpoint Therapeutics comes up with a great new product, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Checkpoint Therapeutics has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

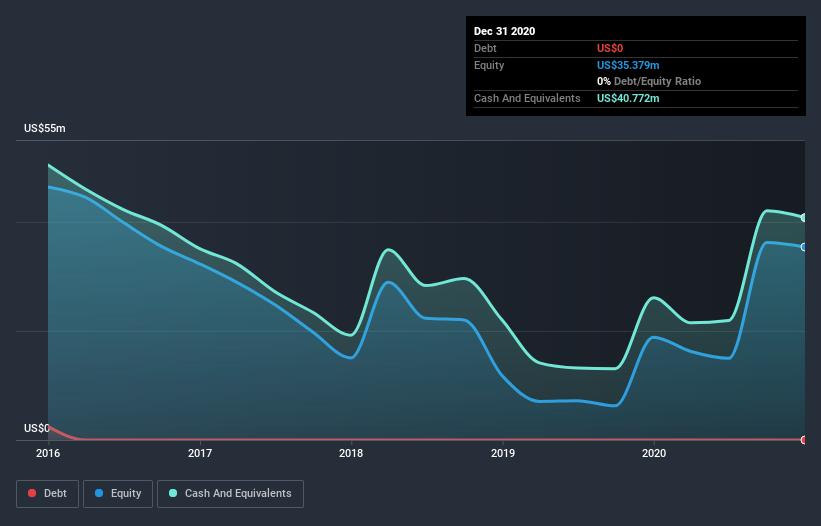

When it last reported its balance sheet in December 2020, Checkpoint Therapeutics had cash in excess of all liabilities of US$34m. That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. Given the share price has increased by a solid 87% in the last year , it's fair to say investors remain excited about the future, despite the potential need for cash. The image below shows how Checkpoint Therapeutics' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. One thing you can do is check if company insiders are buying shares. If they are buying a significant amount of shares, that's certainly a good thing. You can click here to see if there are insiders buying.

A Different Perspective

Pleasingly, Checkpoint Therapeutics' total shareholder return last year was 141%. What is absolutely clear is that is far preferable to the dismal 10% average annual loss suffered over the last three years. It could well be that the business has turned around -- or else regained the confidence of investors. It's always interesting to track share price performance over the longer term. But to understand Checkpoint Therapeutics better, we need to consider many other factors. Case in point: We've spotted 5 warning signs for Checkpoint Therapeutics you should be aware of.

But note: Checkpoint Therapeutics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Checkpoint Therapeutics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CKPT

Checkpoint Therapeutics

A clinical-stage immunotherapy and targeted oncology company, focuses on the acquisition, development, and commercialization of novel treatments for patients with solid tumor cancers in the United States and internationally.

High growth potential moderate.