- United States

- /

- Biotech

- /

- NasdaqGS:CGON

Will CG Oncology’s (CGON) Board Refresh and Cretostimogene Data Shape Its Bladder Cancer Strategy?

Reviewed by Sasha Jovanovic

- CG Oncology announced that former Blueprint Medicines executive Christina Rossi has joined its board, replacing Simone Song, and confirmed that late-breaking clinical data on its investigational bladder cancer therapy cretostimogene were recently presented at the Society of Urologic Oncology Annual Meeting.

- The combination of leadership change and emerging Phase 3 and Phase 2 data for cretostimogene highlights CG Oncology’s focus on advancing its bladder cancer pipeline.

- Against this backdrop, we’ll explore how the upcoming cretostimogene data presentations at SUO may influence CG Oncology’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is CG Oncology's Investment Narrative?

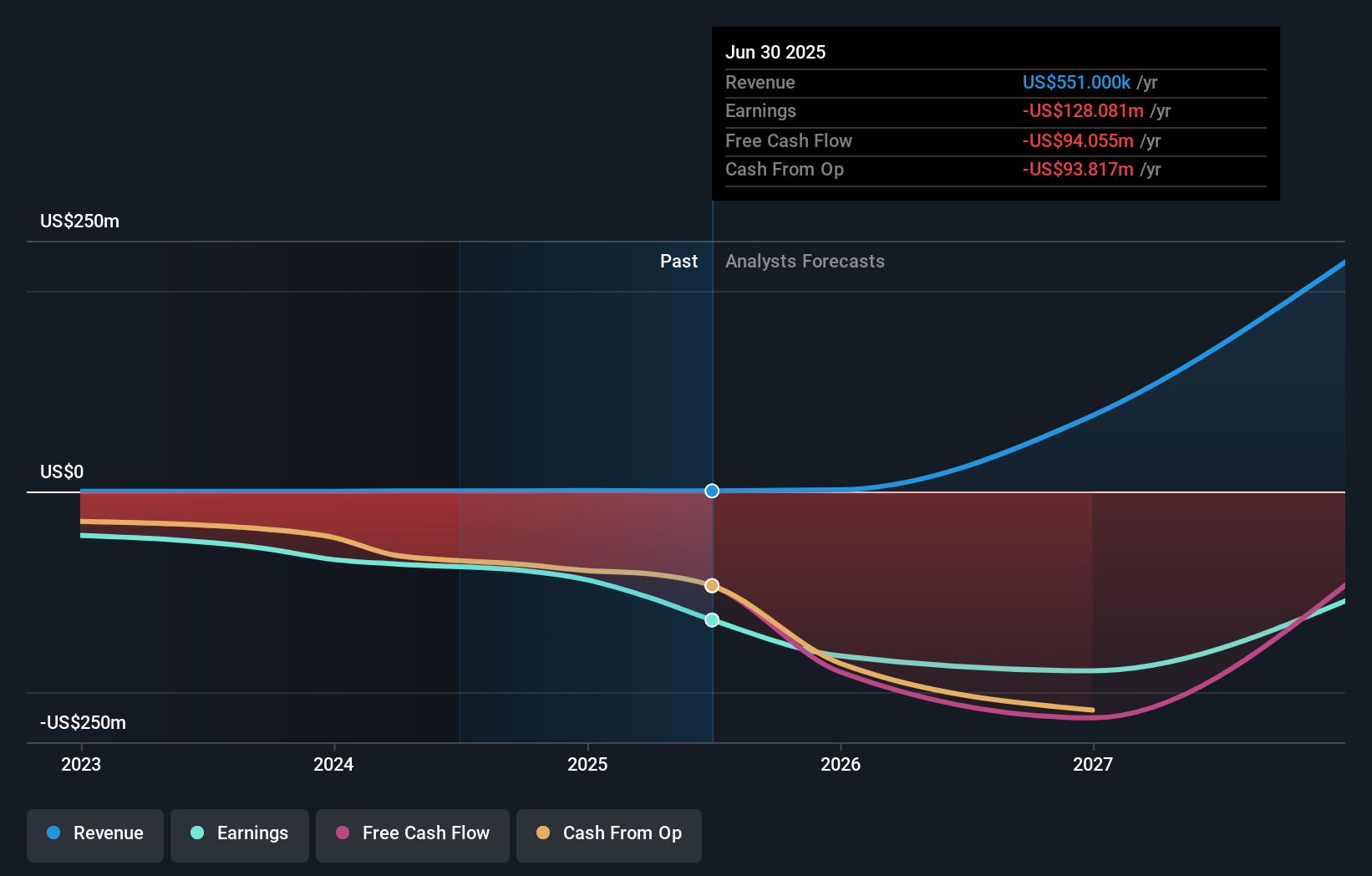

To own CG Oncology, you really need to believe that cretostimogene can carve out a meaningful role in non muscle invasive bladder cancer and eventually justify today’s loss making, low revenue profile. The stock’s recent strength suggests the market is already watching the Phase 3 BOND-003 and Phase 2 CORE-008 readouts closely, and the late breaking SUO presentations should feed directly into that core thesis, even if the event itself may not change the near term catalyst calendar. What could matter more over time is how well CG translates positive data, if it emerges, into real world adoption and pricing. On that front, Christina Rossi’s board appointment adds deep commercial and launch experience, which may partially offset investor concern about management turnover and repeated equity raises.

However, investors also need to weigh funding needs against a history of dilution and growing losses. Despite retreating, CG Oncology's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on CG Oncology - why the stock might be worth just $396.03!

Build Your Own CG Oncology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CG Oncology research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CG Oncology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CG Oncology's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGON

CG Oncology

A late-stage clinical biopharmaceutical company, develops and commercializes backbone bladder-sparing therapeutics for patients with bladder cancer.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026