- United States

- /

- Biotech

- /

- NasdaqCM:CELC

Should FDA Real-Time Review of Gedatolisib Prompt a Closer Look From Celcuity (CELC) Investors?

Reviewed by Sasha Jovanovic

- In August 2025, Celcuity Inc. announced the U.S. FDA had accepted its New Drug Application for gedatolisib under the Real-Time Oncology Review program, which accelerates regulatory evaluation of new therapies.

- This milestone follows strong Phase 3 trial results for gedatolisib in advanced breast cancer and comes as Celcuity expanded its senior secured credit facility to US$500 million to support development and commercialization.

- We’ll now explore how Celcuity’s preparation for potential commercialization of gedatolisib shapes the company’s broader investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Celcuity's Investment Narrative?

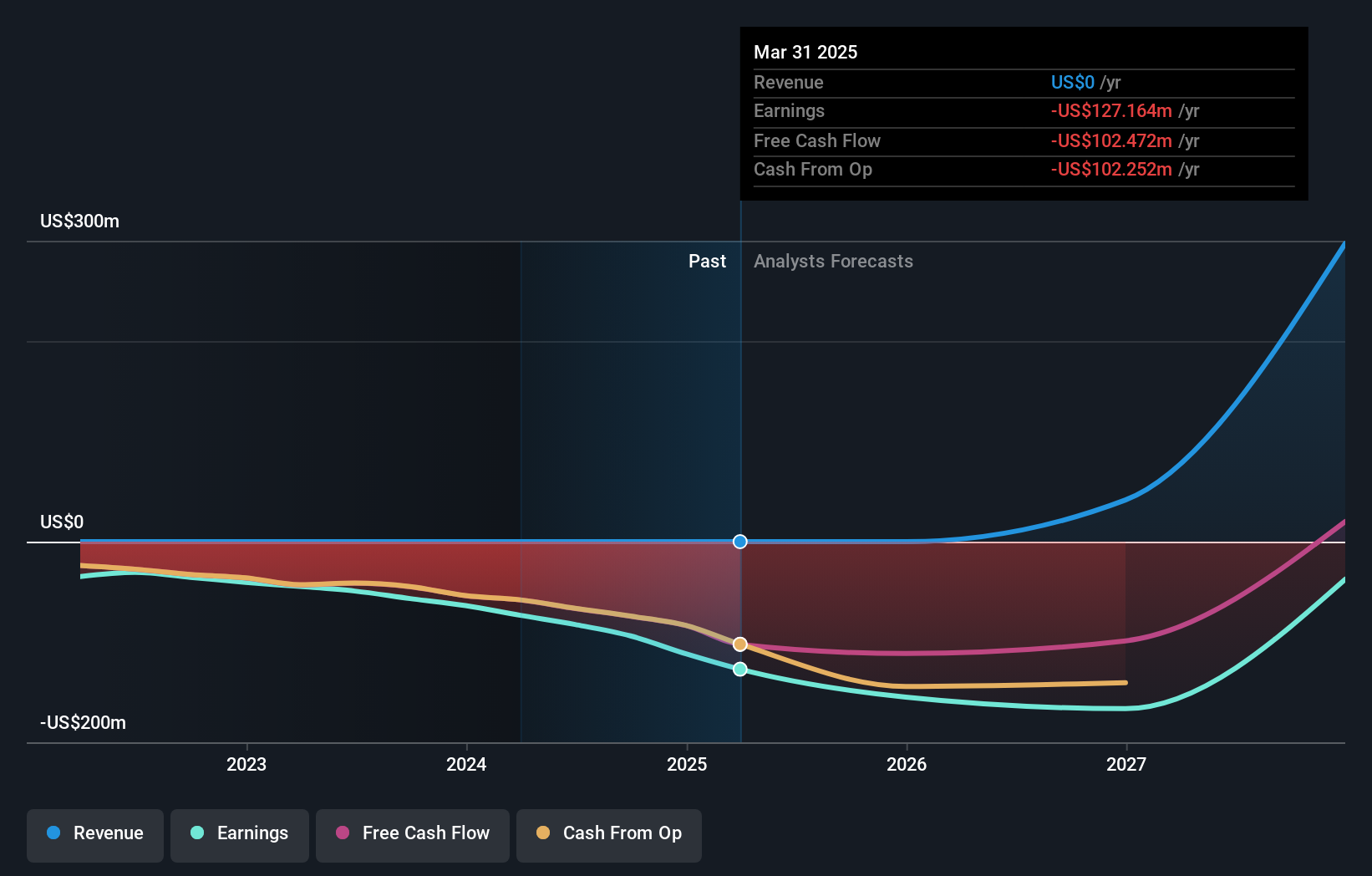

To believe in Celcuity as a shareholder, you have to see value in its high-risk, high-reward profile, where clinical and regulatory milestones drive sentiment and potential upside. The FDA’s Real-Time Oncology Review acceptance for gedatolisib, following robust Phase 3 results, undeniably accelerates Celcuity’s most important near-term catalyst: its first commercial drug launch. This news is material for both the investment thesis and the risk backdrop. It signals a step closer to monetization, helping to justify recent aggressive debt raises and added capital needs. While this boosts the outlook and brings anticipated revenue within reach, it also raises the stakes given Celcuity’s increasing net losses and ongoing lack of sales. With the share price already reflecting some optimism, and the company’s value still hinging on future execution and regulatory outcomes, the path forward remains highly sensitive to new data and regulatory decisions.

Yet, even as the path to commercialization accelerates, funding requirements remain a critical risk.

Exploring Other Perspectives

Explore another fair value estimate on Celcuity - why the stock might be worth over 6x more than the current price!

Build Your Own Celcuity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Celcuity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celcuity's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives