- United States

- /

- Biotech

- /

- NasdaqCM:CELC

A Look at Celcuity (CELC) Valuation After FDA Review Triggered by VIKTORIA-1 Breast Cancer Trial Results

Reviewed by Simply Wall St

If you have been watching Celcuity (CELC), the recent surge may have turned your head. The company just announced that the FDA has agreed to review its New Drug Application for gedatolisib, an investigational treatment for HR+/HER2- advanced breast cancer, under the Real-Time Oncology Review program. This accelerated review, granted on the back of breakthrough efficacy results from the Phase 3 VIKTORIA-1 trial, signals meaningful progress for Celcuity and brings the drug closer to potential approval.

This news came at a time when momentum for Celcuity had already been building. Over the past month, shares have climbed by nearly 36%, with gains accelerating to almost 384% for the past three months and over 310% in the past year. These patterns reinforce a market that has started to re-rate the stock upwards, particularly as pivotal clinical milestones have converted into concrete regulatory events. For longer-term holders, the recent catalyst adds fresh energy atop a five-year rise of over 1,100%, all while revenue and net income growth rates have moved sharply higher on an annual basis.

As we look at 2024’s rally and the remarkable swing in sentiment, the real question is whether Celcuity shares still have room to run or if the market has already baked in all that potential future growth.

Price-to-Book of 59.8x: Is it justified?

Celcuity is currently considered expensive when using the price-to-book (P/B) ratio, which stands at 59.8 times compared to the biotech industry's average of 2.2 times and peer average of 3.1 times. This high P/B ratio suggests investors are paying a significant premium over the company's net assets.

The price-to-book multiple is a standard measure for valuing companies in asset-light and research-driven sectors such as biotechnology. It indicates how much investors are willing to pay for each dollar of net assets or equity. For early-stage or unprofitable biotechs, this ratio can be elevated if the market expects transformative future earnings growth or breakthrough drugs.

This P/B multiple implies substantial optimism about Celcuity's future prospects. However, currently, the company is unprofitable and its losses have actually grown over the past five years. While recent clinical and regulatory milestones may be fueling enthusiasm, the valuation depends on the company delivering dramatic improvements in profitability soon.

Result: Fair Value of $62.53 (OVERVALUED)

See our latest analysis for Celcuity.However, setbacks in FDA approval or disappointing follow-up trial results could quickly undercut the optimism that is fueling Celcuity’s elevated valuation.

Find out about the key risks to this Celcuity narrative.Another View: What Does the SWS DCF Model Say?

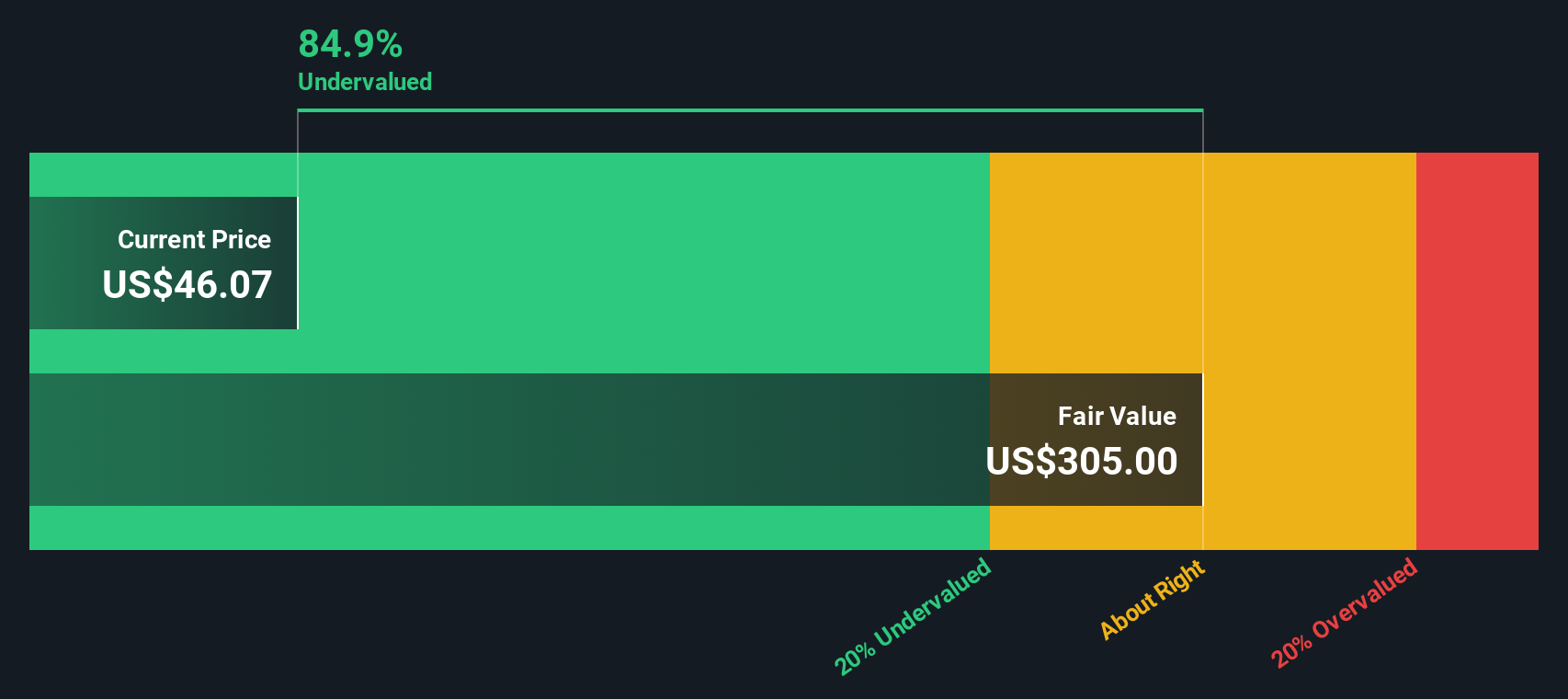

While the earlier valuation method suggests Celcuity is richly priced, the SWS DCF model paints a sharply different picture. According to this approach, shares may actually be undervalued. Can both views be right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Celcuity Narrative

If you see the story differently or want to dig deeper into the numbers, you can easily analyze the data and build your own perspective in just a few minutes. Do it your way.

A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on emerging opportunities. Stay ahead of the curve and uncover stocks with unique growth prospects by using these expert-curated tools.

- Grow your portfolio with confidence by targeting high-yield opportunities using our handpicked list of dividend stocks with yields > 3%.

- Spot tomorrow’s tech giants by tapping into companies revolutionizing artificial intelligence with our exclusive AI penny stocks.

- Capitalize on overlooked market gems with our powerful undervalued stocks based on cash flows and find stocks trading below their true value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion