- United States

- /

- Biotech

- /

- NasdaqGM:CDNA

Should CareDx’s Governance Settlement and ESOP Shift Require Action From CareDx (CDNA) Investors?

Reviewed by Sasha Jovanovic

- CareDx Inc. has disclosed a proposed settlement of shareholder derivative lawsuits in federal and Delaware courts and, in December 2025, secured preliminary court approval for a deal centered on corporate governance reforms, while also amending its bylaws to adopt a majority voting standard for uncontested director elections.

- The combination of governance-focused settlement terms, a shift to majority voting for directors, and a new US$8.27 million ESOP-related shelf registration signals a concerted effort to tighten oversight and better align management incentives with shareholder interests.

- We’ll now examine how the governance-focused litigation settlement and related reforms could reshape CareDx’s longer-term investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

CareDx Investment Narrative Recap

To own CareDx today, you generally need to believe its transplant diagnostics franchise can grow through reimbursement uncertainty and leadership turnover, while governance and compliance stay tight. The recent derivative settlement and bylaw changes look more incremental than transformative for near term revenue, with the key short term swing factor still centered on Medicare coverage and any move toward bundled payments for testing, which could meaningfully affect AlloSure and HeartCare volumes and pricing if policies turn less supportive.

Among the latest announcements, the move to a majority voting standard for uncontested director elections is especially relevant to the litigation settlement, because it reinforces board accountability at a time when regulatory scrutiny, billing oversight and compliance costs remain front of mind. For investors watching catalysts, this governance shift sits in the background of more immediate drivers such as test volume trends, SHORE-related clinical adoption, and how quickly new offerings like HistoMap Kidney gain traction.

Yet investors should also be aware that tighter oversight comes with ongoing regulatory scrutiny risk, especially if...

Read the full narrative on CareDx (it's free!)

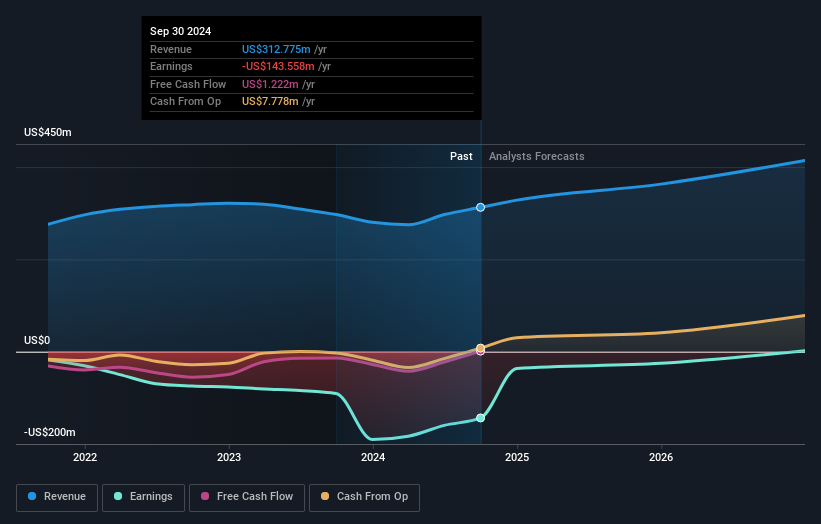

CareDx's narrative projects $485.8 million revenue and $78.0 million earnings by 2028. This requires 12.5% yearly revenue growth and an earnings increase of about $19.9 million from $58.1 million today.

Uncover how CareDx's forecasts yield a $23.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community valuations span from US$23 to US$203.09 per share, underscoring how far apart individual views can be. When you set those against ongoing Medicare reimbursement and bundled payment risks, it becomes even more important to compare several independent perspectives before deciding where you stand on CareDx.

Explore 3 other fair value estimates on CareDx - why the stock might be worth over 10x more than the current price!

Build Your Own CareDx Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CareDx research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CareDx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CareDx's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 10 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CDNA

CareDx

Engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion