- United States

- /

- Biotech

- /

- NasdaqGS:CCCC

C4 Therapeutics, Inc. (NASDAQ:CCCC) Looks Inexpensive After Falling 31% But Perhaps Not Attractive Enough

To the annoyance of some shareholders, C4 Therapeutics, Inc. (NASDAQ:CCCC) shares are down a considerable 31% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 78% share price decline.

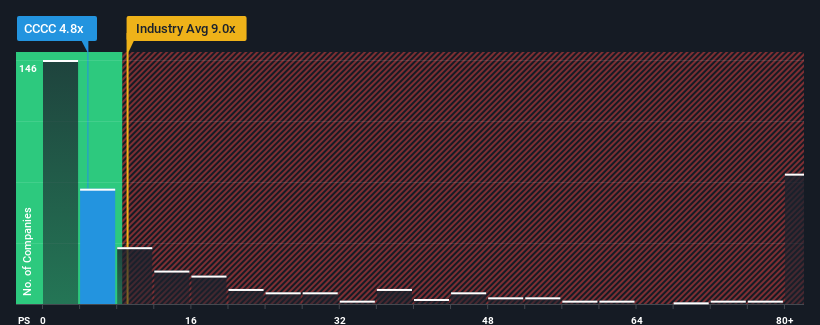

Following the heavy fall in price, C4 Therapeutics may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 4.8x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 9x and even P/S higher than 49x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for C4 Therapeutics

What Does C4 Therapeutics' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, C4 Therapeutics has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on C4 Therapeutics will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For C4 Therapeutics?

In order to justify its P/S ratio, C4 Therapeutics would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 71% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 22% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 24% each year during the coming three years according to the nine analysts following the company. That's not great when the rest of the industry is expected to grow by 128% per annum.

With this in consideration, we find it intriguing that C4 Therapeutics' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From C4 Therapeutics' P/S?

The southerly movements of C4 Therapeutics' shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that C4 Therapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with C4 Therapeutics (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CCCC

C4 Therapeutics

A clinical-stage biopharmaceutical company, develops novel therapeutic candidates to degrade disease-causing proteins.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives