- United States

- /

- Biotech

- /

- NasdaqCM:CAPR

Investors Don't See Light At End Of Capricor Therapeutics, Inc.'s (NASDAQ:CAPR) Tunnel

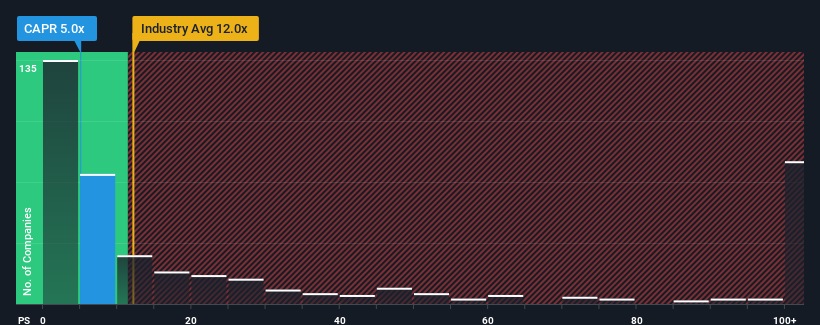

Capricor Therapeutics, Inc.'s (NASDAQ:CAPR) price-to-sales (or "P/S") ratio of 5x might make it look like a strong buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 12x and even P/S above 64x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Capricor Therapeutics

What Does Capricor Therapeutics' P/S Mean For Shareholders?

Capricor Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Capricor Therapeutics will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Capricor Therapeutics' is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The amazing performance means it was also able to deliver huge revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 46% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 181% per year, which is noticeably more attractive.

With this in consideration, its clear as to why Capricor Therapeutics' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Capricor Therapeutics' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Capricor Therapeutics (1 shouldn't be ignored) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CAPR

Capricor Therapeutics

A clinical-stage biotechnology company, focuses on the development of transformative cell and exosome-based therapeutics for the treatment of duchenne muscular dystrophy (DMD) and other diseases with unmet medical needs.

Flawless balance sheet with high growth potential.