- United States

- /

- Biotech

- /

- NasdaqCM:CAPR

High Growth Tech Stocks In The United States To Watch

Reviewed by Simply Wall St

The United States market has shown a positive trajectory, climbing 1.5% in the past week and achieving a 22% increase over the last year, with earnings projected to grow by 15% annually in the coming years. In this favorable environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and robust financial health to capitalize on these expanding opportunities.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 29.07% | 27.57% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 29.97% | 53.77% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

Click here to see the full list of 230 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Capricor Therapeutics (NasdaqCM:CAPR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capricor Therapeutics, Inc. is a clinical-stage biotechnology company that develops cell and exosome-based therapeutics for treating Duchenne muscular dystrophy and other diseases with unmet medical needs, with a market cap of $725.25 million.

Operations: Capricor Therapeutics focuses on developing cell and exosome-based therapeutics, primarily targeting Duchenne muscular dystrophy. The company generates revenue from its biotechnology segment, amounting to $23.23 million.

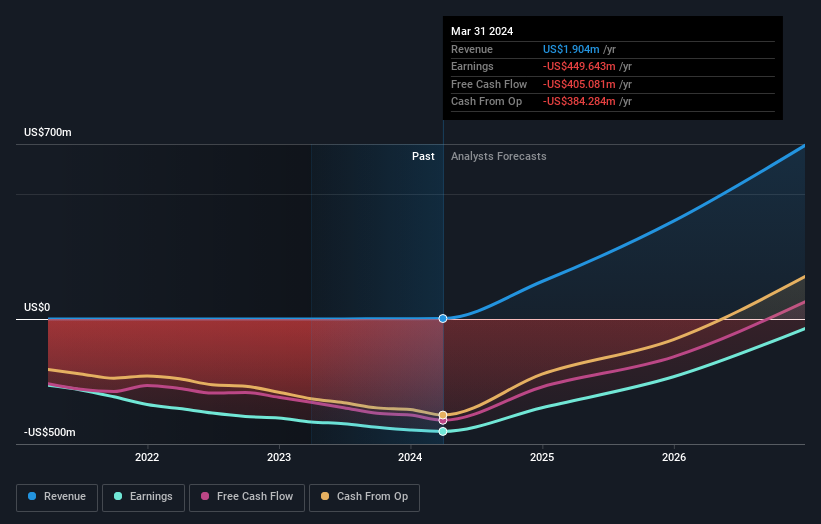

Capricor Therapeutics, a player in the biotechnology landscape, is navigating an ambitious path with its advanced cell therapy treatments. Recently completing its BLA submission for deramiocel to treat Duchenne muscular dystrophy cardiomyopathy, the company's strategic focus on specialized therapies is evident. This move could potentially accelerate FDA approval timelines due to priority review requests, highlighting Capricor’s proactive regulatory strategy. Financially, despite current unprofitability and a volatile share price, Capricor's projected annual revenue growth at 44.2% outpaces the US market average of 8.9%. Moreover, earnings are expected to surge by 55.1% annually, signaling robust future prospects if these projections materialize into sustainable profitability over the next three years.

- Click here and access our complete health analysis report to understand the dynamics of Capricor Therapeutics.

Explore historical data to track Capricor Therapeutics' performance over time in our Past section.

Arcturus Therapeutics Holdings (NasdaqGM:ARCT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Arcturus Therapeutics Holdings Inc. is a late-stage clinical company specializing in messenger RNA medicines and vaccines, with a focus on infectious disease vaccines and treatments for liver and respiratory rare diseases, boasting a market cap of approximately $488.93 million.

Operations: The company generates revenue primarily from the research and development of medical applications, totaling $160.40 million.

Arcturus Therapeutics Holdings is charting a promising trajectory with recent European Commission approval for its innovative sa-mRNA COVID-19 vaccine, KOSTAIVE, enhancing its market presence in immunization. This milestone follows significant R&D investments that underscore the company's commitment to cutting-edge healthcare solutions. Despite current unprofitability and a volatile share price, Arcturus's revenue growth forecast at 31.7% annually outstrips the U.S. market average significantly. With earnings expected to climb by over 60% annually, driven by strategic leadership additions like Dr. Moncef Slaoui and ongoing advancements in mRNA technology, Arcturus is poised for impactful growth in biotechnology sectors focused on urgent global health needs.

- Click to explore a detailed breakdown of our findings in Arcturus Therapeutics Holdings' health report.

Understand Arcturus Therapeutics Holdings' track record by examining our Past report.

Iovance Biotherapeutics (NasdaqGM:IOVA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Iovance Biotherapeutics, Inc. is a commercial-stage biotechnology company focused on developing and commercializing cell therapies for treating metastatic melanoma and other solid tumor cancers in the United States, with a market cap of $1.70 billion.

Operations: Iovance Biotherapeutics focuses on developing cell therapies using autologous tumor infiltrating lymphocyte (TIL) technology for solid tumor cancers, generating revenue of $90.86 million from this segment.

Iovance Biotherapeutics is enhancing its leadership in the biotech industry with strategic executive hires, including Dan Kirby as Chief Commercial Officer and Raj Puri as Chief Regulatory Officer, signaling robust commercial and regulatory strategies ahead. Despite being currently unprofitable, Iovance's revenue is projected to grow at an impressive 35.9% annually, outpacing the U.S. market average of 8.9%. The company's commitment to innovation is further underscored by a recent $15.92 million shelf registration for funding potential expansions or operations, positioning it well for future profitability with expected earnings growth of 57.1% per year.

Taking Advantage

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 227 more companies for you to explore.Click here to unveil our expertly curated list of 230 US High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CAPR

Capricor Therapeutics

A clinical-stage biotechnology company, focuses on the development of transformative cell and exosome-based therapeutics for the treatment of duchenne muscular dystrophy (DMD) and other diseases with unmet medical needs.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives