- United States

- /

- Biotech

- /

- NasdaqCM:CAPR

Capricor Therapeutics (CAPR): Assessing Valuation After FDA Setback and Class Action Complaint

Reviewed by Kshitija Bhandaru

Capricor Therapeutics (CAPR) is back in focus this week after news of a class action complaint, prompted by the FDA’s denial of approval for its lead drug candidate, deramiocel, triggered a steep drop in the company’s stock price.

See our latest analysis for Capricor Therapeutics.

Capricor's journey this year has been anything but quiet, with shares plunging after regulatory setbacks even as the company delivered strong annual revenue growth. Despite a dramatic year-to-date share price return of -49.06%, long-term holders have still seen a 56.5% total return over five years. However, momentum lately is under pressure as the company faces heightened scrutiny and evolving risks.

If Capricor's rapid shifts caught your attention, now may be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares near multi-year lows despite increased revenue and trading at a steep discount to analyst targets, investors must ask whether Capricor is a bargain with upside remaining or if the market has already fully accounted for its risks and future growth.

Most Popular Narrative: 63% Undervalued

Capricor Therapeutics is trading at $7.62, while the most widely followed narrative assigns a fair value near $20.60. This significant pricing gap reflects bold assumptions about the company’s growth potential and highlights the factors shaping its valuation.

With growing adoption of personalized and precision medicine, Capricor's advanced exosome platform is now in the clinic with StealthX. This broadens potential future applications (beyond vaccines) and strategic partnerships, enabling pipeline diversification and supporting future earnings growth and revenue stability.

Want to know how ambitious growth rates and a pipeline pivot could justify this eye-catching target? The revenue and margin story could surprise even the bulls. Only by reading further will you uncover the numbers behind this valuation leap.

Result: Fair Value of $20.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in regulatory approval or delays in commercialization could quickly challenge these optimistic forecasts and have a significant impact on future returns.

Find out about the key risks to this Capricor Therapeutics narrative.

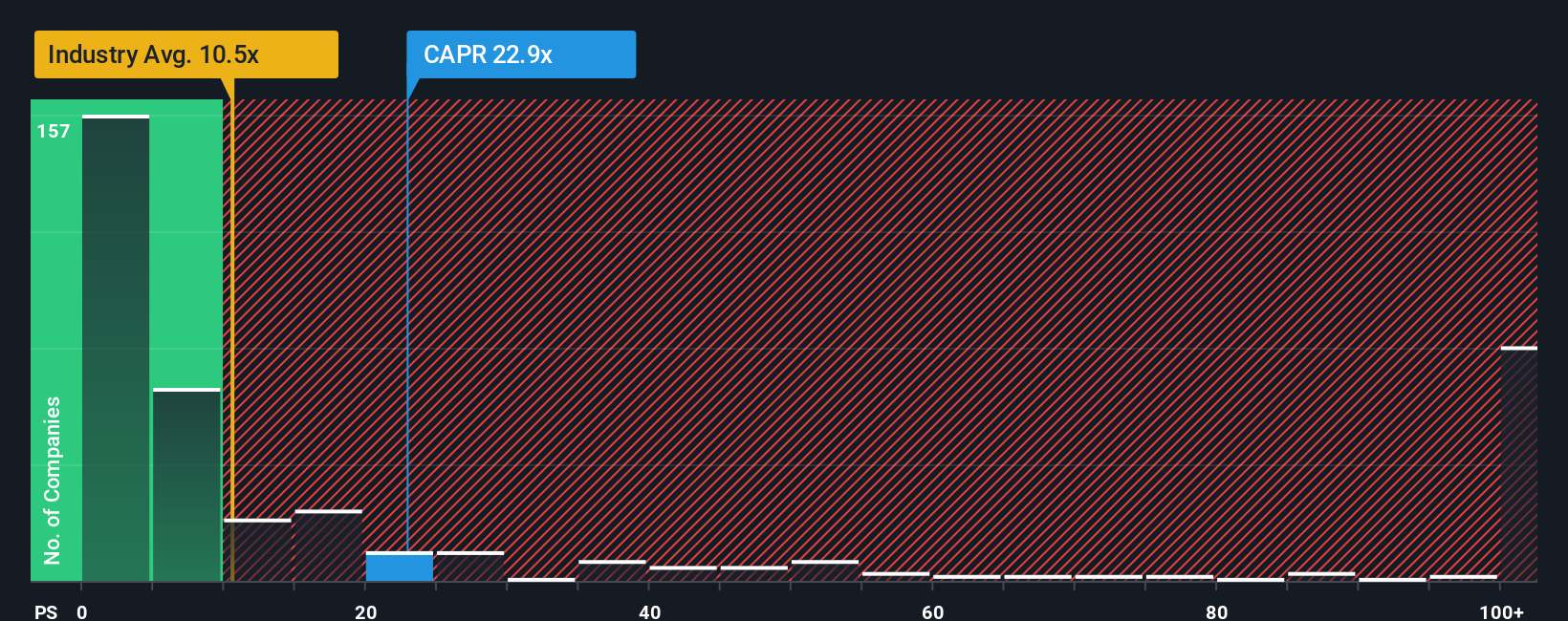

Another View: Perspective from Market Multiples

While analyst narratives point to big upside, market pricing tells a different story. Capricor trades at a price-to-sales ratio of 26x, which is more than double its US biotech peers at 10.5x and far higher than the peer average of 9.8x. The fair ratio is estimated at 0x, so the market could re-rate even lower if expectations shift. Does this premium spell risk or reflect something the crowd is missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capricor Therapeutics Narrative

If you prefer a different take or want to dive deeper into the numbers yourself, shaping your own perspective is quick and straightforward, often taking less than three minutes. Do it your way

A great starting point for your Capricor Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your investment journey stop here. The market is full of opportunity, and you could be missing out on companies quietly hitting their stride, rewarding shareholders, or breaking new ground in high-growth sectors. Use the tools below to target your next move.

- Tap into tomorrow’s tech trendsetters by scouting these 25 AI penny stocks, now powering innovation in data analysis, automation, and smart technology.

- Unlock the potential of high-yield portfolios by hunting for consistent income streams among these 18 dividend stocks with yields > 3%, producing impressive payouts and stability.

- Catch undervalued gems overlooked by the crowd by screening for these 888 undervalued stocks based on cash flows and see which stocks could offer strong upside on reliable fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CAPR

Capricor Therapeutics

A clinical-stage biotechnology company, engages in the development of transformative cell and exosome-based therapeutics for treating duchenne muscular dystrophy (DMD) and other diseases with unmet medical needs in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives