- United States

- /

- Biotech

- /

- NasdaqGS:BPMC

Risks To Shareholder Returns Are Elevated At These Prices For Blueprint Medicines Corporation (NASDAQ:BPMC)

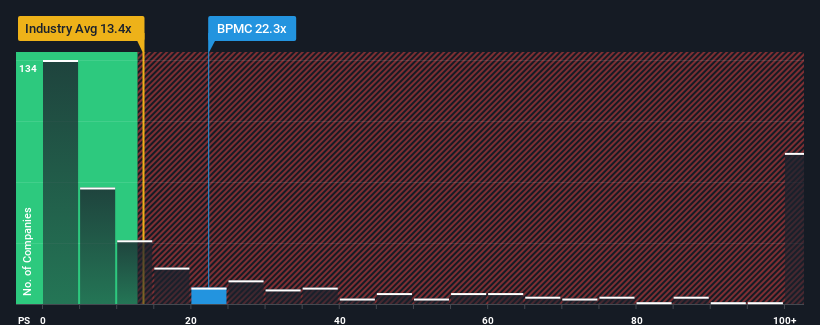

Blueprint Medicines Corporation's (NASDAQ:BPMC) price-to-sales (or "P/S") ratio of 22.3x might make it look like a strong sell right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios below 13.4x and even P/S below 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Blueprint Medicines

What Does Blueprint Medicines' Recent Performance Look Like?

Blueprint Medicines could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Blueprint Medicines will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Blueprint Medicines' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 69% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 49% per annum over the next three years. With the industry predicted to deliver 164% growth per annum, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Blueprint Medicines is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It comes as a surprise to see Blueprint Medicines trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Blueprint Medicines has 2 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Blueprint Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BPMC

Blueprint Medicines

A precision therapy company, develops medicines for genomically defined cancers and blood disorders in the United States and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives