- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

High Growth Tech Stocks to Watch in January 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet over the past 12 months, it has risen by an impressive 24%, with earnings expected to grow by 15% per annum in the coming years. In this context of robust market performance and anticipated growth, identifying high growth tech stocks involves looking for companies with innovative solutions and strong potential to capitalize on emerging trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.86% | 54.70% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.23% | 56.37% | ★★★★★★ |

| TG Therapeutics | 29.99% | 44.07% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 235 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Blueprint Medicines (NasdaqGS:BPMC)

Simply Wall St Growth Rating: ★★★★★★

Overview: Blueprint Medicines Corporation is a precision therapy company that focuses on developing medicines for genomically defined cancers and blood disorders, with a market cap of approximately $5.69 billion.

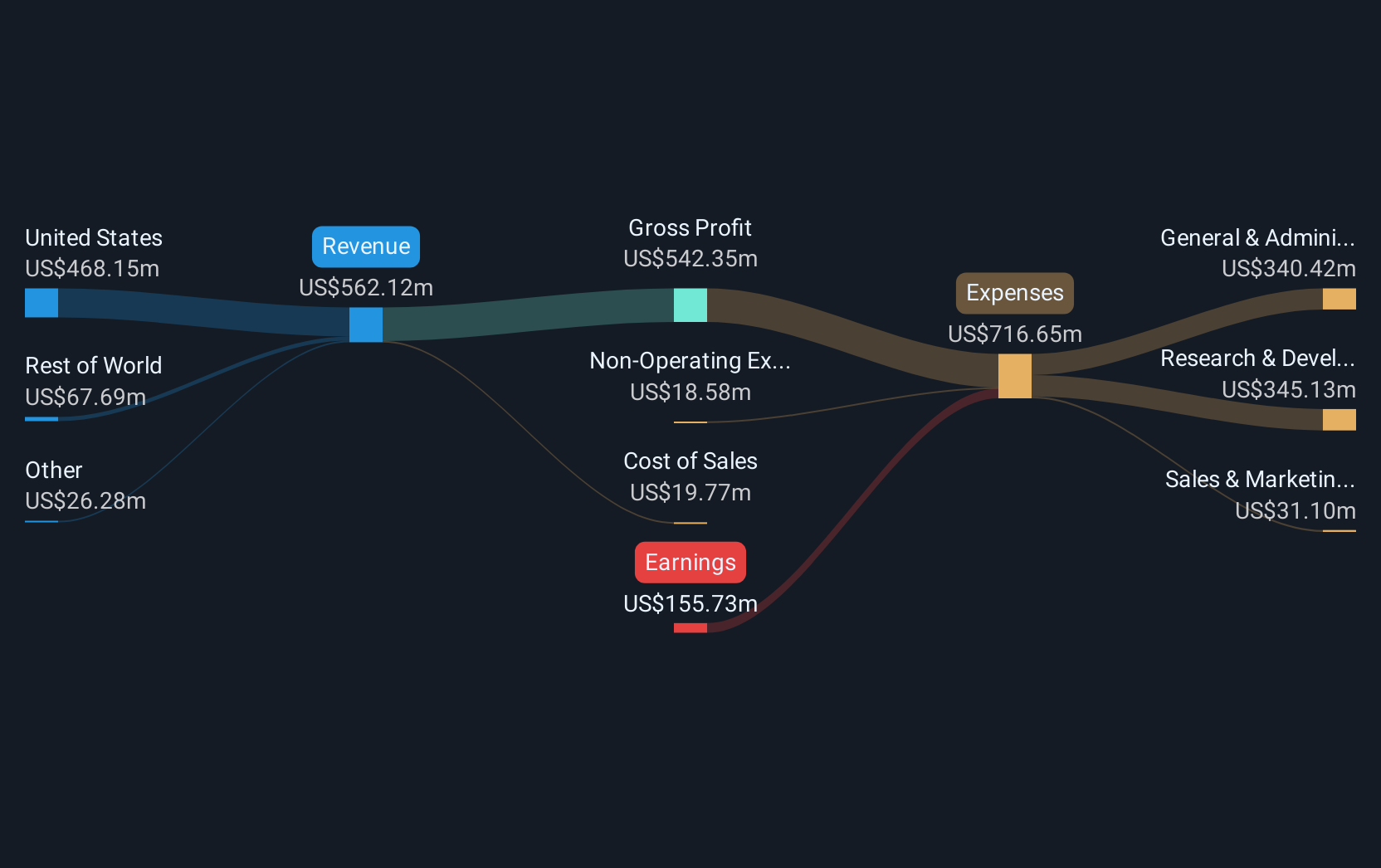

Operations: Blueprint Medicines generates revenue primarily from its pharmaceuticals segment, amounting to $434.42 million. The company specializes in developing targeted therapies for specific cancer types and blood disorders, serving both the U.S. and international markets.

Blueprint Medicines, amidst a transformative phase, has demonstrated a robust annual revenue growth of 22.6%, significantly outpacing the US market average of 9.1%. This growth trajectory is complemented by an anticipated profitability within the next three years, with earnings expected to surge by 55.4% annually. The company's strategic focus on R&D is evident from its recent presentations at various healthcare conferences, underscoring its commitment to innovation in Mast Cell Diseases and other areas. Despite currently being unprofitable and experiencing shareholder dilution over the past year, Blueprint Medicines revised its full-year revenue guidance upwards to between $475 million and $480 million due to strong performance indicators. This adjustment reflects not only a solid operational execution but also an optimistic outlook for sustained growth driven by increasing patient numbers and improved compliance rates.

- Click to explore a detailed breakdown of our findings in Blueprint Medicines' health report.

Understand Blueprint Medicines' track record by examining our Past report.

Cloudflare (NYSE:NET)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cloudflare, Inc. operates as a cloud services provider offering various solutions to businesses globally, with a market cap of $39.12 billion.

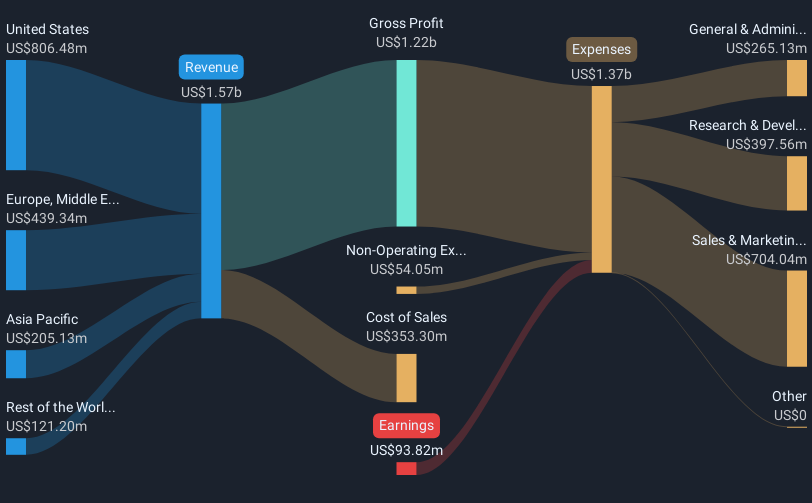

Operations: The company generates revenue primarily from its Internet Telephone segment, which amounted to $1.57 billion.

Cloudflare has shown resilience and strategic growth with a 19% annual revenue increase, outstripping the US market's 9.1% average. Despite a net loss reduction from $156.08 million to $65.95 million in nine months, its commitment to expansion is clear, as evidenced by the new Lisbon hub aimed at bolstering EMEA operations. The firm forecasts robust year-end revenues up to $1.662 billion and an operating income of about $221 million, reflecting strong operational execution and market confidence amidst ongoing global digital transformation efforts.

- Unlock comprehensive insights into our analysis of Cloudflare stock in this health report.

Gain insights into Cloudflare's historical performance by reviewing our past performance report.

Pure Storage (NYSE:PSTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services globally, with a market cap of $21.06 billion.

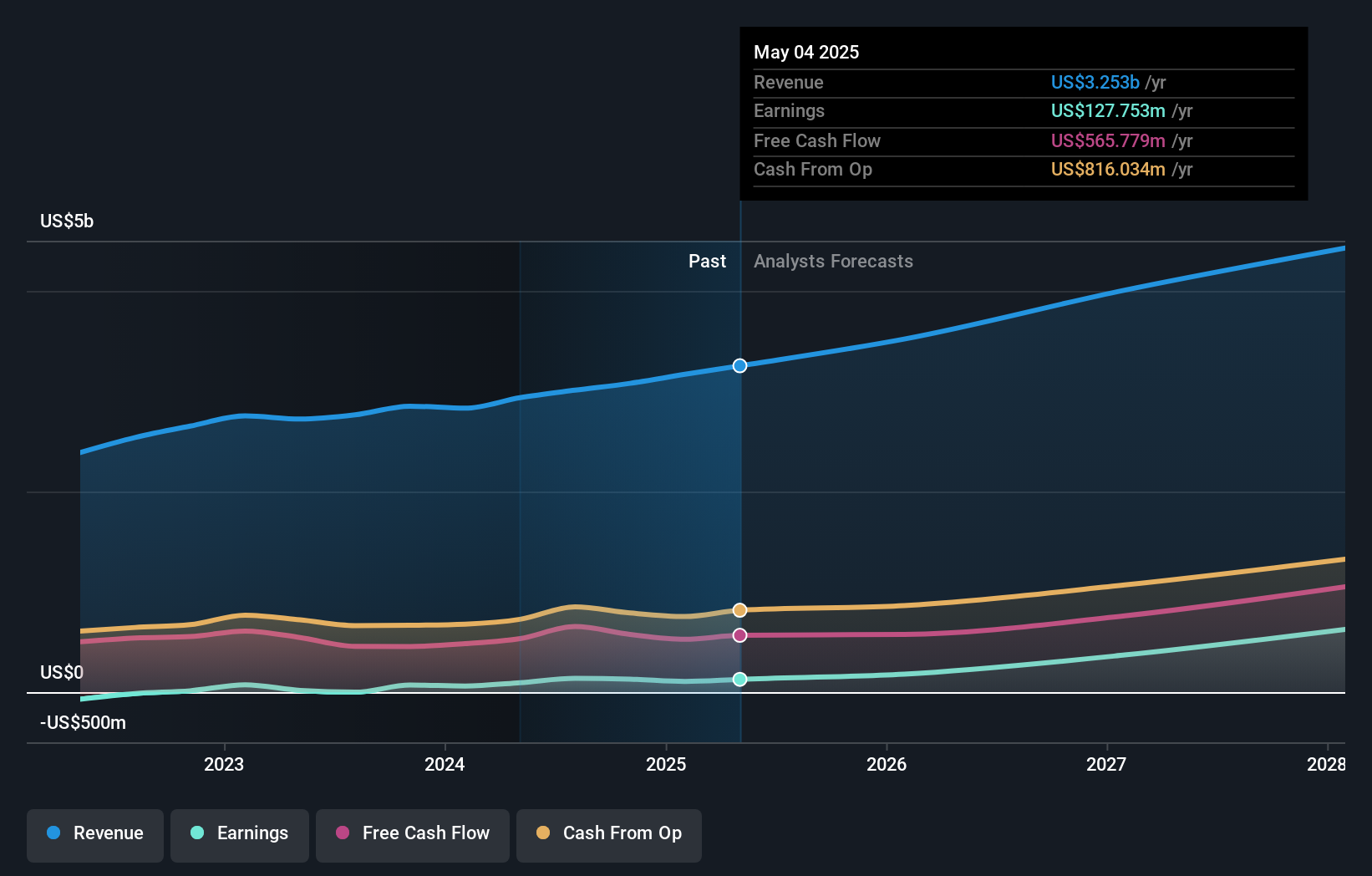

Operations: Pure Storage generates revenue primarily from its computer storage devices segment, which accounts for $3.08 billion. The company operates within the data storage and management industry, offering its technologies and services both in the United States and internationally.

Pure Storage is capitalizing on the rapid expansion of data storage needs in hyperscale environments, evidenced by its strategic collaborations with industry giants like Micron and Kioxia. These partnerships are set to enhance Pure Storage's offerings with cutting-edge NAND technology for high-capacity, energy-efficient solutions crucial for modern data centers. The company has reported a robust earnings growth of 49.5% annually and an impressive revenue increase to $3.15 billion forecasted for 2025, highlighting its strong market execution and innovation-driven approach. Additionally, Pure Storage's recent buyback activity underscores its financial health, repurchasing shares worth $36.48 million in the latest quarter, reflecting confidence in its business trajectory amidst evolving tech landscapes.

Make It Happen

- Unlock our comprehensive list of 235 US High Growth Tech and AI Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Engages in the provision of data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.