- United States

- /

- Banks

- /

- NasdaqGM:SMBC

Undiscovered Gems To Explore In The United States January 2025

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has experienced a significant 24% rise over the last year, with earnings projected to grow by 15% annually. In this dynamic environment, identifying stocks that are not only resilient but also poised for growth can present unique opportunities for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Citizens Financial Services (NasdaqCM:CZFS)

Simply Wall St Value Rating: ★★★★★★

Overview: Citizens Financial Services, Inc. is a bank holding company offering a range of banking products and services to individual, business, governmental, and institutional clients with a market cap of $289.39 million.

Operations: Citizens Financial Services generates its revenue primarily from the community banking segment, amounting to $98.20 million.

With total assets of US$3 billion and equity of US$298.7 million, Citizens Financial Services seems to be an intriguing player in the financial sector. Their deposits stand at US$2.5 billion while loans are at US$2.3 billion, reflecting a solid loan-to-deposit ratio. The bank maintains a bad loans ratio of 0.9%, backed by a sufficient allowance for bad loans at 101%. Earnings have surged by 50% over the past year, outpacing industry trends significantly and trading well below estimated fair value, suggesting potential undervaluation in its current market position.

Southern Missouri Bancorp (NasdaqGM:SMBC)

Simply Wall St Value Rating: ★★★★★★

Overview: Southern Missouri Bancorp, Inc. is the bank holding company for Southern Bank, offering banking and financial services to individuals and corporate customers in the United States, with a market cap of $636.71 million.

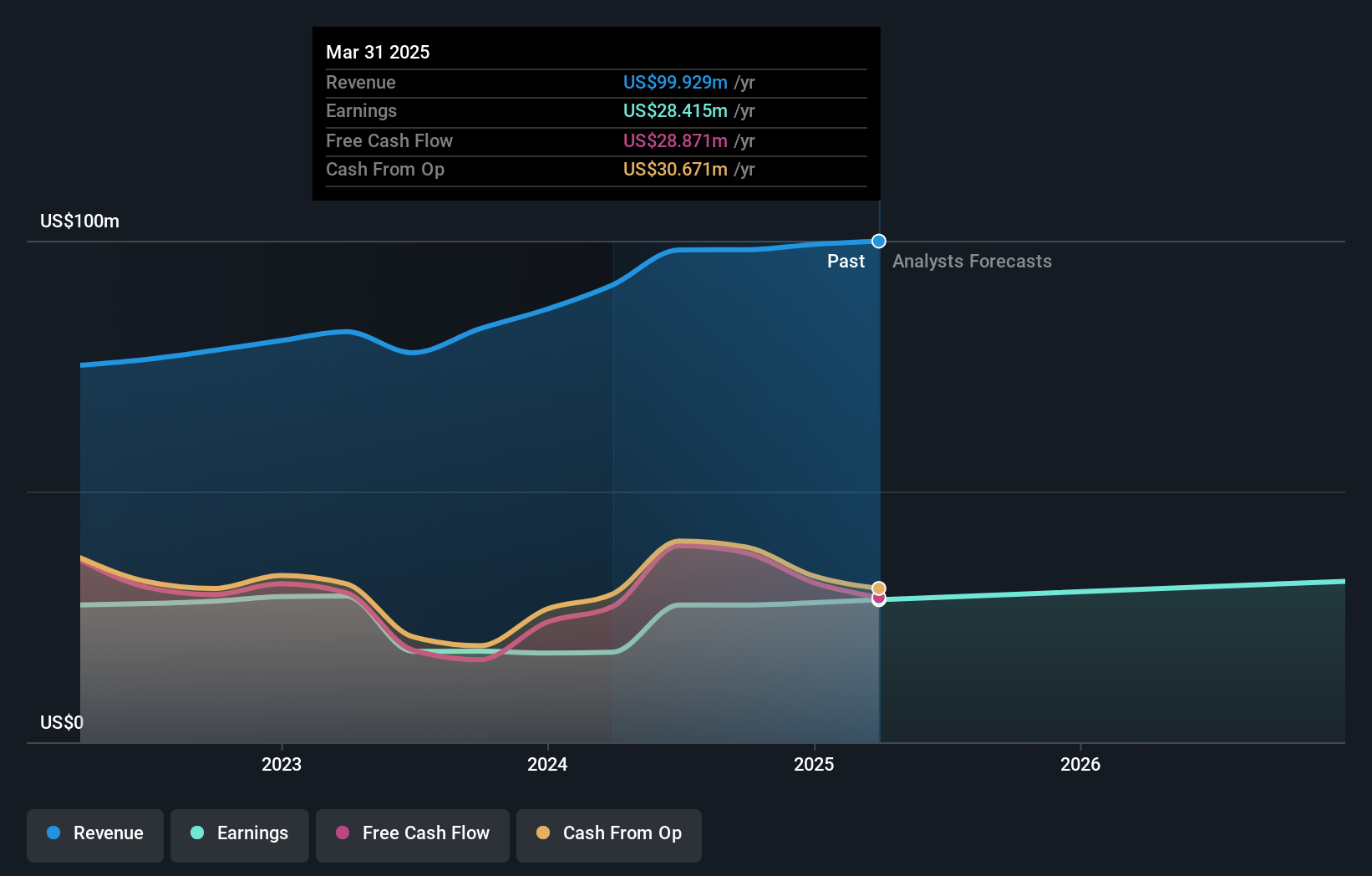

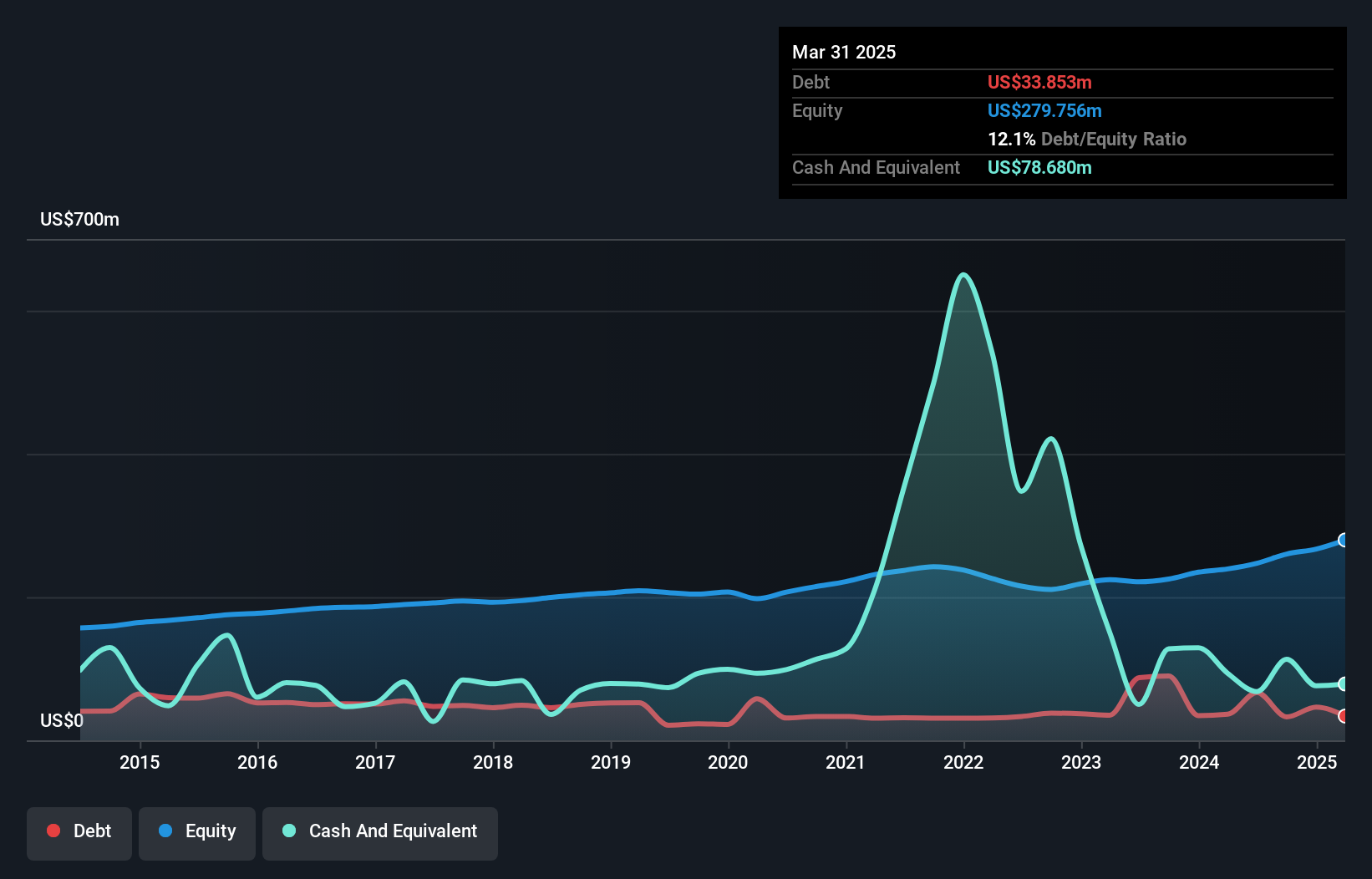

Operations: Southern Missouri Bancorp generates revenue primarily from its thrift and savings and loan institutions, amounting to $162.06 million. The company's financial performance includes a focus on net profit margin, which is a key indicator of profitability.

Southern Missouri Bancorp, with assets totaling US$4.7 billion and equity of US$505.6 million, is an intriguing player in the financial sector. It has a robust deposit base of US$4 billion against loans of US$3.9 billion, illustrating a solid funding structure primarily from customer deposits, which are less risky than external borrowing. The bank's allowance for bad loans stands at a healthy 663%, while non-performing loans are just 0.2%. Despite facing competitive pressures and challenges in the agricultural sector, it trades at 41.9% below its estimated fair value and reports high-quality earnings with significant growth potential compared to industry peers.

Northrim BanCorp (NasdaqGS:NRIM)

Simply Wall St Value Rating: ★★★★★★

Overview: Northrim BanCorp, Inc. is a bank holding company for Northrim Bank, offering commercial banking products and services to businesses and professional individuals, with a market cap of $416.44 million.

Operations: Northrim BanCorp generates revenue primarily from its Community Banking segment, contributing $112.55 million, and Home Mortgage Lending, adding $29.04 million. The company's net profit margin is a key financial metric to consider when evaluating its performance.

Northrim BanCorp, with assets totaling US$3 billion and equity at US$260.1 million, stands out for its robust financial health. The bank's total deposits of US$2.6 billion primarily fund its operations, reducing reliance on external borrowing. With a net interest margin of 4.2%, it demonstrates efficient earning capabilities from its loans portfolio valued at US$2 billion. Northrim's allowance for bad loans is more than adequate at 394%, and non-performing loans are low at 0.2%. Recent board addition Shauna Hegna brings strong leadership experience that could bolster the company's strategic direction in Alaska’s banking landscape.

- Unlock comprehensive insights into our analysis of Northrim BanCorp stock in this health report.

Assess Northrim BanCorp's past performance with our detailed historical performance reports.

Seize The Opportunity

- Click this link to deep-dive into the 246 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMBC

Southern Missouri Bancorp

Operates as the bank holding company for Southern Bank that provides banking and financial services to individuals and corporate customers in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives