- United States

- /

- Biotech

- /

- NasdaqGS:BNTX

Will Chief Strategy Officer Richardson’s Departure Shift BioNTech's (BNTX) Narrative?

Reviewed by Simply Wall St

- BioNTech SE recently announced that Ryan Richardson, Chief Strategy Officer and a key contributor to the company's growth initiatives, will step down from the Management Board by September 30, 2025, with a gradual transition of his responsibilities to ensure continuity.

- This leadership change comes as BioNTech prepares to present at the MRNA-Based Therapeutics Summit, signaling a pivotal period for both executive management and its innovation pipeline.

- We'll explore how Richardson's departure could influence BioNTech's long-term growth plans and the broader investment outlook for the company.

BioNTech Investment Narrative Recap

To be a shareholder in BioNTech, you need confidence in its ability to transition from reliance on COVID-19 vaccine sales to a diversified pipeline, particularly in oncology and mRNA therapeutics. The recent announcement of Ryan Richardson's future departure as Chief Strategy Officer is not expected to materially affect the short-term catalyst, progress on BNT323 or mRNA oncology assets, nor does it significantly alter the primary near-term risk of ongoing financial losses if new products do not ramp quickly.

Of the many company updates, the upcoming BioNTech presentation at the MRNA-Based Therapeutics Summit stands out for investors. This event underscores the focus on advancing its innovation pipeline, a key catalyst for shifting revenue away from dependence on COVID-19 vaccines and addressing the main challenge of turning high R&D expense into successful product launches.

In contrast, investors should also keep in mind the risk to BioNTech’s revenue stability if COVID-19 vaccination rates continue to fall, considering...

Read the full narrative on BioNTech (it's free!)

BioNTech's narrative projects €2.4 billion revenue and €402.6 million earnings by 2028. This requires a 3.8% yearly revenue decline and an €1,168.6 million increase in earnings from €-766.0 million today.

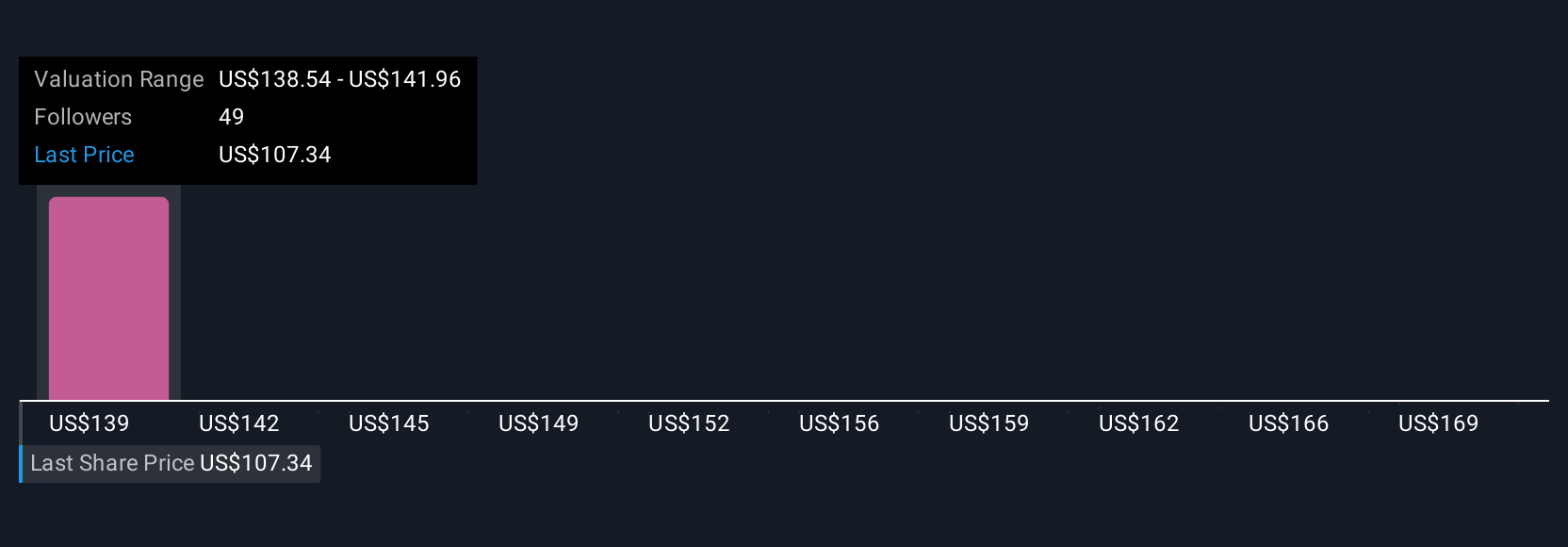

Uncover how BioNTech's forecasts yield a $136.68 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Three distinct community perspectives estimate BioNTech's fair value between US$136.68 and US$170.60 per share. While optimism about the oncology pipeline is evident, ongoing high R&D costs challenge profitability, inviting readers to compare several outlooks for a fuller picture.

Explore 3 other fair value estimates on BioNTech - why the stock might be worth just $136.68!

Build Your Own BioNTech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free BioNTech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BioNTech's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioNTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BNTX

BioNTech

A biotechnology company, develops and commercializes immunotherapies to treat cancer and infectious diseases in Germany.

Adequate balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives