- United States

- /

- Pharma

- /

- NasdaqGM:AXSM

Axsome Therapeutics, Inc.'s (NASDAQ:AXSM) Price In Tune With Revenues

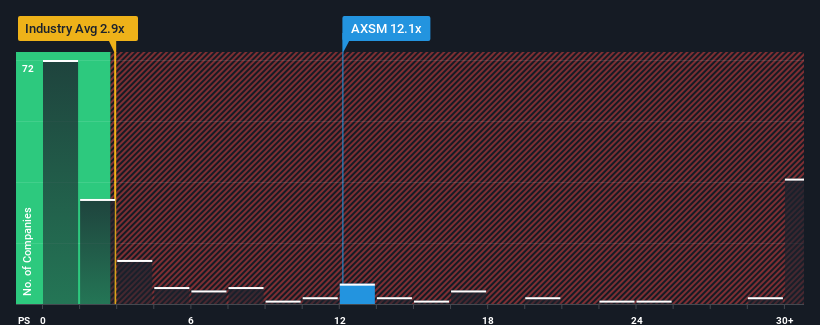

Axsome Therapeutics, Inc.'s (NASDAQ:AXSM) price-to-sales (or "P/S") ratio of 12.1x might make it look like a strong sell right now compared to the Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios below 2.9x and even P/S below 0.8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Axsome Therapeutics

What Does Axsome Therapeutics' Recent Performance Look Like?

Axsome Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Axsome Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Axsome Therapeutics' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Still, revenue has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 59% per year over the next three years. With the industry only predicted to deliver 14% each year, the company is positioned for a stronger revenue result.

With this information, we can see why Axsome Therapeutics is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Axsome Therapeutics' P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Axsome Therapeutics shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Axsome Therapeutics that we have uncovered.

If these risks are making you reconsider your opinion on Axsome Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AXSM

Axsome Therapeutics

A biopharmaceutical company, develops and delivers novel therapies for the management of central nervous system (CNS) disorders in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives