- United States

- /

- Biotech

- /

- NasdaqGM:AUPH

Aurinia Pharmaceuticals Inc.'s (NASDAQ:AUPH) 26% Dip In Price Shows Sentiment Is Matching Revenues

Unfortunately for some shareholders, the Aurinia Pharmaceuticals Inc. (NASDAQ:AUPH) share price has dived 26% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

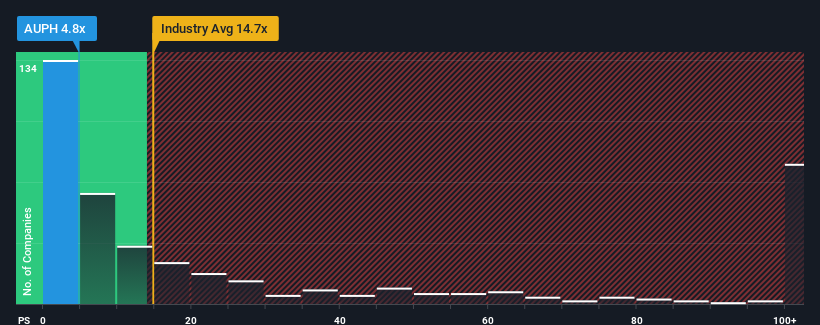

Since its price has dipped substantially, Aurinia Pharmaceuticals may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 4.8x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 14.7x and even P/S higher than 62x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Aurinia Pharmaceuticals

What Does Aurinia Pharmaceuticals' P/S Mean For Shareholders?

Recent revenue growth for Aurinia Pharmaceuticals has been in line with the industry. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Aurinia Pharmaceuticals.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Aurinia Pharmaceuticals' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. The strong recent performance means it was also able to grow revenue by 250% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 34% per annum over the next three years. That's shaping up to be materially lower than the 254% per annum growth forecast for the broader industry.

With this in consideration, its clear as to why Aurinia Pharmaceuticals' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Aurinia Pharmaceuticals' P/S?

Shares in Aurinia Pharmaceuticals have plummeted and its P/S has followed suit. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Aurinia Pharmaceuticals' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Aurinia Pharmaceuticals, and understanding should be part of your investment process.

If you're unsure about the strength of Aurinia Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AUPH

Aurinia Pharmaceuticals

A biopharmaceutical company that engages in delivering therapies to people living with autoimmune diseases with high unmet medical needs.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives