- United States

- /

- Biotech

- /

- NasdaqCM:ATYR

Should You Reconsider aTyr Pharma After the Recent 17% Price Surge?

Reviewed by Bailey Pemberton

Deciding what to do with aTyr Pharma stock right now? You’re definitely not alone. With wild price swings in the rearview mirror, investors are wondering if this is a turnaround story or a value trap in disguise. Over the past week, shares actually jumped by 17.1%, shaking off at least some of the sting from a dramatic slide in the last month, where the stock plunged 84.0%. Year-to-date returns remain deep in the red at -75.3%, and those losses stretch even further if you zoom out: down 56.9% for the year and 72.1% over five years.

So, why the sudden bounce? While there’s no earth-shattering news shaking up the narrative, broader market sentiment and renewed attention to the biotech sector seem to be sparking short-term optimism. Against this backdrop of volatility, thoughts turn naturally to whether aTyr is undervalued at these levels or if there’s more risk lurking under the surface.

Let’s get practical: by the numbers, aTyr Pharma scores a 4 out of 6 on our valuation check, meaning it stands out as undervalued in four major categories. But what does that really tell us, and how should it inform your next move?

Next, I’ll break down the different valuation approaches that analysts use when sizing up stocks like aTyr Pharma. Then, I’ll share an even sharper perspective on how to decode undervalued companies, one that most investors overlook.

Why aTyr Pharma is lagging behind its peers

Approach 1: aTyr Pharma Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by estimating all the company’s future cash flows and discounting them back to today’s value. This approach aims to find the present worth of a company by looking at future money it may generate. This method is especially useful for cash-burning biotechs like aTyr Pharma.

aTyr Pharma’s latest reported Free Cash Flow stands at -$55.7 million, reflecting ongoing investment and negative FCF for now. Analyst projections only go out five years, forecasting a gradual improvement, shifting from heavier outflows to stronger positive cash flows. By 2029, projections show a turnaround to $19.7 million in FCF. Beyond that, extended estimates suggest continued improvement, with Simply Wall St extrapolating even higher numbers through 2035.

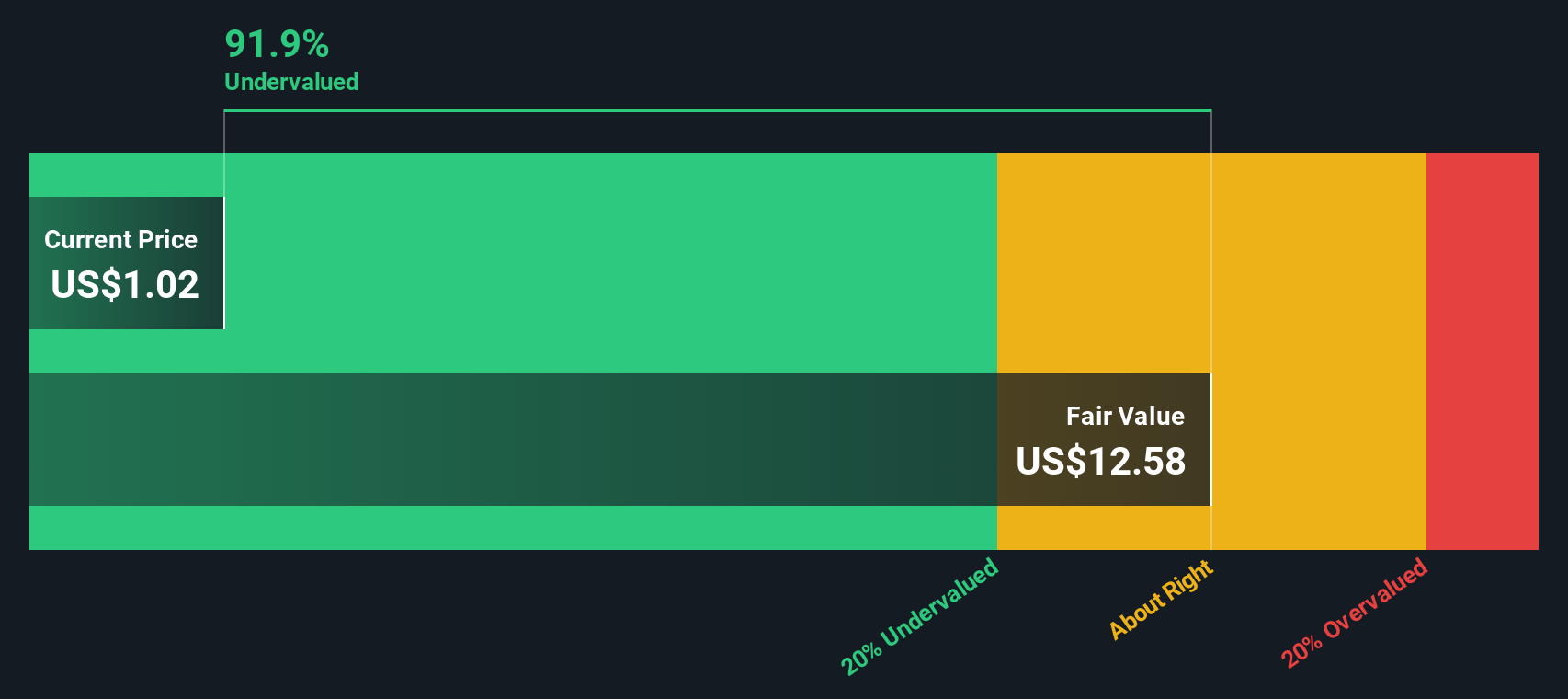

When these future cash flows are discounted back to today's values and summed together using the 2 Stage Free Cash Flow to Equity model, the DCF analysis calculates an intrinsic value of $12.61 per share. With the current share price trading at a steep discount, this model implies a 92.3% undervaluation compared to what the company’s future could be worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests aTyr Pharma is undervalued by 92.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: aTyr Pharma Price vs Book

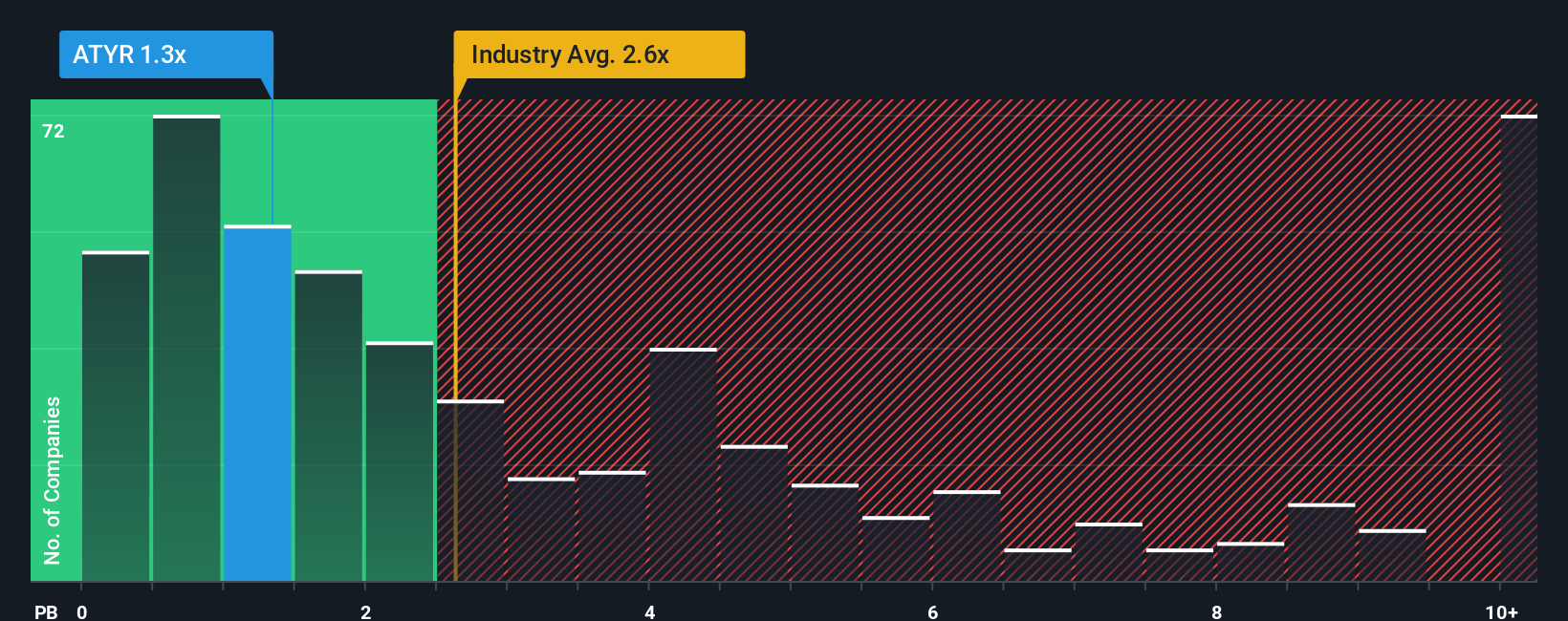

For companies in the biotech sector, especially those not yet consistently profitable, the Price-to-Book (PB) ratio is commonly used as a valuation yardstick. PB is particularly helpful for assessing companies like aTyr Pharma because it compares market value with the company’s tangible assets, which is especially important when earnings are negative or volatile, as is the case here.

Generally, growth expectations and the persistence of risk impact what constitutes a “fair” PB multiple. Fast-growing, lower-risk firms can command higher PB ratios. Companies facing more uncertainty or slower growth usually trade at a lower multiple. For context, aTyr Pharma currently trades at a PB ratio of 1.26x. That is materially lower than the biotech industry average of 2.50x and under the peer group average of 2.69x, suggesting a discount relative to both benchmarks.

Simply Wall St’s proprietary “Fair Ratio” refines this comparison by factoring in aTyr’s unique growth outlook, profit margins, risk profile, industry, and market cap. This gives a more tailored benchmark than a raw industry average. This holistic approach means investors get a realistic view as it adjusts for nuances that basic peer averages can overlook.

Based on these models, aTyr Pharma’s current PB of 1.26x falls well below its calculated Fair Ratio, signaling the stock is undervalued on this metric.

Result: UNDERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your aTyr Pharma Narrative

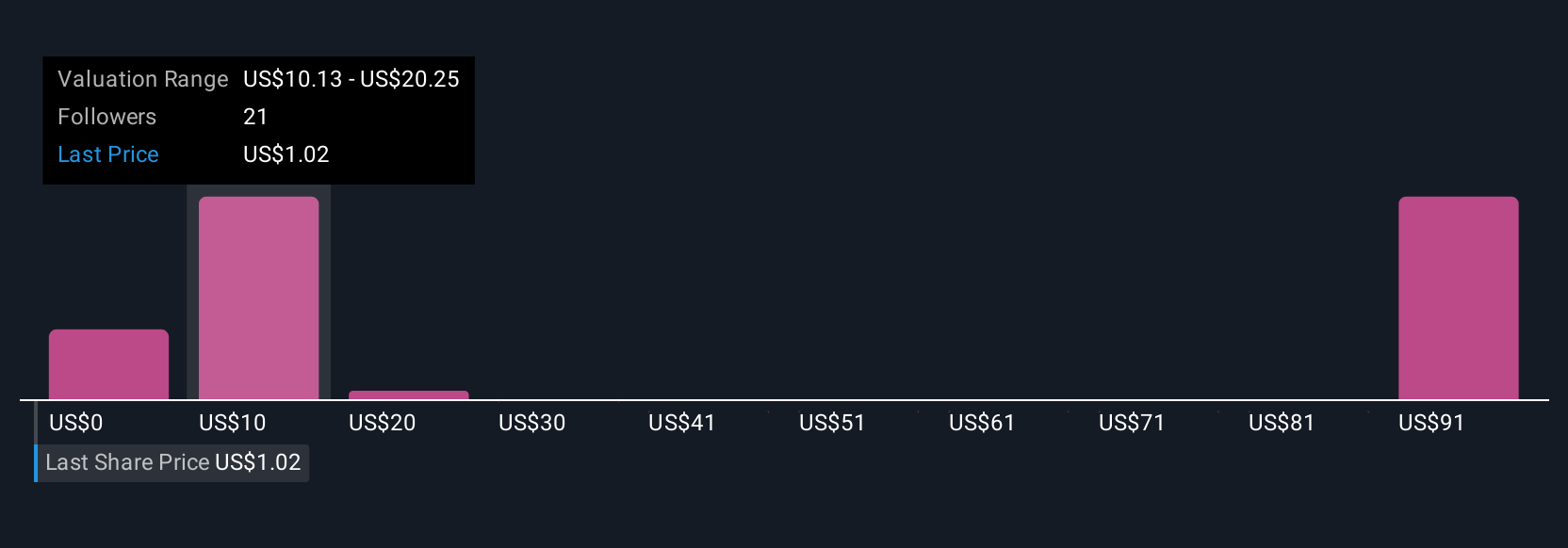

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your personal story or perspective about a company, built around your own assumptions for fair value and estimates for future revenue, earnings, and margins. Narratives connect the story you believe about a company like aTyr Pharma with the numbers that drive a financial forecast and ultimately calculate a fair value.

Narratives are easy to use and available to everyone on Simply Wall St’s platform, featured right on each company’s Community page. With Narratives, you can clearly see how your Fair Value compares to the current share price, helping you decide if it is the right time to buy, hold, or sell. As new information, such as fresh earnings reports or market news, comes in, Narratives update automatically to keep your investment story current.

For example, one investor's Narrative might reflect strong optimism and forecast high potential, while another sees greater risk and projects lower values for aTyr Pharma. This can lead to very different Fair Values for the same stock.

Do you think there's more to the story for aTyr Pharma? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ATYR

aTyr Pharma

A clinical stage biotechnology company, engages in the discovery and development of product candidates that translate tRNA synthetase biology into new therapies for fibrosis and inflammation in the United States.

Flawless balance sheet and good value.

Market Insights

Community Narratives