- United States

- /

- Biotech

- /

- NasdaqGM:ZLAB

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

As the U.S. market grapples with mixed stock performances and rising Treasury yields following a recent credit rating downgrade, investor sentiment remains cautious yet hopeful amid ongoing economic uncertainties. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience and innovation potential, particularly those capable of navigating fiscal challenges while capitalizing on technological advancements.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.28% | 37.43% | ★★★★★★ |

| Ardelyx | 20.57% | 59.97% | ★★★★★★ |

| Travere Therapeutics | 25.82% | 65.45% | ★★★★★★ |

| Blueprint Medicines | 21.36% | 61.45% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.65% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.28% | 60.66% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 110.32% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Zai Lab (NasdaqGM:ZLAB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zai Lab Limited is a biopharmaceutical company dedicated to the discovery, development, and commercialization of treatments for oncology, immunology, neuroscience, and infectious diseases with a market cap of approximately $3.36 billion.

Operations: Zai Lab generates revenue primarily from its biotechnology segment, amounting to $418.33 million.

Zai Lab has demonstrated a robust trajectory in the biotech sector, with its revenue soaring by 30.2% annually, outpacing the industry's average. The company recently reaffirmed its annual revenue forecast between $560 million and $590 million, reflecting confidence in continued growth despite current unprofitability. Innovatively, Zai Lab is advancing in oncology; their investigational therapies ZL-6201 and ZL-1222 have shown promising results at recent clinical trials, potentially revolutionizing treatment paradigms for solid tumors and enhancing patient outcomes. These developments are pivotal as they navigate from a period of net losses towards projected profitability within three years, indicating a strategic pivot towards high-value, research-driven outputs that could reshape therapeutic standards in cancer care.

- Take a closer look at Zai Lab's potential here in our health report.

Assess Zai Lab's past performance with our detailed historical performance reports.

Ascendis Pharma (NasdaqGS:ASND)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ascendis Pharma A/S is a biopharmaceutical company that develops TransCon-based therapies to address unmet medical needs globally, with a market cap of $9.51 billion.

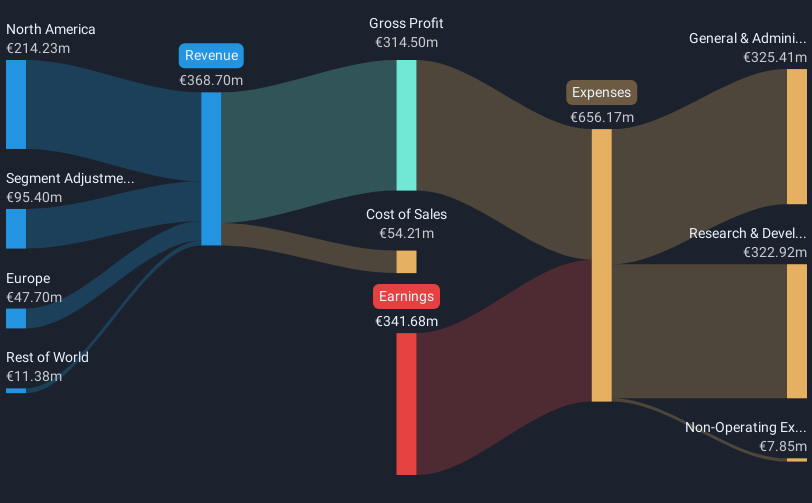

Operations: The company generates revenue primarily from its biotechnology segment, amounting to €368.70 million. Ascendis Pharma A/S focuses on developing TransCon-based therapies across various regions including Denmark, Europe, and North America.

Ascendis Pharma's recent advancements underscore its potential in the biotech landscape, particularly with its TransCon technology platform. The company's R&D expenditure has been significant, aligning with its innovative approach in developing treatments for conditions like achondroplasia and hypoparathyroidism. Notably, at the ESPE & ESE 2025 congress, Ascendis presented promising Phase 2 trial results for TransCon PTH and pivotal trial data for TransCon CNP, demonstrating enhanced growth metrics and bone health in patients. These developments could position Ascendis favorably as it moves towards profitability forecasted within three years, supported by a robust annual revenue growth of 35.2% and an impressive projected annual earnings growth of over 60%.

- Get an in-depth perspective on Ascendis Pharma's performance by reading our health report here.

Review our historical performance report to gain insights into Ascendis Pharma's's past performance.

Take-Two Interactive Software (NasdaqGS:TTWO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Take-Two Interactive Software, Inc. is a global company that develops, publishes, and markets interactive entertainment solutions with a market cap of $40.16 billion.

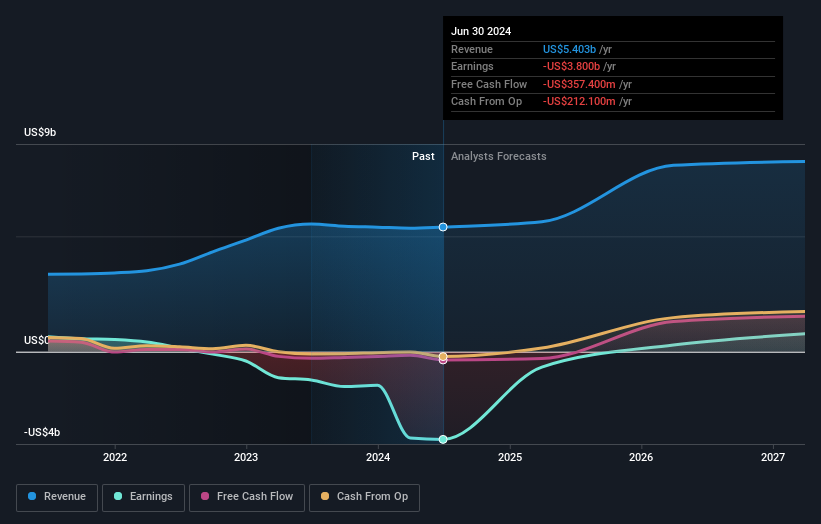

Operations: The company generates revenue primarily through its publishing segment, which accounts for $5.63 billion.

Take-Two Interactive Software, despite facing a net loss this fiscal year, is steering through challenging waters with notable strategic initiatives. The company's recent unveiling of "Mafia: The Old Country" leverages Unreal Engine 5, promising a transformative gaming experience and potentially revitalizing its product line amid financial turbulence. With an expected revenue growth of 14.2% per year outpacing the US market average of 8.5%, Take-Two is strategically positioning itself for recovery and growth. This aligns with their R&D focus which remains robust, crucial for innovation in the competitive tech landscape where annual earnings are forecasted to surge by 94.3%.

Taking Advantage

- Get an in-depth perspective on all 233 US High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zai Lab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ZLAB

Zai Lab

A biopharmaceutical company, focuses on discovering, developing, and commercializing products that address medical conditions in the areas of oncology, immunology, neuroscience, and infectious diseases.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives