- United States

- /

- Pharma

- /

- NasdaqGS:ARVN

Arvinas, Inc.'s (NASDAQ:ARVN) Shares Bounce 37% But Its Business Still Trails The Industry

Arvinas, Inc. (NASDAQ:ARVN) shareholders are no doubt pleased to see that the share price has bounced 37% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 70% share price decline over the last year.

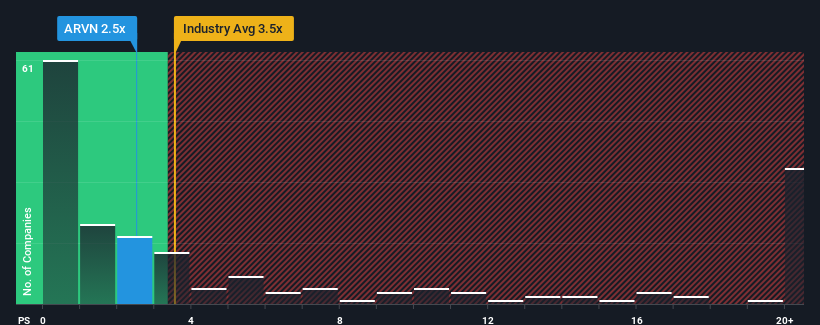

Although its price has surged higher, Arvinas may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.5x, since almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 3.5x and even P/S higher than 14x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Arvinas

What Does Arvinas' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Arvinas has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Arvinas will help you uncover what's on the horizon.How Is Arvinas' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Arvinas' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 236% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 6.0% each year during the coming three years according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 20% each year, which paints a poor picture.

With this information, we are not surprised that Arvinas is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Despite Arvinas' share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Arvinas' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Arvinas' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Arvinas (1 can't be ignored) you should be aware of.

If these risks are making you reconsider your opinion on Arvinas, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ARVN

Arvinas

A clinical-stage biotechnology company, engages in the discovery, development, and commercialization of therapies to degrade disease-causing proteins.

Flawless balance sheet slight.

Market Insights

Community Narratives