- United States

- /

- Software

- /

- NasdaqGS:PRGS

Exploring High Growth Tech Stocks In The US October 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 34% over the past year with earnings forecasted to grow by 15% annually. In this context of robust growth and stability, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to changing market dynamics.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.58% | 44.12% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.37% | ★★★★★★ |

| AsiaFIN Holdings | 60.53% | 81.55% | ★★★★★★ |

| Travere Therapeutics | 26.51% | 69.33% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 252 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Mirum Pharmaceuticals (NasdaqGM:MIRM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mirum Pharmaceuticals, Inc. is a biopharmaceutical company dedicated to developing and commercializing innovative treatments for rare and orphan diseases, with a market cap of $1.91 billion.

Operations: Mirum Pharmaceuticals focuses on developing and commercializing therapies for rare and orphan diseases, generating $264.38 million in revenue from its pharmaceutical segment.

Mirum Pharmaceuticals, despite its current unprofitability, is poised for significant growth with earnings expected to surge by 69.8% annually. This growth trajectory is underpinned by a robust 25% yearly revenue increase, outpacing the broader U.S. market's 8.7%. Recent FDA approval of LIVMARLI for expanded use highlights Mirum's commitment to addressing rare pediatric liver diseases, potentially enhancing its market presence significantly. With R&D expenses strategically allocated to foster innovations like LIVMARLI, Mirum's focus on specialized treatments could redefine its financial landscape and industry standing in the coming years.

- Unlock comprehensive insights into our analysis of Mirum Pharmaceuticals stock in this health report.

Gain insights into Mirum Pharmaceuticals' past trends and performance with our Past report.

Arcutis Biotherapeutics (NasdaqGS:ARQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Arcutis Biotherapeutics, Inc. is a biopharmaceutical company dedicated to developing and commercializing treatments for dermatological diseases, with a market cap of approximately $1.12 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to $132.06 million. It focuses on dermatological treatments, leveraging its expertise in biopharmaceutical development and commercialization.

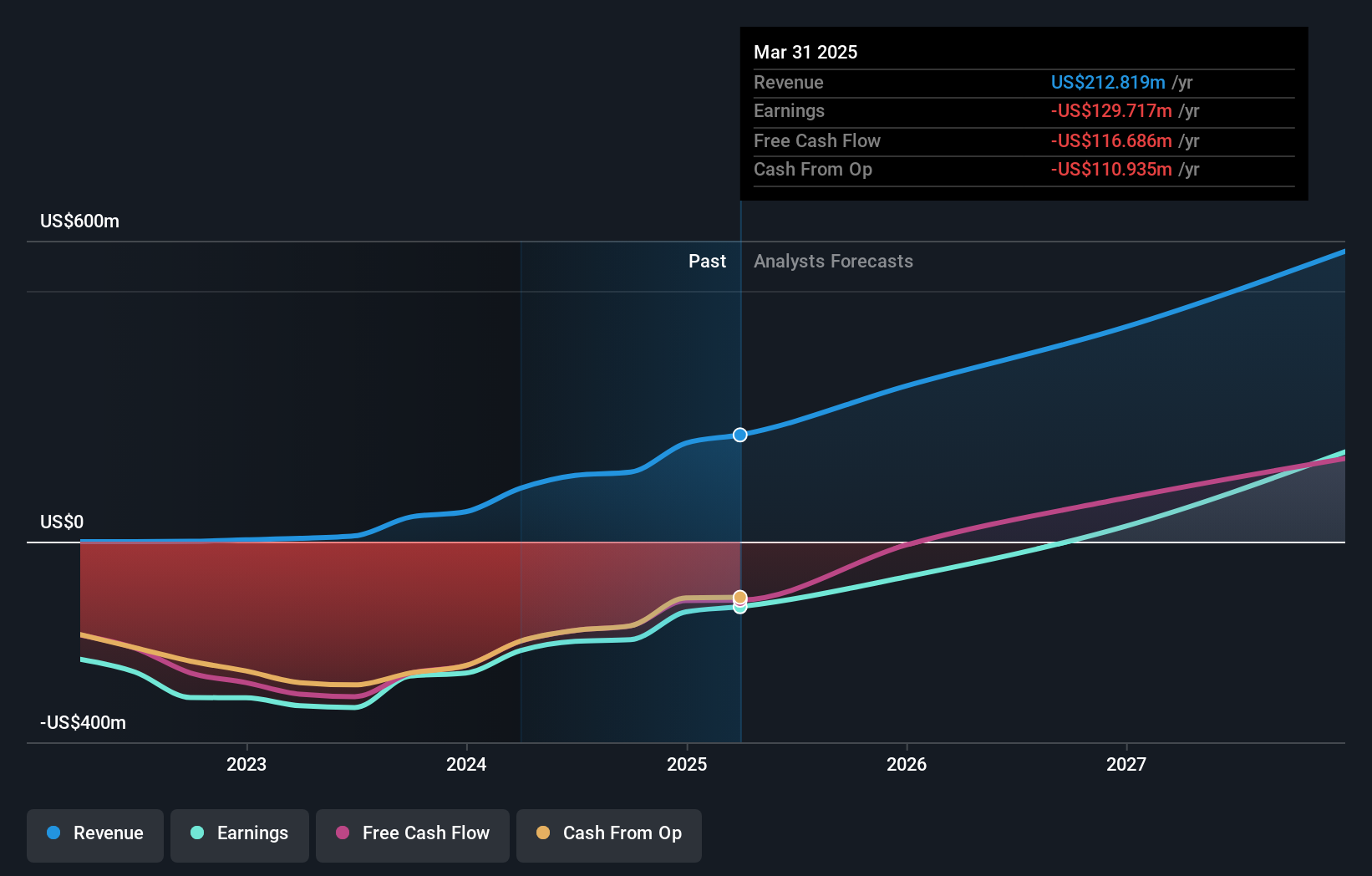

Arcutis Biotherapeutics has shown promising strides with its recent FDA approval of ZORYVE cream for atopic dermatitis, marking a significant milestone in non-steroidal treatments. The company's dedication to innovation is underscored by a robust R&D focus, where expenditures are aligned with strategic product development—evident from their pivotal Phase 3 studies showing substantial efficacy in treatment outcomes. Despite a current unprofitable status, Arcutis' revenue has surged by 34.7% annually, outpacing the industry standard significantly. This growth trajectory is further supported by expectations of transitioning into profitability within three years, propelled by an anticipated annual earnings increase of 69.3%.

- Take a closer look at Arcutis Biotherapeutics' potential here in our health report.

Explore historical data to track Arcutis Biotherapeutics' performance over time in our Past section.

Progress Software (NasdaqGS:PRGS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Progress Software Corporation focuses on developing, deploying, and managing business applications both in the United States and internationally, with a market capitalization of approximately $2.81 billion.

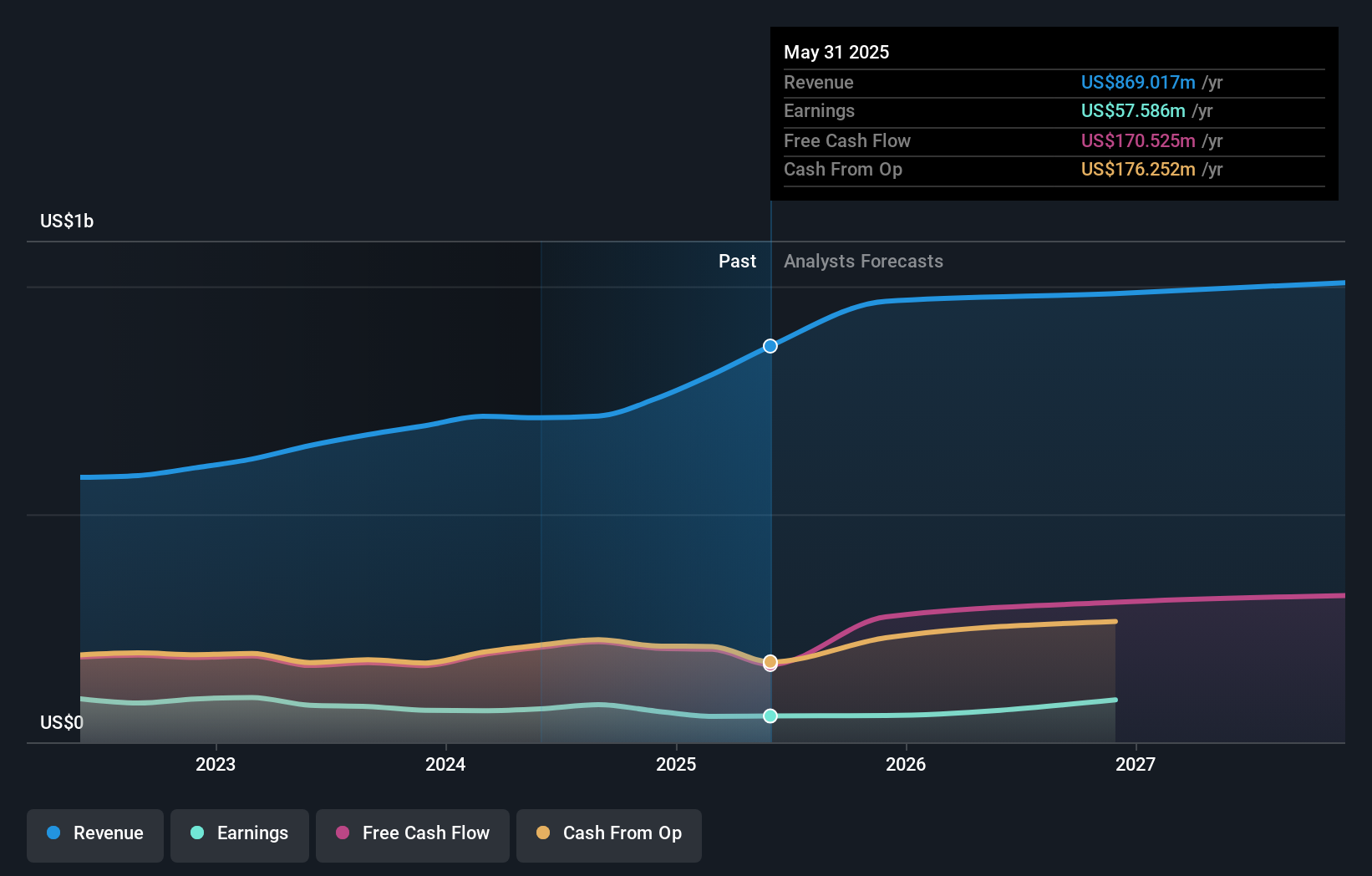

Operations: Progress Software generates revenue primarily from its software products aimed at developing, deploying, and managing high-impact applications, amounting to $715.42 million.

Progress Software's strategic focus on M&A and share buybacks underscores its growth-oriented approach, aligning with a 12.9% annual revenue increase forecast, outpacing the US market's 8.7%. This trajectory is complemented by an anticipated earnings growth of 24.5% per year, reflecting robust financial health and market confidence. The company's R&D commitment is evident from its $75 million expenditure in the latest fiscal year, accounting for approximately 14% of total revenues—highlighting its dedication to innovation and competitive edge in software solutions.

- Navigate through the intricacies of Progress Software with our comprehensive health report here.

Assess Progress Software's past performance with our detailed historical performance reports.

Summing It All Up

- Click here to access our complete index of 252 US High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRGS

Progress Software

Develops, deploys, and manages artificial intelligence (AI) powered applications and digital experiences in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives