- United States

- /

- Software

- /

- NYSE:OLO

Exploring High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The United States market has experienced a positive trajectory, climbing 2.2% in the last 7 days and showing an 8.2% increase over the past year, with earnings forecasted to grow by 14% annually. In this context of robust growth, identifying high-growth tech stocks involves evaluating companies that demonstrate strong innovation potential and scalability within these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.40% | 34.10% | ★★★★★★ |

| Ardelyx | 20.63% | 59.87% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.42% | 58.25% | ★★★★★★ |

| Travere Therapeutics | 28.83% | 64.80% | ★★★★★★ |

| TG Therapeutics | 26.12% | 38.99% | ★★★★★★ |

| Alkami Technology | 22.46% | 76.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.67% | 61.17% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Soleno Therapeutics (NasdaqCM:SLNO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Soleno Therapeutics, Inc. is a clinical-stage biopharmaceutical company dedicated to developing and commercializing novel therapeutics for rare diseases, with a market cap of $3.75 billion.

Operations: Soleno Therapeutics is engaged in creating and bringing to market innovative treatments for rare diseases. The company is currently in the clinical stage, focusing on the development of its therapeutic pipeline.

Soleno Therapeutics, despite its current unprofitability, is navigating a promising trajectory with an expected revenue growth of 51.4% annually, outpacing the US market's 8.4%. This growth is bolstered by the recent FDA approval of VYKAT XR for Prader-Willi syndrome—a significant milestone reflecting Soleno's innovative edge in biotech. However, financial challenges persist as evidenced by a substantial net loss increase to $175.85 million in 2024 from $38.99 million the previous year, and shareholder dilution over the past year raises concerns about future equity value retention.

- Click here to discover the nuances of Soleno Therapeutics with our detailed analytical health report.

Gain insights into Soleno Therapeutics' past trends and performance with our Past report.

Arcutis Biotherapeutics (NasdaqGS:ARQT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Arcutis Biotherapeutics, Inc. is a biopharmaceutical company dedicated to the development and commercialization of treatments for dermatological diseases, with a market cap of $1.81 billion.

Operations: Arcutis Biotherapeutics focuses on developing and commercializing pharmaceuticals for dermatological diseases, generating $196.54 million in revenue from this segment.

Arcutis Biotherapeutics is carving a niche in the competitive biotech landscape with its robust pipeline and strategic R&D investments. In 2024, the company's revenue surged to $196.54 million from $59.61 million the previous year, underpinned by a significant 26.4% annual growth rate that outstrips the broader US market average of 8.4%. Despite current unprofitability, Arcutis is on a promising trajectory with earnings expected to grow by an impressive 58.25% annually over the next few years. The firm's commitment to innovation is evident in its R&D spending, crucial for sustaining long-term growth and competitiveness in biotechnology—a sector driven by constant advancements and regulatory achievements like their recent FDA approvals for dermatological treatments.

Olo (NYSE:OLO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Olo Inc. provides a Software-as-a-Service platform that enables restaurants in the United States to manage their digital ordering and delivery operations, with a market capitalization of approximately $1.22 billion.

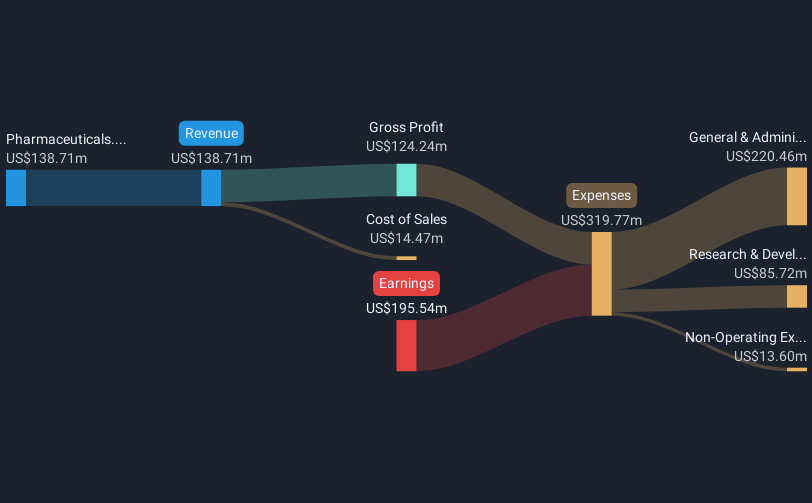

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $284.94 million. Its SaaS platform supports restaurants in optimizing digital ordering and delivery processes across the U.S.

Amidst recent M&A rumors, Olo is a focal point in the tech landscape due to its strategic partnerships and innovative delivery solutions like Dispatch, which now serves over 500 Waffle House locations. In 2024, the company's revenue climbed to $284.94 million, up from $228.29 million the previous year, demonstrating a robust growth rate of 15.7%. Despite a net loss reduction to just $0.897 million from $58.29 million in the prior year, Olo continues to invest in technology that enhances restaurant operations and customer experiences—a vital asset as it explores potential sales or partnerships with industry giants like Oracle Corp.

Turning Ideas Into Actions

- Click here to access our complete index of 231 US High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OLO

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives