- United States

- /

- Metals and Mining

- /

- NYSEAM:DC

February 2025's Promising Penny Stocks On US Exchanges

Reviewed by Simply Wall St

As of February 2025, the U.S. stock market is experiencing a positive shift, with major indices like the S&P 500 and Nasdaq Composite seeing gains as investors react to tariff news and a series of earnings reports. Amidst this backdrop, penny stocks continue to capture attention for their potential growth opportunities despite being considered an outdated term. These smaller or newer companies can offer significant returns when supported by robust financial health, making them an intriguing option for investors seeking hidden value in quality stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8577 | $6.52M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $121.59M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2799 | $9.75M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.03 | $88.27M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.43 | $47.85M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.09 | $51.01M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.35 | $21.99M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9234 | $83.69M | ★★★★★☆ |

| SideChannel (OTCPK:SDCH) | $0.038815 | $9.04M | ★★★★★★ |

Click here to see the full list of 705 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Achilles Therapeutics (NasdaqCM:ACHL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Achilles Therapeutics plc is a biopharmaceutical company focused on developing precision T cell therapies for the treatment of solid tumors, with a market cap of $46.03 million.

Operations: Achilles Therapeutics plc does not report any revenue segments.

Market Cap: $46.03M

Achilles Therapeutics, a pre-revenue biopharmaceutical firm with a market cap of US$46.03 million, recently transferred its listing to the Nasdaq Capital Market to address compliance issues related to its share price. Despite being unprofitable and experiencing declining earnings over the past five years, Achilles maintains financial stability with no debt and short-term assets significantly exceeding liabilities. The company has sufficient cash runway for over a year based on current free cash flow levels. Recent board resignations may impact strategic direction, but management remains seasoned with an average tenure of 5.7 years.

- Jump into the full analysis health report here for a deeper understanding of Achilles Therapeutics.

- Gain insights into Achilles Therapeutics' historical outcomes by reviewing our past performance report.

Amylyx Pharmaceuticals (NasdaqGS:AMLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Amylyx Pharmaceuticals, Inc. is a commercial-stage biotechnology company focused on developing treatments for amyotrophic lateral sclerosis (ALS) and neurodegenerative diseases, with a market cap of approximately $232.84 million.

Operations: The company generates revenue of $196.49 million from its efforts in researching and developing therapeutics for neurodegenerative disorders.

Market Cap: $232.84M

Amylyx Pharmaceuticals, with a market cap of US$232.84 million, is navigating the volatile penny stock landscape while focusing on treatments for neurodegenerative diseases. Despite being unprofitable and experiencing increased losses over the past five years, Amylyx remains debt-free with short-term assets significantly exceeding liabilities. The company recently completed a US$60 million follow-on equity offering to support its development pipeline, including AMX0114 for ALS and avexitide for post-bariatric hypoglycemia. Leadership changes include appointing Dan Monahan as Chief Commercial Officer to strengthen commercialization efforts amid ongoing clinical trials and collaborations aimed at advancing its therapeutic portfolio.

- Click here and access our complete financial health analysis report to understand the dynamics of Amylyx Pharmaceuticals.

- Review our growth performance report to gain insights into Amylyx Pharmaceuticals' future.

Dakota Gold (NYSEAM:DC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Dakota Gold Corp. focuses on the acquisition, exploration, and development of mineral properties in the United States, with a market cap of approximately $217.19 million.

Operations: No revenue segments are reported for this company.

Market Cap: $217.19M

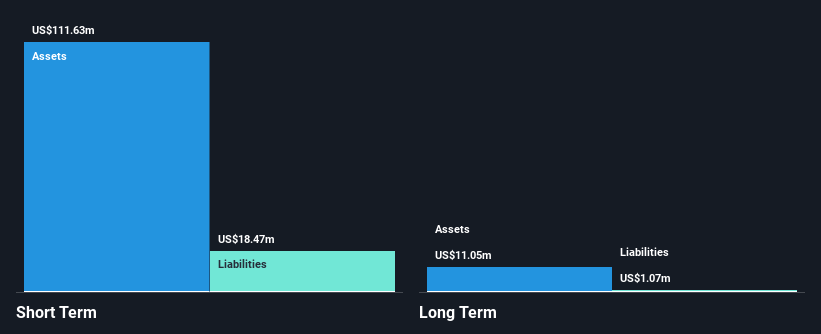

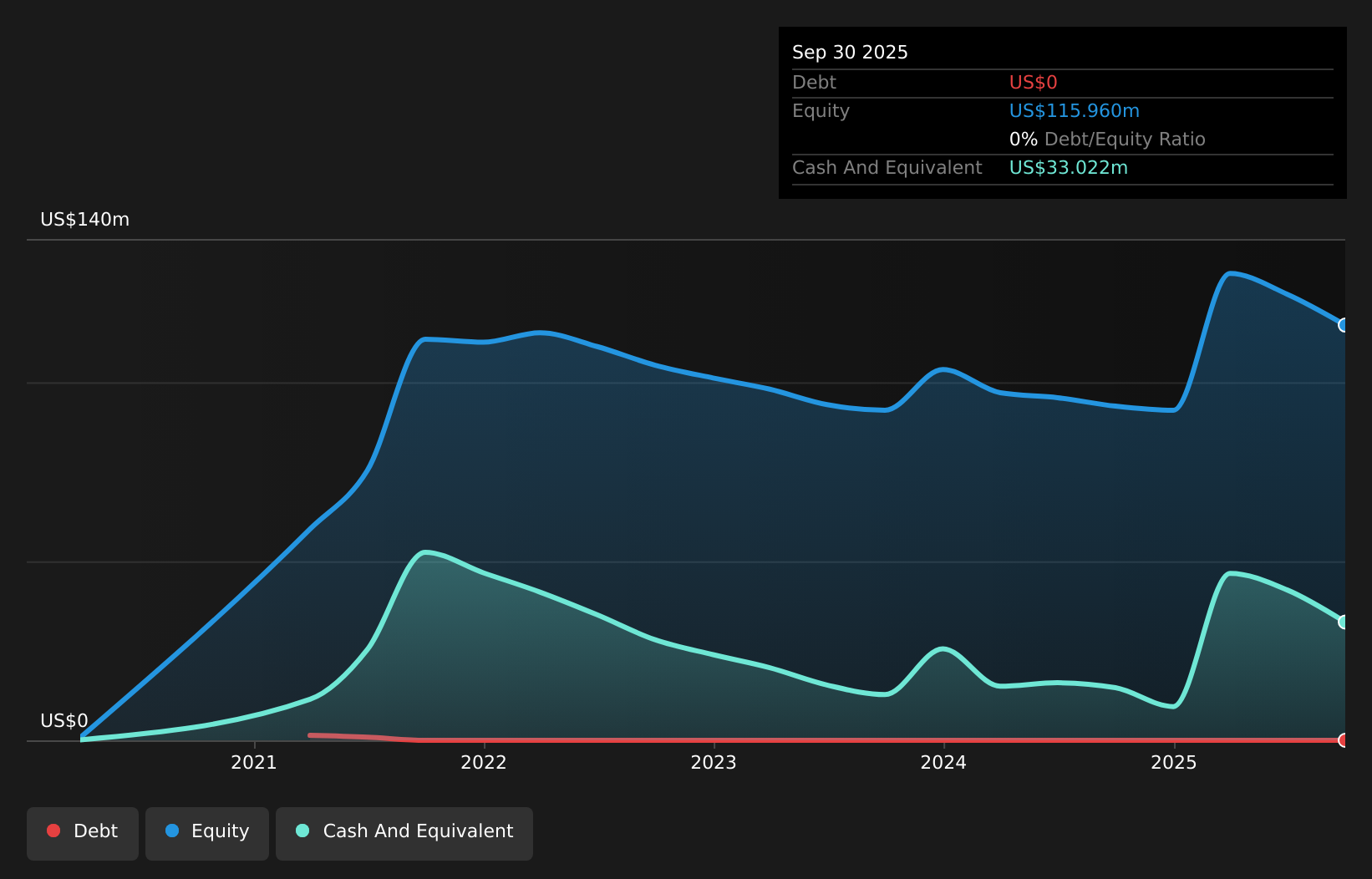

Dakota Gold Corp., with a market cap of US$217.19 million, operates in the mineral exploration sector and remains pre-revenue. The company has no debt and its short-term assets of US$15.5 million exceed both short-term liabilities and long-term liabilities, indicating a stable financial position despite ongoing losses. Recent drilling at the Maitland Gold Project has significantly extended known gold mineralization, suggesting potential for future resource expansion. Concurrently, Dakota is advancing its Richmond Hill Oxide Heap Leach Gold Project towards feasibility studies, leveraging existing permits to expedite development amidst environmental assessments and engineering evaluations underway.

- Take a closer look at Dakota Gold's potential here in our financial health report.

- Learn about Dakota Gold's historical performance here.

Turning Ideas Into Actions

- Dive into all 705 of the US Penny Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:DC

Dakota Gold

Engages in the acquisition, exploration, and development of mineral properties in the United States.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives