- United States

- /

- Biotech

- /

- NasdaqGS:ALLK

Discover US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the U.S. stock market continues to rally, with major indices closing higher following President Trump's recent executive actions, investors are exploring diverse opportunities. Among these are penny stocks, which despite their name suggesting an outdated concept, remain a relevant area for investment consideration. Typically representing smaller or newer companies, penny stocks can offer growth potential and affordability when backed by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.36M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.88224 | $6.46M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $4.00 | $11.73M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.75 | $2.08B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2998 | $10.12M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.49 | $52.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.41 | $61.94M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.25 | $20.04M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9174 | $80.38M | ★★★★★☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Allakos (NasdaqGS:ALLK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Allakos Inc. is a clinical-stage biotechnology company focused on developing therapeutics targeting immunomodulatory receptors for allergy, inflammatory, and proliferative diseases in the United States, with a market cap of $76.43 million.

Operations: Allakos Inc. currently does not report any revenue segments, as it is a clinical-stage biotechnology company focused on developing treatments for allergy, inflammatory, and proliferative diseases in the United States.

Market Cap: $76.43M

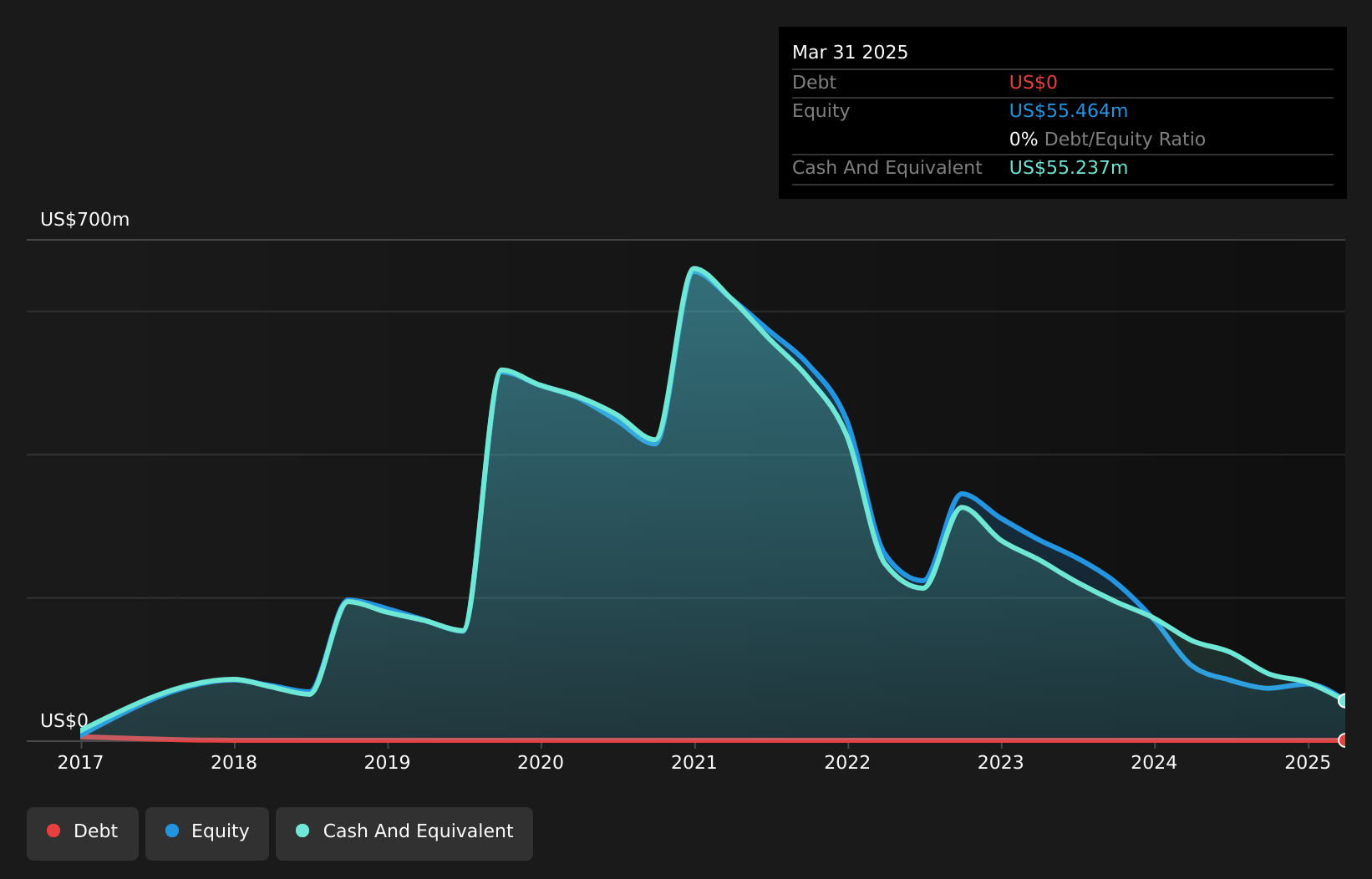

Allakos Inc., a clinical-stage biotechnology company, remains pre-revenue with its focus on developing therapeutics. Despite having no debt and short-term assets of US$97.2 million exceeding liabilities, the company faces financial challenges, including a net loss of US$18.37 million in Q3 2024 and less than one year of cash runway if current cash flow trends persist. While the management team is experienced, Allakos has seen increased volatility in its share price recently and has filed a shelf registration for US$5.22 million to potentially bolster funding through an employee stock ownership plan-related offering.

- Unlock comprehensive insights into our analysis of Allakos stock in this financial health report.

- Explore Allakos' analyst forecasts in our growth report.

SES AI (NYSE:SES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SES AI Corporation develops and produces high-performance Lithium-metal rechargeable batteries for electric vehicles and other applications, with a market cap of $335.34 million.

Operations: SES AI Corporation has not reported any revenue segments.

Market Cap: $335.34M

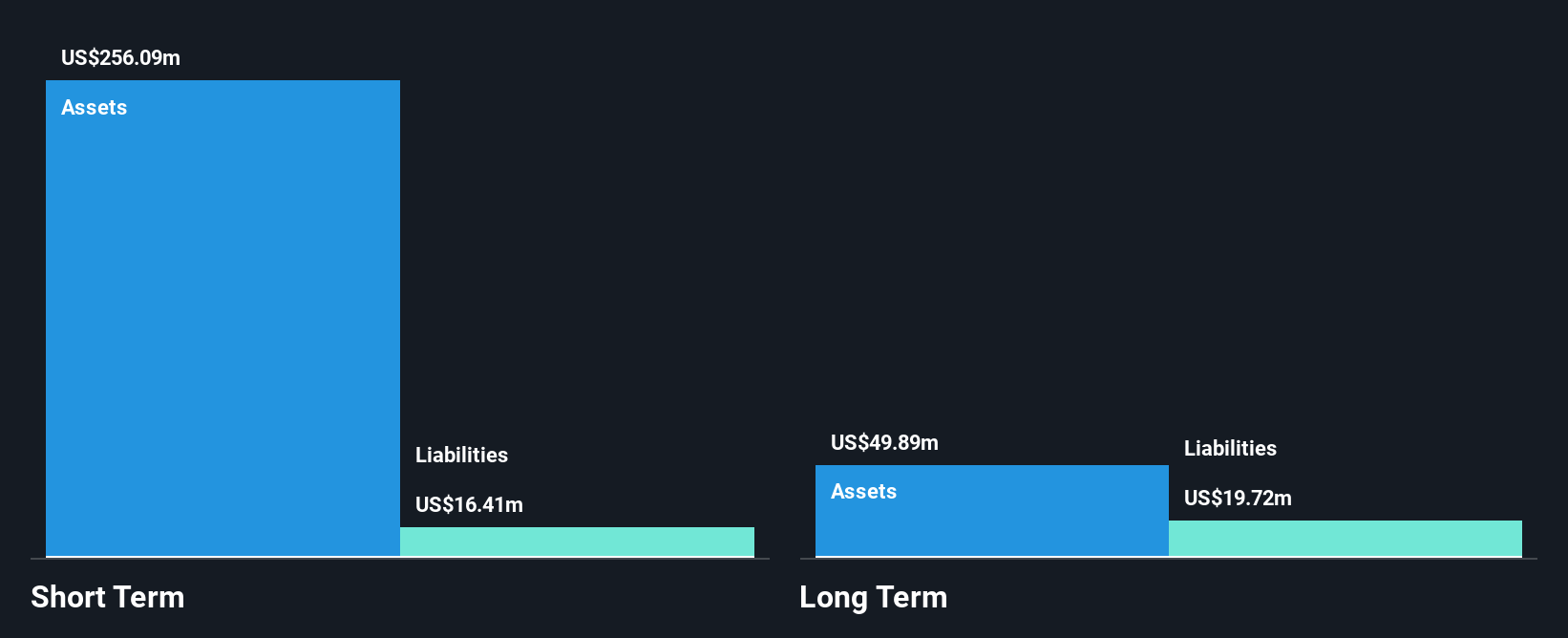

SES AI Corporation, a developer of advanced lithium-metal batteries, is pre-revenue with a market cap of US$335.34 million and no significant revenue streams. The company has sufficient short-term assets (US$291.5 million) to cover liabilities and remains debt-free, though it faces challenges with negative return on equity and increased share price volatility. Recent innovations include the unveiling of an AI-enhanced 2170 cylindrical cell for robotics at CES 2025, leveraging its Molecular Universe initiative in collaboration with NVIDIA to enhance battery performance significantly. Despite these advancements, SES AI remains unprofitable without expected profitability in the near term.

- Click here to discover the nuances of SES AI with our detailed analytical financial health report.

- Gain insights into SES AI's outlook and expected performance with our report on the company's earnings estimates.

Waterdrop (NYSE:WDH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Waterdrop Inc. operates as an online insurance brokerage in the People's Republic of China, connecting users with insurance products, and has a market cap of approximately $442.73 million.

Operations: The company's revenue is primarily derived from its insurance segment, which generated CN¥2.37 billion, complemented by CN¥242.53 million from crowd funding activities.

Market Cap: $442.73M

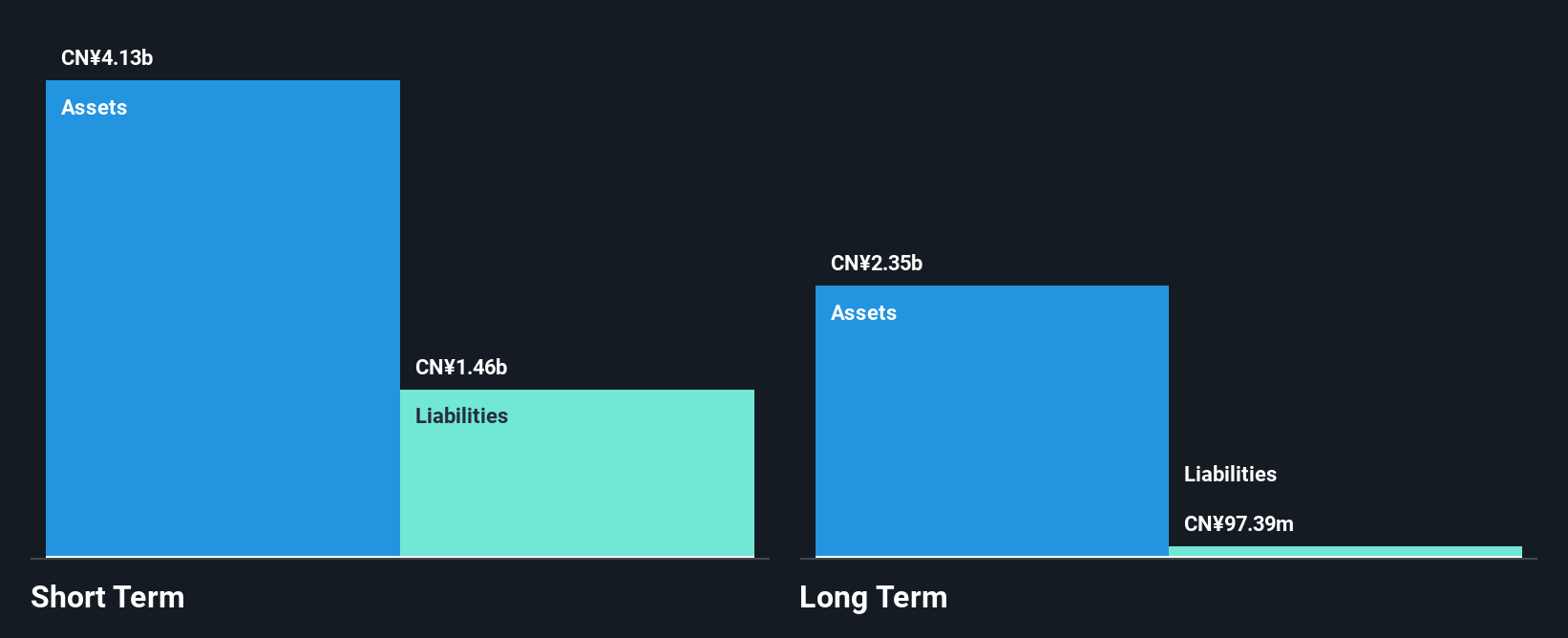

Waterdrop Inc., with a market cap of approximately CN¥442.73 million, has shown promising financial health and growth potential. The company reported third-quarter sales of CN¥704.14 million, up from a year ago, and net income rose significantly to CN¥92.81 million. Its short-term assets (CN¥4.4 billion) comfortably cover both long-term (CN¥104.2 million) and short-term liabilities (CN¥1.4 billion). Waterdrop's earnings growth outpaced the insurance industry average last year, although it was below its five-year average rate of 57.9% annually, indicating strong but decelerating profit expansion over time.

- Navigate through the intricacies of Waterdrop with our comprehensive balance sheet health report here.

- Examine Waterdrop's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Reveal the 709 hidden gems among our US Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALLK

Allakos

A clinical stage biotechnology company, develops therapeutics that target immunomodulatory receptors present on immune effector cells in allergy, inflammatory, and proliferative diseases in the United States.

Moderate with adequate balance sheet.