- United States

- /

- Biotech

- /

- NasdaqGS:ALEC

Discovering 3 US Penny Stocks With Market Caps Below $200M

Reviewed by Simply Wall St

As the U.S. stock market experiences a rise, driven by investor reactions to recent executive orders and economic policies, attention is drawn to various investment opportunities. Penny stocks, though often seen as relics of past market eras, continue to hold potential for investors seeking affordable growth prospects. These stocks typically represent smaller or newer companies that can offer significant upside when supported by strong financials and robust fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.36M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.89 | $6.46M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.91 | $11.73M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.73 | $2.08B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.275 | $10.12M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.58 | $52.14M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.57 | $61.94M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.13 | $20.04M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8937 | $80.38M | ★★★★★☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Alector (NasdaqGS:ALEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alector, Inc. is a clinical-stage biopharmaceutical company focused on developing therapies for neurodegenerative diseases, with a market cap of $167.46 million.

Operations: Alector generates its revenue primarily from its biotechnology segment, amounting to $61.51 million.

Market Cap: $167.46M

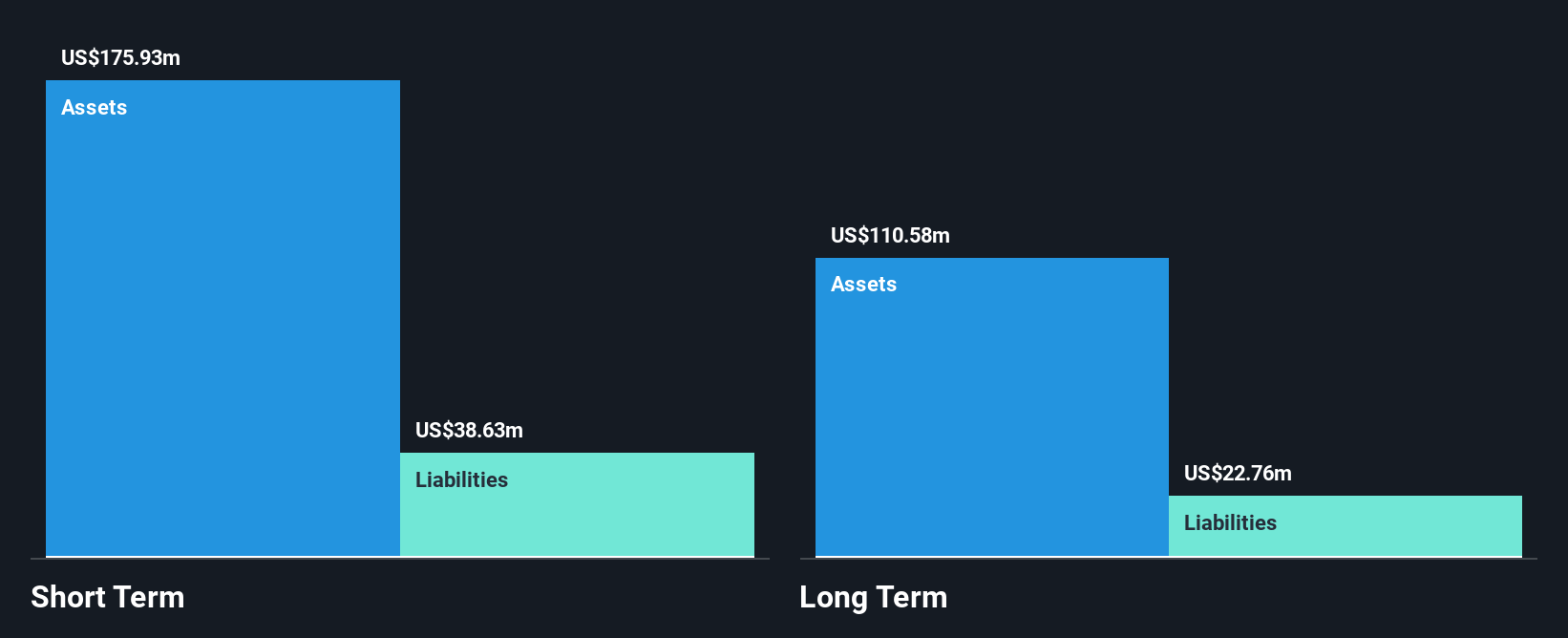

Alector, Inc., a clinical-stage biopharmaceutical company, faces challenges typical of penny stocks. Despite promising collaborations with AbbVie and GSK, its AL002 program for Alzheimer’s disease did not meet primary endpoints in recent trials. The company has a solid cash position of US$457.2 million to support operations through 2026 but remains unprofitable with increasing losses over the past five years. While Alector's management and board are experienced, the stock exhibits high volatility and significant insider selling was reported recently. Continued focus on progranulin-elevating programs may offer potential future value amidst these uncertainties.

- Jump into the full analysis health report here for a deeper understanding of Alector.

- Examine Alector's earnings growth report to understand how analysts expect it to perform.

Clarus (NasdaqGS:CLAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Clarus Corporation designs, develops, manufactures, and distributes outdoor equipment and lifestyle products both in the United States and internationally, with a market cap of approximately $176.85 million.

Operations: The company generates revenue from its Outdoor segment, which accounts for $182.63 million, and its Adventure segment, contributing $86.78 million.

Market Cap: $176.85M

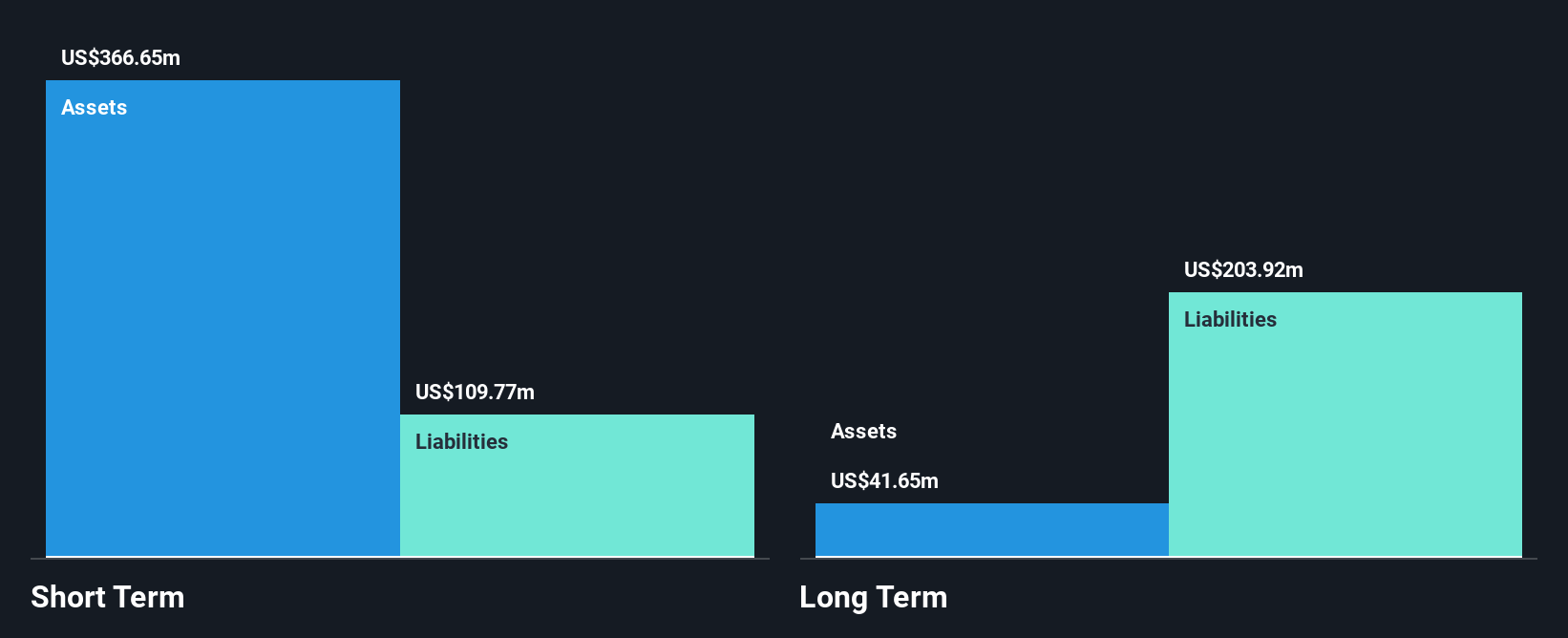

Clarus Corporation, with a market cap of US$176.85 million, is navigating the challenges typical of penny stocks. The company remains unprofitable, reporting a net loss of US$3.16 million in Q3 2024 despite revenues from its Outdoor and Adventure segments totaling US$192.91 million for the first nine months of the year. Although trading below its estimated fair value and debt-free, Clarus faces declining sales projections for 2024 and an unsustainable dividend yield due to insufficient earnings coverage. Recent board changes add financial expertise but highlight ongoing management instability with limited tenure experience among executives.

- Unlock comprehensive insights into our analysis of Clarus stock in this financial health report.

- Gain insights into Clarus' outlook and expected performance with our report on the company's earnings estimates.

Oportun Financial (NasdaqGS:OPRT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oportun Financial Corporation offers financial services and has a market cap of approximately $141.39 million.

Operations: The company's revenue segment comprises Financial Services - Consumer, generating $796.99 million.

Market Cap: $141.39M

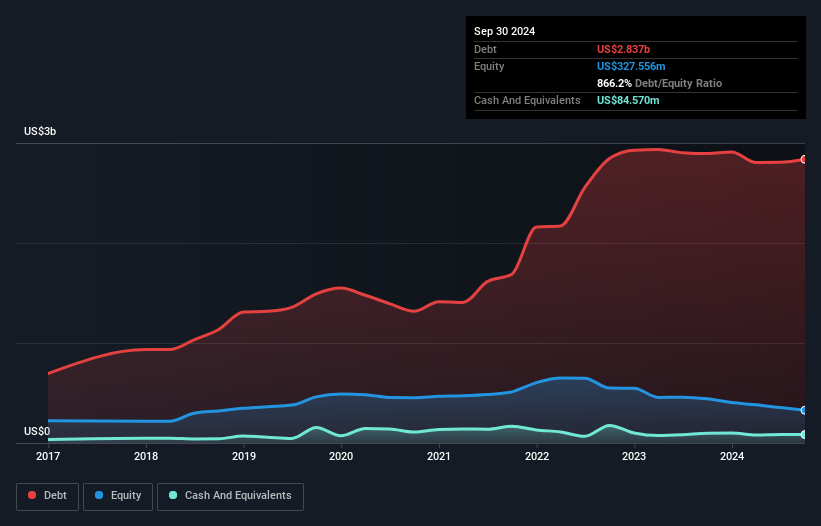

Oportun Financial Corporation, with a market cap of US$141.39 million, is experiencing typical penny stock challenges, including unprofitability and a high net debt to equity ratio of 840.3%. Despite generating US$796.99 million in revenue from its consumer financial services segment, the company reported increased losses over the past five years at an annual rate of 41.8%. However, Oportun's seasoned management team and sufficient cash runway for over three years due to positive free cash flow offer some stability. Recent earnings guidance suggests potential improvement in profitability for 2025 with expected GAAP diluted EPS between $0.25 and $0.50.

- Get an in-depth perspective on Oportun Financial's performance by reading our balance sheet health report here.

- Evaluate Oportun Financial's prospects by accessing our earnings growth report.

Key Takeaways

- Jump into our full catalog of 709 US Penny Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALEC

Alector

A clinical stage biopharmaceutical company, develops therapies for the treatment of neurodegeneration diseases.

Flawless balance sheet low.