- United States

- /

- Biotech

- /

- NasdaqCM:AKBA

Akebia Therapeutics, Inc. (NASDAQ:AKBA) Stock Catapults 34% Though Its Price And Business Still Lag The Industry

Akebia Therapeutics, Inc. (NASDAQ:AKBA) shareholders are no doubt pleased to see that the share price has bounced 34% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

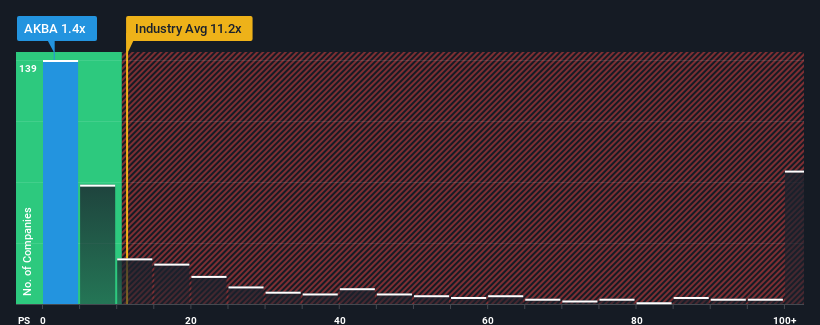

Even after such a large jump in price, Akebia Therapeutics' price-to-sales (or "P/S") ratio of 1.4x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.2x and even P/S above 63x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Akebia Therapeutics

How Akebia Therapeutics Has Been Performing

Akebia Therapeutics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Akebia Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Akebia Therapeutics' Revenue Growth Trending?

Akebia Therapeutics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 28% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 11% per annum as estimated by the three analysts watching the company. With the industry predicted to deliver 181% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Akebia Therapeutics' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Akebia Therapeutics' recent share price jump still sees fails to bring its P/S alongside the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Akebia Therapeutics' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Akebia Therapeutics is showing 3 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AKBA

Akebia Therapeutics

A biopharmaceutical company, focuses on the development and commercialization of therapeutics for patients with kidney diseases.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives