- United States

- /

- Life Sciences

- /

- NasdaqGS:ADPT

Adaptive Biotechnologies (ADPT): Valuation Check After New Pfizer Collaborations and Surging 2024 Share Price

Reviewed by Simply Wall St

Adaptive Biotechnologies (ADPT) just landed two non exclusive collaborations with Pfizer that lean heavily on its T cell receptor platform, a material win that could reshape both its revenue trajectory and strategic relevance.

See our latest analysis for Adaptive Biotechnologies.

The stock has been on a strong run, with a year to date share price return above 150 percent and a 1 year total shareholder return above 130 percent, helped by growing clonoSEQ adoption, insider selling headlines, and now the Pfizer collaborations signalling improving growth optionality.

If this kind of deal making has you rethinking where the next big winners could come from, it might be worth scanning healthcare stocks for similar healthcare names building momentum.

With shares up more than 150 percent year to date and still trading at a sizable discount to Wall Street’s target, has Adaptive’s Pfizer fueled pipeline expansion left meaningful upside on the table, or is the market already discounting future growth?

Most Popular Narrative Narrative: 19.8% Undervalued

Adaptive Biotechnologies latest close at $15.69 sits well below the most followed narrative fair value estimate of $19.57, framing a sizable valuation gap.

Substantial expansion in the MRD clinical pharma pipeline, evidenced by a growing clinical trial backlog (now at $218 million, up 21% over prior year) and increased use of clonoSEQ as a primary endpoint, forecasts future milestone payments and a high-quality revenue stream as regulatory momentum globally accelerates MRD adoption in drug development.

Want to see what kind of revenue curve and margin lift this backlog implies, and how rich a future earnings multiple it bakes in? Read on.

Result: Fair Value of $19.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained losses and heavy reliance on key partnerships mean any stumble on execution or reimbursement could quickly challenge the undervaluation thesis.

Find out about the key risks to this Adaptive Biotechnologies narrative.

Another Lens on Valuation

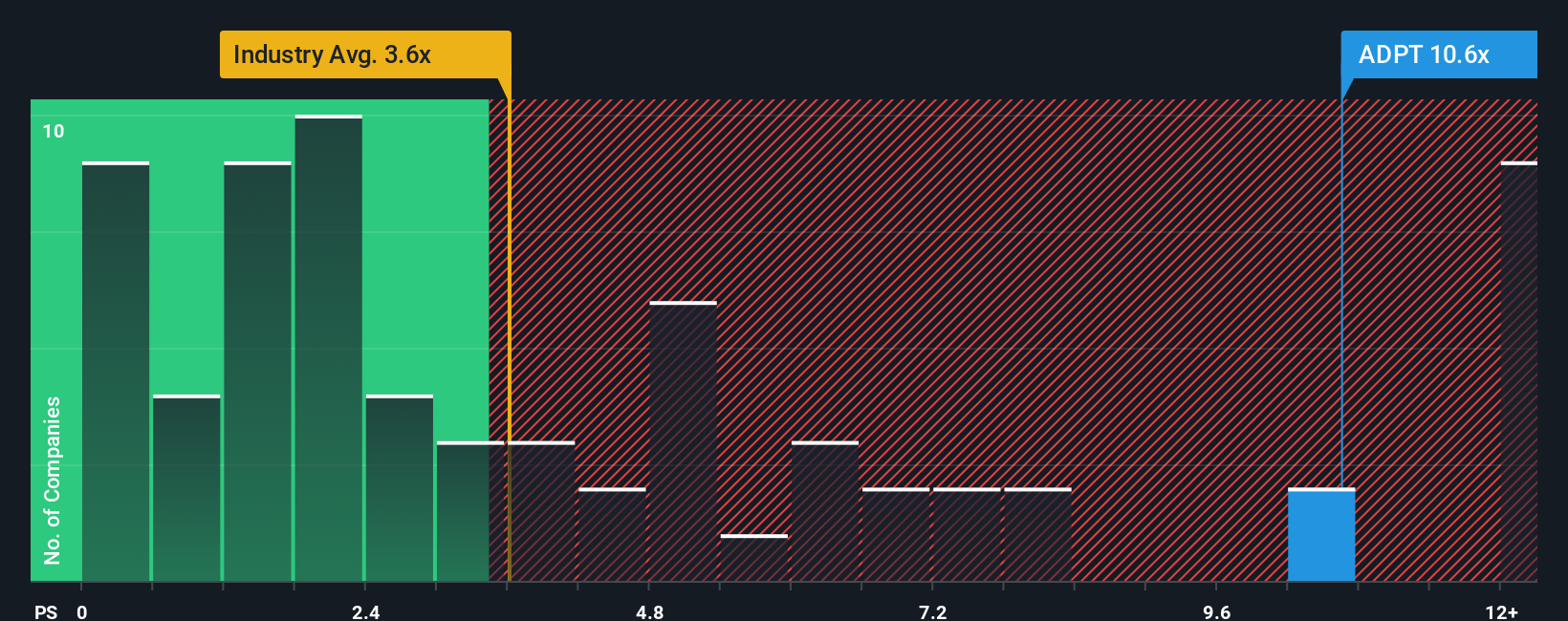

Analysts see upside to $19.86, but the price to sales ratio paints a sharper risk picture. ADPT trades at 9.5 times sales, nearly triple the US Life Sciences average of 3.3 times and well above its 4.8 times fair ratio. This suggests expectations may already be stretched.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Adaptive Biotechnologies Narrative

If you see the story differently or would rather test your own assumptions on the numbers, you can build a complete view in just a few minutes: Do it your way.

A great starting point for your Adaptive Biotechnologies research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you close this tab, make sure you scan other opportunities on Simply Wall St and position yourself ahead of the next wave of standout stocks.

- Capture early stage potential by reviewing these 3622 penny stocks with strong financials that pair low share prices with balance sheets and earnings profiles that stand up to serious scrutiny.

- Target future facing innovation by assessing these 26 AI penny stocks harnessing machine learning breakthroughs to reshape how businesses operate and scale.

- Lock in quality income streams by evaluating these 13 dividend stocks with yields > 3% that offer attractive yields without sacrificing financial strength or long term resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADPT

Adaptive Biotechnologies

A commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)