- United States

- /

- Professional Services

- /

- NasdaqGS:CRAI

Unveiling US Undiscovered Gems For December 2025

Reviewed by Simply Wall St

As the United States stock market continues to climb, with major indices like the S&P 500 and Dow Jones Industrial Average nearing record highs, investors are keenly observing the ongoing tech share rally that has bolstered these gains. In this vibrant market environment, identifying promising small-cap stocks can be particularly rewarding; such stocks often offer unique growth opportunities that align well with current economic trends and technological advancements.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Hingham Institution for Savings (HIFS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hingham Institution for Savings offers a range of financial services to individuals and small businesses in the United States, with a market cap of $644.65 million.

Operations: Hingham Institution for Savings generates revenue primarily from its financial services segment, totaling $90.53 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Hingham Institution for Savings, a financial entity with $4.5 billion in assets and $461.7 million in equity, is making waves with its robust performance. Despite a 17.9% annual decline over five years, recent earnings surged by 95.4%, outpacing the industry average of 18.5%. The bank's liabilities are primarily low-risk customer deposits at 61%, while total loans stand at $3.9 billion with an insufficient bad loan allowance of 0.8%. With a P/E ratio of 14x below the market's average and plans to repurchase up to $20 million worth of shares, HIFS shows promise despite past challenges.

CRA International (CRAI)

Simply Wall St Value Rating: ★★★★☆☆

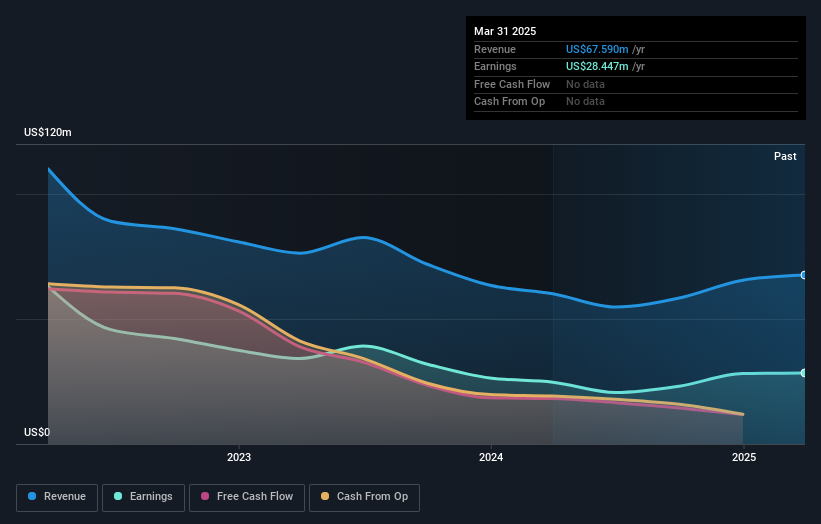

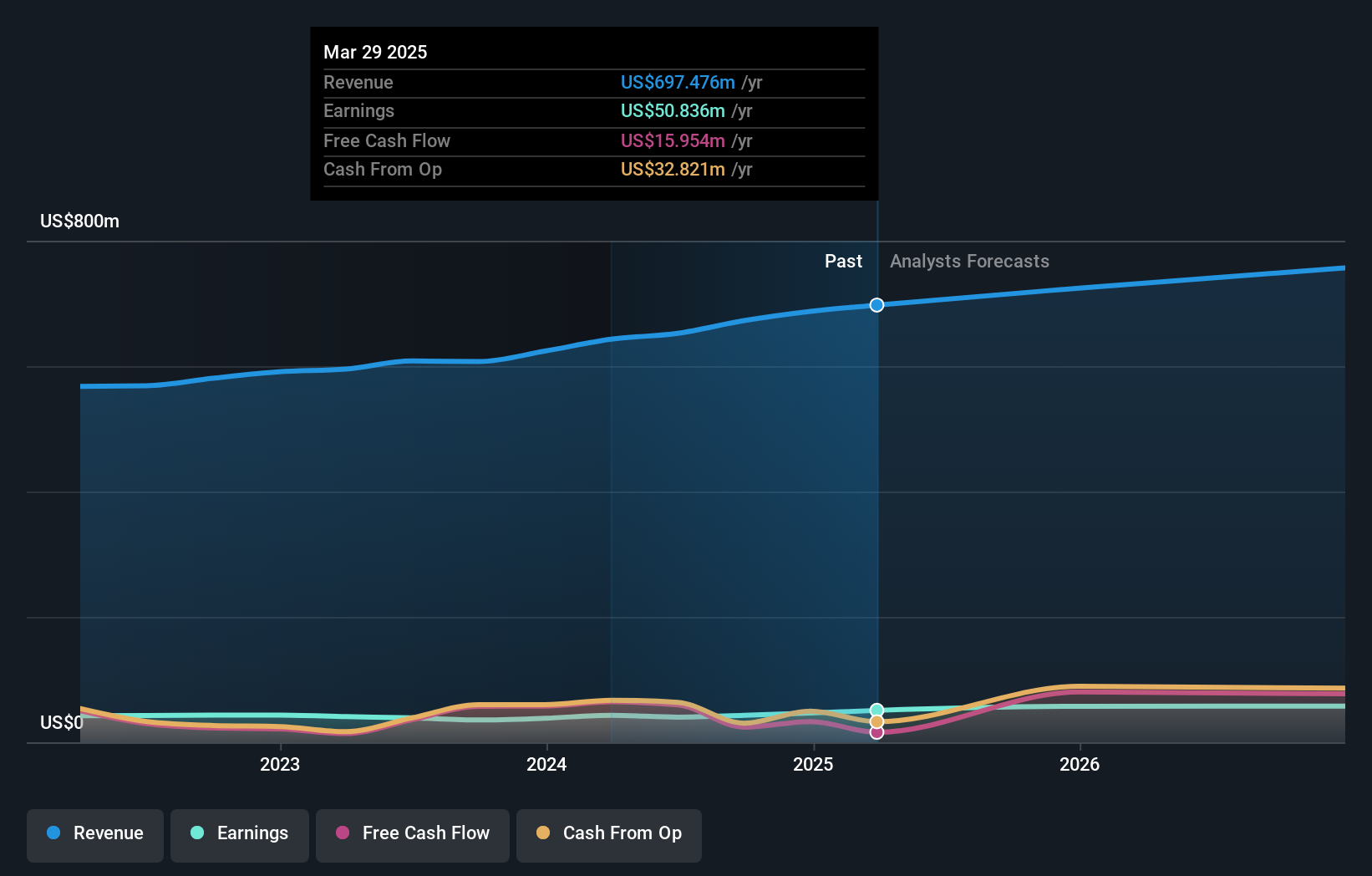

Overview: CRA International, Inc. offers economic, financial, and management consulting services globally and has a market capitalization of approximately $1.37 billion.

Operations: CRAI generates revenue primarily from professional and consulting services, amounting to $731.05 million.

CRA International, a relatively small player in the consulting space, has shown remarkable growth with earnings jumping 31.4% over the past year, outpacing its industry peers. The company trades at 31.3% below its estimated fair value and maintains a satisfactory net debt to equity ratio of 36%. With free cash flow remaining positive and interest payments well-covered by EBIT at 16.8 times, CRAI's financial health appears robust. Recent buybacks of over 21,500 shares for $4 million highlight strategic capital allocation efforts amidst increased demand for advisory services driven by regulatory complexities and M&A activities.

Yalla Group (YALA)

Simply Wall St Value Rating: ★★★★★★

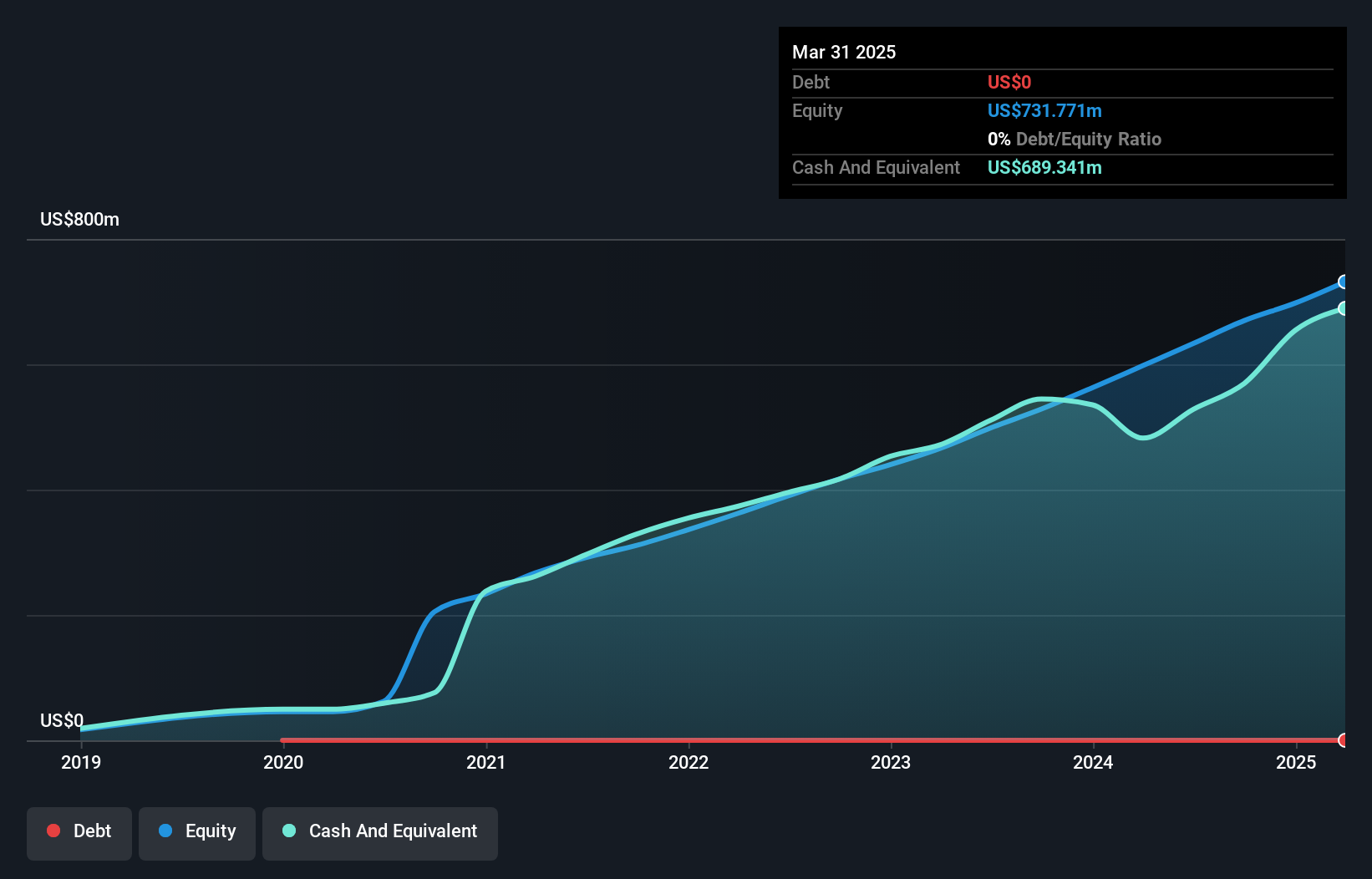

Overview: Yalla Group Limited operates a social networking and gaming platform in the Middle East and North Africa region, with a market cap of approximately $1.11 billion.

Operations: Yalla Group generates revenue primarily from its social networking and entertainment platform, with reported earnings of $348.90 million. The company's financial performance is influenced by its ability to manage costs associated with operating this platform. Gross profit margin trends are notable, reflecting the efficiency in managing production costs relative to revenue generation.

Yalla Group, a nimble player in the interactive media space, has demonstrated robust financial performance with earnings growing 33.8% annually over the past five years. The company is debt-free, eliminating concerns about interest coverage and showcasing prudent financial management. Recent earnings reports for Q3 2025 revealed net income of US$41 million, up from US$39.85 million the previous year, indicating solid profitability. Additionally, Yalla repurchased 1.49 million shares for US$10.9 million between July and September 2025 as part of its ongoing buyback program aimed at enhancing shareholder value by reducing share count and potentially boosting earnings per share further.

- Navigate through the intricacies of Yalla Group with our comprehensive health report here.

Review our historical performance report to gain insights into Yalla Group's's past performance.

Seize The Opportunity

- Click through to start exploring the rest of the 295 US Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRAI

CRA International

Provides economic, financial, and management consulting services worldwide.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion