- United States

- /

- Interactive Media and Services

- /

- NYSE:YALA

Discovering Three Hidden Gems Among US Small Caps With Strong Potential

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 28% over the past year with earnings expected to grow by 15% per annum in the coming years. In this environment, identifying small-cap stocks with strong potential often involves finding companies that are poised for growth and can capitalize on favorable economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

IBEX (NasdaqGM:IBEX)

Simply Wall St Value Rating: ★★★★★★

Overview: IBEX Limited offers comprehensive technology-enabled customer lifecycle experience solutions globally, with a market capitalization of $340.83 million.

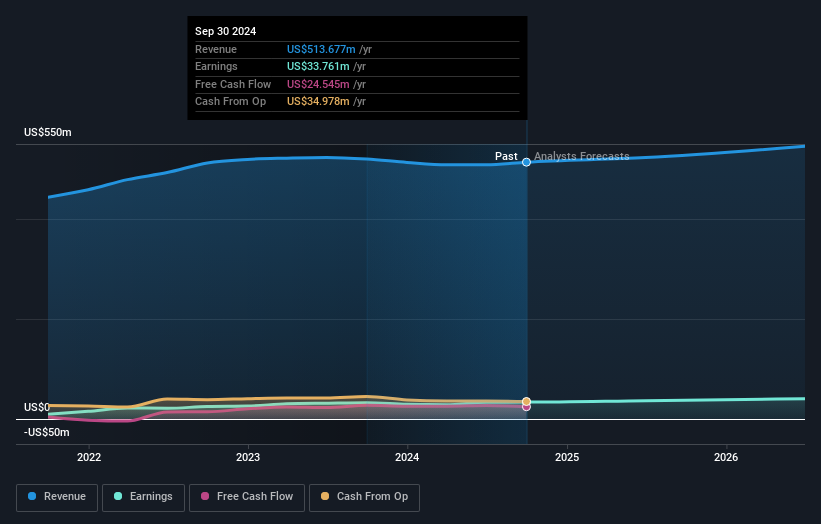

Operations: IBEX generates revenue primarily from its Business Process Outsourcing segment, which amounts to $513.68 million. The company's market capitalization is approximately $340.83 million.

IBEX, a dynamic player in the professional services industry, is making waves with its robust financial health and strategic expansions. The company has no debt, a significant improvement from five years ago when the debt-to-equity ratio was 361.6%. Over the past five years, earnings have surged by 41% annually. Recent developments include a $4.67 million share buyback and an expansion in Honduras that increased operational capacity by 35%, creating about 250 jobs. With earnings guidance for fiscal year 2025 raised to between $515 million and $525 million, IBEX appears poised for continued growth.

- Click to explore a detailed breakdown of our findings in IBEX's health report.

Gain insights into IBEX's past trends and performance with our Past report.

L.B. Foster (NasdaqGS:FSTR)

Simply Wall St Value Rating: ★★★★★★

Overview: L.B. Foster Company offers engineered and manufactured products and services for building and infrastructure projects across the United States, Canada, the United Kingdom, and internationally, with a market cap of $314.83 million.

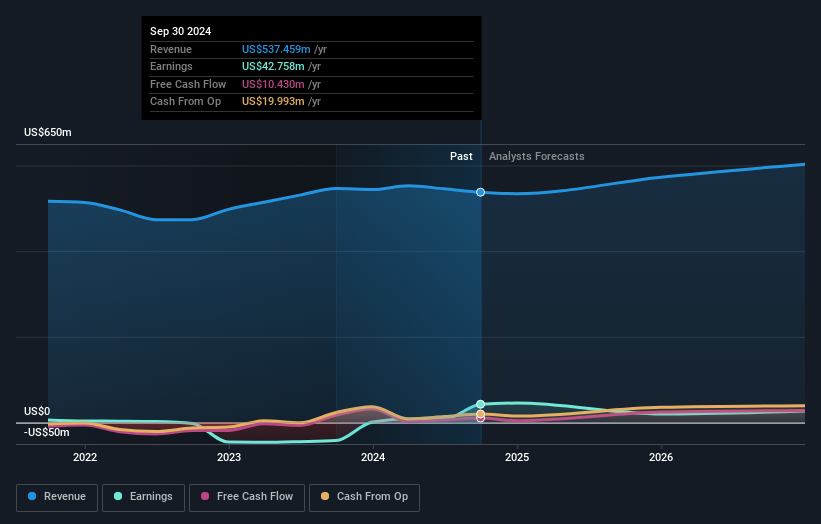

Operations: The company's revenue primarily comes from its Rail, Technologies, and Services segment, which generated $317.01 million. Segment adjustments accounted for $220.45 million.

L.B. Foster, a smaller player in the industry, is making strategic moves with investments in rail technologies and a new precast concrete facility to boost revenue and improve gross margins by 2025. Despite facing challenges like declining sales, the company reported net income of US$35.91 million for Q3 2024, a significant jump from US$0.52 million last year. Their debt-to-equity ratio has improved from 52.7% to 37.3% over five years, showing financial prudence. The company also repurchased over 330,000 shares recently for US$6.62 million under its buyback program to enhance shareholder value amidst weak demand concerns in key markets.

Yalla Group (NYSE:YALA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yalla Group Limited operates a social networking and gaming platform primarily in the Middle East and North Africa region, with a market cap of $702.20 million.

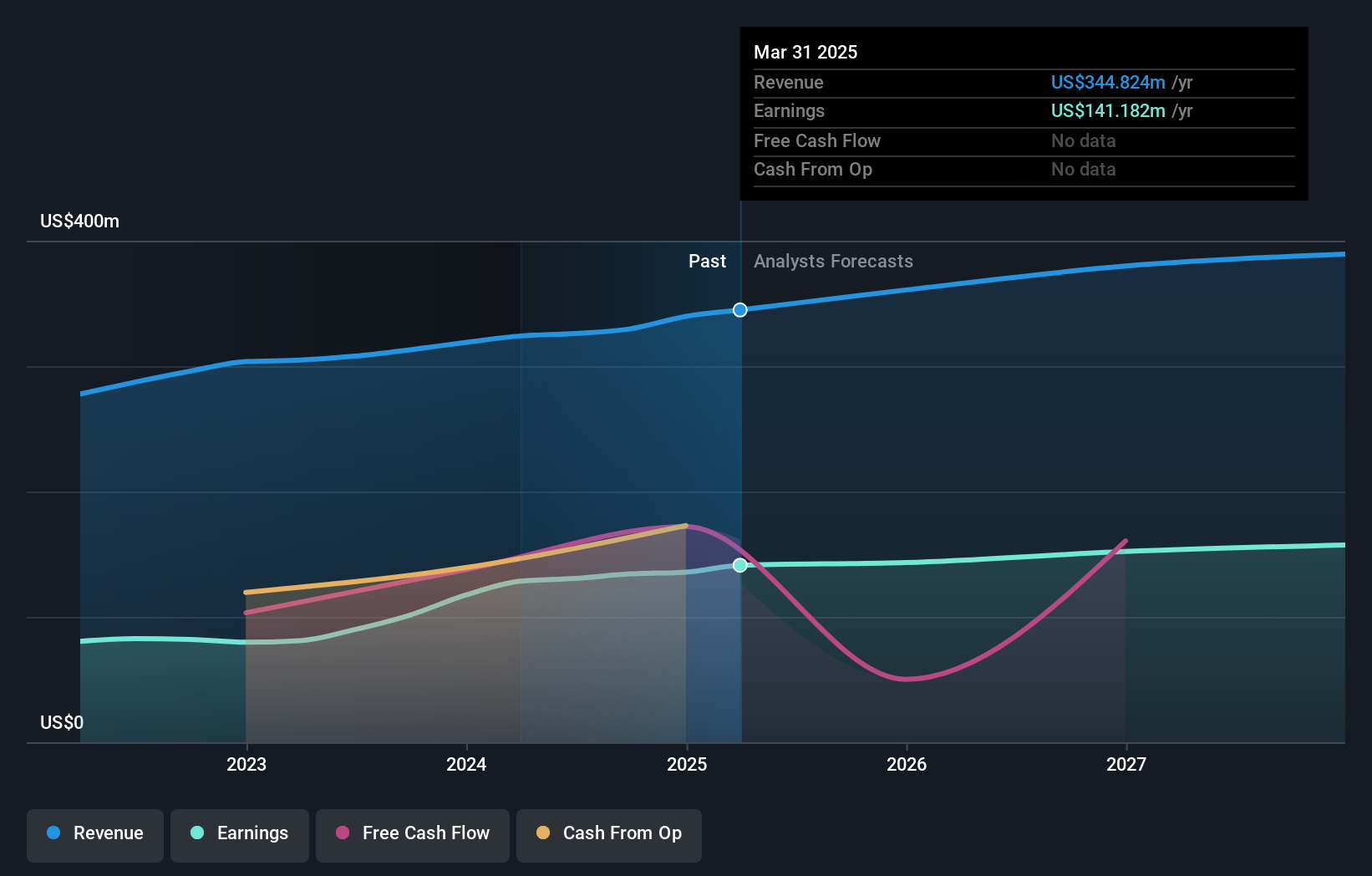

Operations: Yalla Group generates revenue primarily from its social networking and entertainment platform, which reported $329.77 million in revenue. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Yalla Group is making strides in the MENA region by targeting mid-core and hard-core gaming markets, with a focus on premium game development. This expansion strategy is likely to boost revenue, projected at a 6.2% annual growth over the next three years, though rising costs and regulatory taxes could affect net margins. Recent earnings show sales of US$88.92 million for Q3 2024, up from US$85.19 million last year, with net income at US$39.85 million compared to US$36.23 million previously. The company repurchased 1,736,383 shares for $7 million recently and trades below its estimated fair value at $4.42 per share against a target of $6.1 per share.

Seize The Opportunity

- Unlock our comprehensive list of 236 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YALA

Yalla Group

Operates a social networking and gaming platform primarily in the Middle East and North Africa region.

Flawless balance sheet and undervalued.