- United States

- /

- Media

- /

- NYSE:WLY

A Look at Wiley's (WLY) Valuation After Swing to Profit in Latest Quarter

Reviewed by Simply Wall St

John Wiley & Sons (NYSE:WLY) just turned heads with its latest first quarter results. After posting a net loss this time last year, the company delivered a net income of $11.7 million, even as sales slipped slightly from $403.81 million to $396.8 million. That turnaround in profitability is significant, highlighting management’s efforts to improve operations and possibly signaling that the business has pivoted into a more stable phase. No surprise, investors are wondering whether this marks the beginning of a more lasting change for Wiley.

Looking at the stock’s performance, it has not been a smooth ride. Shares have bounced around in recent months, eking out a modest 1% gain in the past quarter but still down about 4% over the past year. While the quick swing to profitability stands out, longer-term returns remain muted. The backdrop includes a consistent buyback program and choppy financial results, so momentum has yet to build in a meaningful way for investors looking for a sustained uptrend.

So after this year’s uneven performance and the promising Q1 results, is Wiley trading at a discount that reflects caution, or is the market already factoring in renewed growth potential?

Most Popular Narrative: 33.6% Undervalued

The most widely followed valuation view sees John Wiley & Sons as substantially undervalued, indicating that significant upside potential exists if the outlined catalysts play out as projected by analysts.

Rapid expansion into AI licensing and data analytics partnerships with major corporate clients is unlocking new, high-margin revenue streams outside of Wiley's traditional academic markets. This is increasing earnings diversity and accelerating top-line growth.

Curious about why this narrative is creating so much buzz? The fair value projection leans heavily on a transformation play, with expectations of booming profits, bigger margins, and bold assumptions about what digital and AI deals could deliver in just a few years. What key metric forms the backbone of this optimistic forecast? Find out what’s driving the debate on Wiley’s future worth and see the underlying numbers behind this bullish call.

Result: Fair Value of $60.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, lingering doubts remain if new AI licensing revenues prove unpredictable or if open access publishing erodes Wiley’s traditional, higher-margin business model.

Find out about the key risks to this John Wiley & Sons narrative.Another View: What Do Earnings Multiples Suggest?

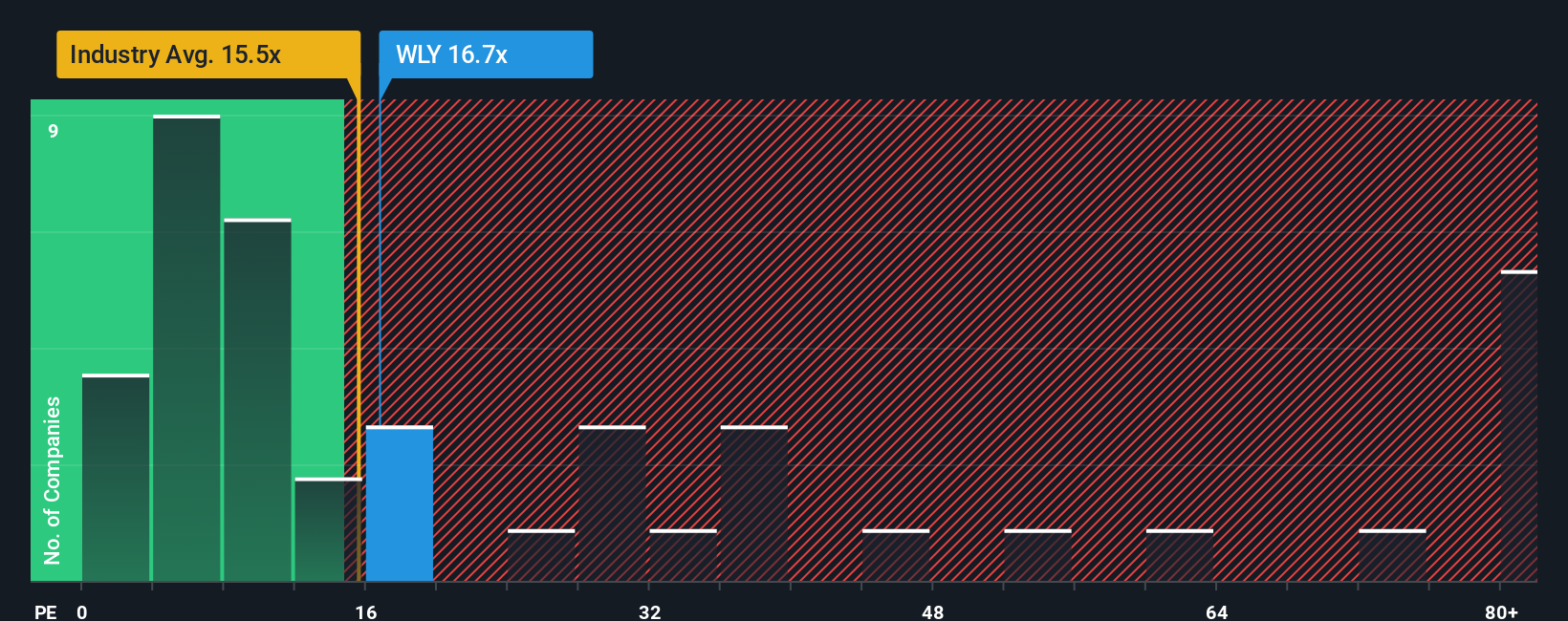

While the bullish outlook is built on future growth assumptions, a different lens compares John Wiley & Sons’ current valuation to similar companies in its industry. Using this measure, the stock actually appears expensive. Which story is closer to reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own John Wiley & Sons Narrative

If you are not swayed by these arguments or would like to see what your own research turns up, you can pull together your personal narrative in just a few minutes. Do it your way

A great starting point for your John Wiley & Sons research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for the next opportunity. Get ahead of the market by using the Simply Wall Street Screener and uncover fresh, high-potential stocks you could be missing out on right now.

- Boost your income by targeting companies built for strong yield potential using dividend stocks with yields > 3%.

- Power up your growth strategy with emerging tech leaders at the forefront of artificial intelligence through AI penny stocks.

- Find remarkable value plays trading below their intrinsic worth by checking undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:WLY

John Wiley & Sons

A publisher, provides authoritative content, data-driven insights, and knowledge services for the advancement of science, innovation, and learning in the United States, China, the United Kingdom, Japan, Australia, and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)