- United States

- /

- Interactive Media and Services

- /

- NYSE:TWTR

By Numbers, Musk Isn't Buying Twitter, Inc. (NYSE:TWTR) for its Earning Potential

The wealthiest people in the world often keep social media at arm''s length, emerging sparsely and usually to make calculated announcements. Yet, Elon Musk builds his persona around social media, sometimes engaging in reckless behavior that puts him on the regulators'' radar. Thus, it is not surprising that his campaign to acquire Twitter, Inc. (NYSE: TWTR) stirred up more drama.

While billionaires play the game on a whole different level, from our perspective, we''ll examine Twitter in numbers and try to get a hold of its fundamentals.

See our latest analysis for Twitter.

Crunching the Numbers

Twitter is not profitable at the moment, so to gauge its valuation, we have to consider the price-to-sales ratio, which is at 7.3x – meaning that an investor pays US$7.3 for every US$1 in revenues.

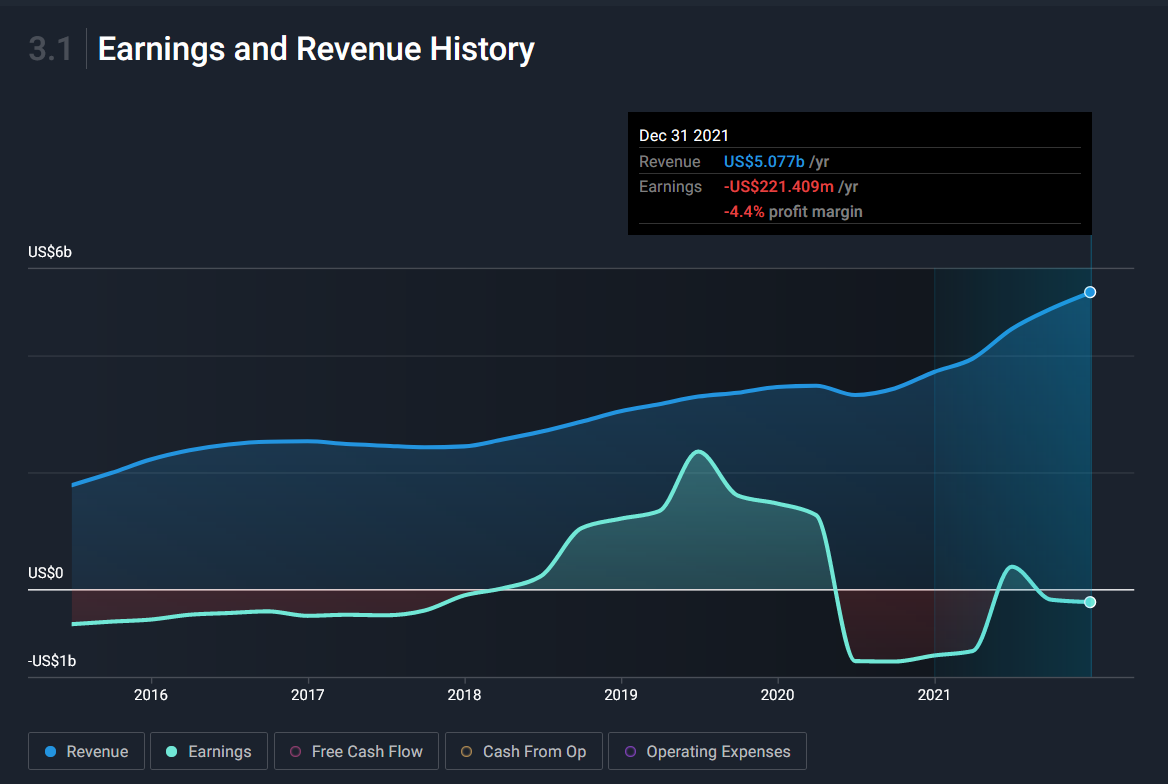

Speaking of earnings, you might notice large oscillations in the graph above. As you can see, Twitter turned profitable in 2018 before nosediving in 2020. Those who dig deeper might notice that Twitter holds tax assets to a tune of US$1.15b. Interestingly, this has been an ongoing situation as early as 2013. Eventually, these payments will be made from the profits.

While the trend seemed downward in 2021 as well, we have to take into account that this situation is due to litigation costs, which hit the company with US$750m.

Finally, Twitter holds a significant amount of cash and short-term investments (US$6.4b) against US$4.3b of debt. While convertible bonds are the primary source of debt, large tranches mature as late as 2024. Thus dilution is not a concern in the short term.

What is Elon buying?

While Twitter grew its revenues by 36% in 2021, it reached "only" US$5.08b and almost all of it was from advertising (89%). That is a lot of eggs in one basket, with the interest rates going up and a potential recession looming over advertising.

Meanwhile, Elon Musk has secured US$46.5b in the financing, over 9 times the revenues of an unprofitable company. However, with a "poison pill" in play, he will have to negotiate with the board – as any shareholder that crosses the 14.9% threshold allows the existing shareholders to buy additional shares at a 50% discount.

Considering Twitter''s business model, the macroeconomic environment, and the hefty premium offered – it is hard not to speculate that Mr.Musk isn''t playing a game whose goals transcend the ones of a typical investor, which is to buy low and sell high.

If you are no longer interested in Twitter, you can use our free platform to see our list of over 50 other stocks with high growth potential.

Valuation is complex, but we're here to simplify it.

Discover if Twitter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:TWTR

Twitter, Inc. operates as a platform for public self-expression and conversation in real-time.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives