- United States

- /

- Entertainment

- /

- NYSE:TME

Why We Think Tencent Music Entertainment Group (NYSE:TME) Could Be Worth Looking At

As an investor, I look for investments which does not compromise one fundamental factor for another. By this I mean, I look at stocks holistically, from their financial health to their future outlook. In the case of Tencent Music Entertainment Group (NYSE:TME), it is a company with impressive financial health as well as a buoyant future outlook. Below is a brief commentary on these key aspects. If you're interested in understanding beyond my broad commentary, take a look at the report on Tencent Music Entertainment Group here.

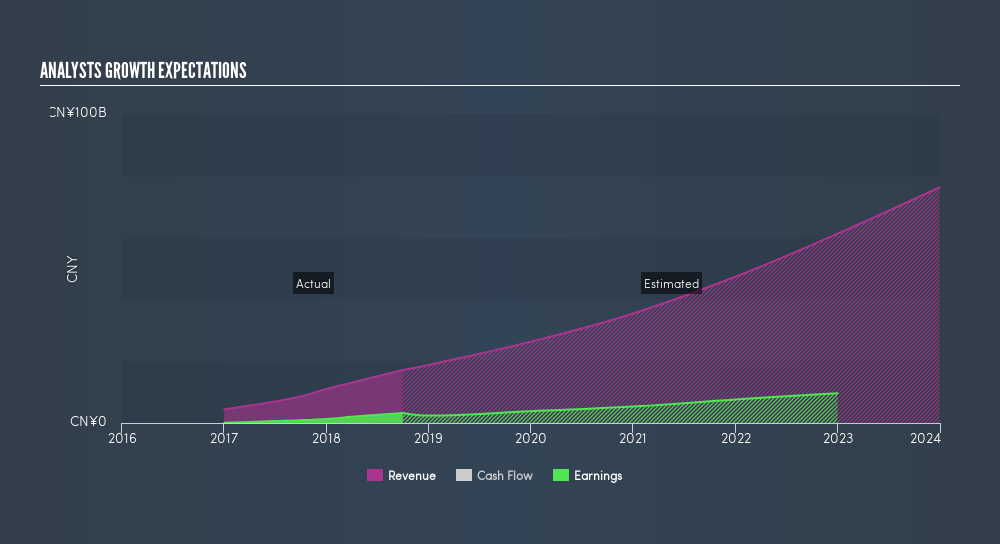

Flawless balance sheet with high growth potential

TME is an attractive stock for growth-seeking investors, with an expected earnings growth of 32% in the upcoming year. This growth in the bottom-line is bolstered by an impressive top-line expansion of 93% over the same period, which is a sustainable driver of high-quality earnings, as opposed to pure cost-cutting activities. TME is financially robust, with ample cash on hand and short-term investments to meet upcoming liabilities. This implies that TME manages its cash and cost levels well, which is an important determinant of the company’s health. TME currently has no debt on its balance sheet. It has only utilized funding from its equity capital to run the business, which is rather impressive for a US$28b market cap company. Therefore the company has plenty of headroom to grow, and the ability to raise debt should it need to in the future.

Next Steps:

For Tencent Music Entertainment Group, there are three fundamental aspects you should further examine:

- Historical Performance: What has TME's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Valuation: What is TME worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether TME is currently mispriced by the market.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of TME? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:TME

Tencent Music Entertainment Group

Operates online music entertainment platforms that provides music streaming, online karaoke, and live streaming services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)