- United States

- /

- Entertainment

- /

- NYSE:TKO

TKO Group Holdings (NYSE:TKO) Posts US$642 Million Q4 Sales US$31 Million Net Income and Affirms US$0.38 Dividend

Reviewed by Simply Wall St

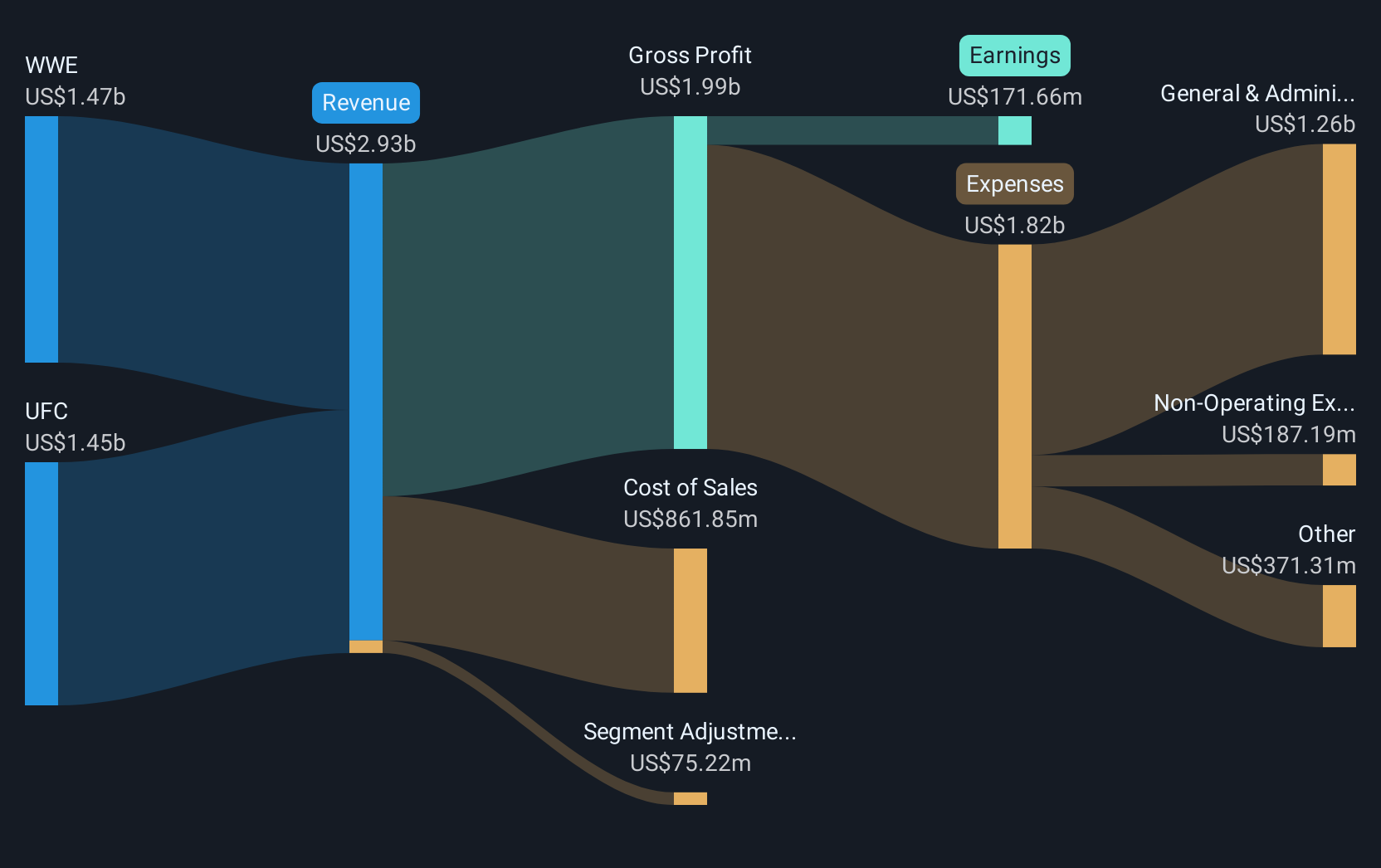

TKO Group Holdings (NYSE:TKO) demonstrated a significant 15% price increase over last quarter, boosted by a robust fourth-quarter earnings report declaring $642 million in sales, up from $614 million, and a turnaround to $31 million in net income from a net loss previously. The declaration of a quarterly dividend of $0.38 per share further emphasized the company’s commitment to returning value to shareholders, possibly aiding the share price appreciation. Broader market trends presented mixed signals with major U.S. stock indexes displaying volatility; the Dow Jones gained 1% while the S&P 500 and Nasdaq Composite experienced minor setbacks. Despite macroeconomic uncertainties and tariff announcements influencing broader market apprehensions, TKO's financial performance and dividend announcement could have fortified investor confidence amidst said market dynamics, differentiating its stock performance from the downtrend seen in notable tech stocks and other sectors during the period.

Click here to discover the nuances of TKO Group Holdings with our detailed analytical report.

Over the past year, TKO Group Holdings achieved a total return of 92.39%, significantly outperforming both the US market and the US Entertainment industry returns of 16.7% and 43.7%, respectively. During this time, several factors contributed to this impressive performance. Key among them was the implementation of a share buyback program, which authorized up to US$2 billion in repurchases, likely boosting shareholder value. Additionally, their consistent revenue growth, underscored by the upward revision of their full-year 2024 revenue guidance to as much as US$2.745 billion, reflects the company's ability to capitalize on market opportunities.

Moreover, TKO's decision to partner with Endeavor Group Holdings through the acquisition of Professional Bull Riders hinted at a commitment to growth through acquisitions, further attracting investor interest. Complementing these strategic moves, TKO enhanced its financial flexibility by filing a shelf registration in December 2024, potentially positioning itself for future capital raises or debt issuances. These elements together have bolstered investor confidence, delineating a path that aligns with shareholder interests over the longer term.

- Analyze TKO Group Holdings' fair value against its market price in our detailed valuation report—access it here.

- Gain insight into the risks facing TKO Group Holdings and how they might influence its performance—click here to read more.

- Is TKO Group Holdings part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

Reasonable growth potential with acceptable track record.

Market Insights

Community Narratives