- United States

- /

- Entertainment

- /

- NYSE:TKO

TKO Group Holdings (NYSE:TKO) Dropped From Multiple Indices But Shows 3% Price Uptick

Reviewed by Simply Wall St

On March 24, 2025, TKO Group Holdings (NYSE:TKO) was removed from several key indices, including the S&P 400 and the S&P 1000, which coincided with the company's stock price moving 3% over the last quarter. Despite the index changes, TKO Group reported stronger financial results, with Q4 sales rising to USD 642 million and positive net income, a reversal from the previous year's loss, potentially supporting the stock's performance. Additionally, a dividend affirmation and positive future guidance may have offset some negative sentiment from its index exclusion. Broader market trends, such as ongoing economic uncertainties and tech sector rallies, also likely played a role.

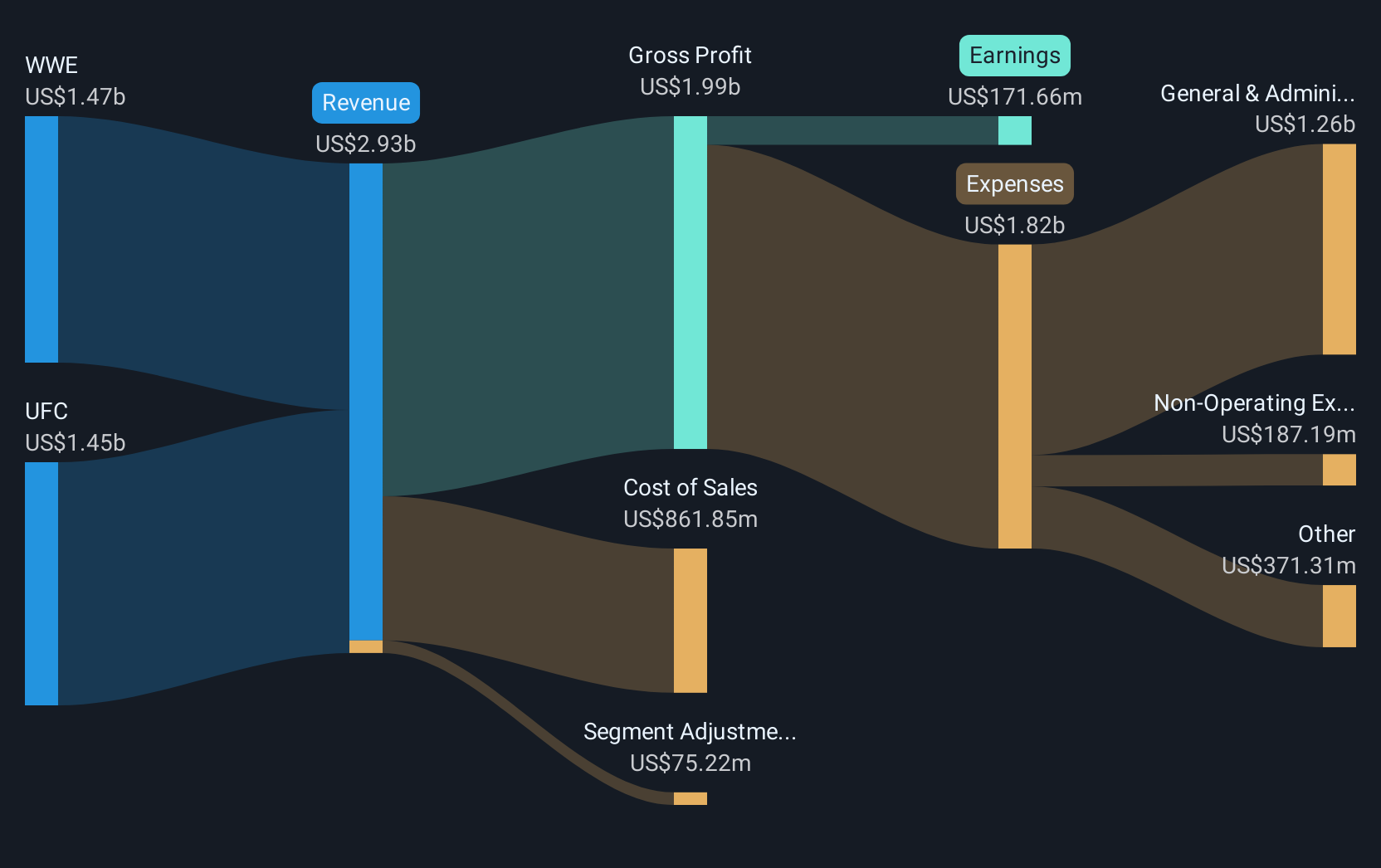

The past year has seen TKO Group achieve a remarkable total shareholder return of 75.14%, significantly outpacing both the US market's 8.1% and the US Entertainment industry's 33.9%. This robust performance is attributable to several key factors. Notably, the company returned to profitability over the year, with full-year 2024 sales reaching US$2.80 billion, a substantial rise from the previous year, along with a positive net income of US$9.41 million, compared to a net loss the year before. This financial revival likely provided a solid foundation for investor confidence.

Furthermore, TKO Group demonstrated its commitment to growth through corporate activities such as a raised revenue guidance issued in November 2024 and its ongoing exploration of mergers and acquisitions, including a discussed acquisition of Professional Bull Riders. The company's inclusion in several Russell indices in July 2024 possibly enhanced its visibility among investors, reinforcing its market position and contributing to the impressive shareholder returns over the year.

Understand TKO Group Holdings' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

Exceptional growth potential with acceptable track record.